Who We Are

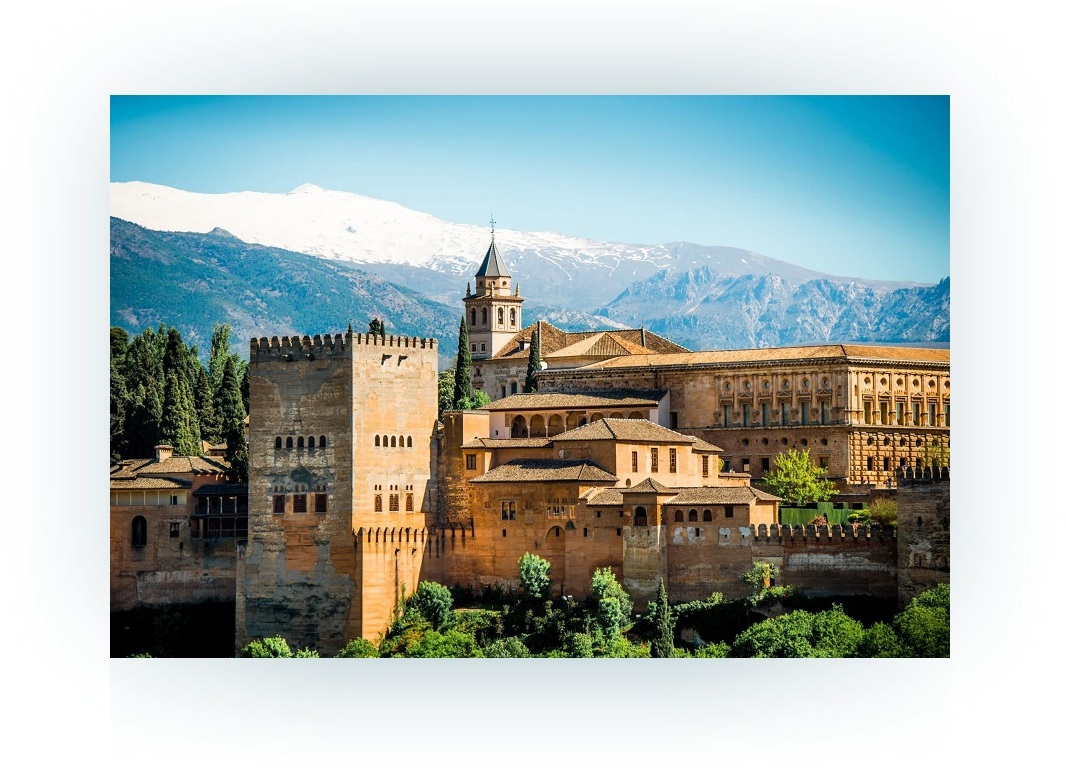

Our namesake is the Alhambra, a fortress in southern Spain dating back to 889. For more than a thousand years, people of different backgrounds found refuge behind her venerable walls. Today, the Alhambra remains as strong as ever, an enduring symbol of wealth, prosperity, and security.

Like this ancient citadel, our investment strategy is intended to stand the arduous test of time. At Alhambra Investments, our goal is to achieve wealth while maximizing security for our clients. They are not mutually exclusive; our job is to find balance between the two.

Alhambra. A fortress against market storms.

What We Do

Clients choose Alhambra Investments based on our understanding of the global risk environment. Our philosophy is to safeguard against major losses and to use the best investment strategies to grow wealth. When driven by insightful research, we believe an asset allocation process delivers superior risk-adjusted returns.

Stay In Touch