Thinking Things Over January 3, 2012

Volume II, Number 1: Predictions for 2012: Obama Loses, 2.5% Growth in the U.S., Eurotrouble, No War with Iran, 2013 Warnings

By John L. Chapman, Ph.D. Canton, Ohio

Used to the conditions of a capitalistic environment, the average American takes it for granted that every year business makes something new and better accessible to him. Looking backward upon the years of his own life, he realizes that many implements that were totally unknown in the days of his youth and many others which at that time could be enjoyed only by a small minority are now standard equipment of almost every household. He is fully confident that this trend will prevail also in the future. He simply calls it the American way of life and does not give serious thought to the question of what made this continuous improvement in the supply of material goods possible. — Ludwig von Mises

As 2012 dawns on a watchful world, the words of the great Austrian economist Mises seem drawn from the mists of time that lead back to an era long gone. For the global economy is now entering its fifth year of broad torpor, and in spite of official statistics indicating an expansionary U.S. economy now for 30 months, life no longer has that “feel” of irrepressible progress for most Americans. And how could it, when real per capita incomes have declined nearly 10% in the last four years even as 25 million Americans, via an 8.6% unemployment rate and another 8% underemployed or discouraged, cannot find full time jobs they seek, often desperately?

The irony is that when Mises spoke of the halcyon era of 1950s America, his worry was that U.S. voters and taxpayers were so accustomed to taking economic progress and prosperity for granted that they did not understand the institutional conditions necessary to engender that progress; hence, they might fall prey to the then-growing calls by Keynesian and socialist proponents of big government for retrograde policies of capital consumption, policies that harmed economic growth and the standard of living stealthily, over time. Today, by contrast, the economic environment is worrisome and not benign, but Mises’ fears of American blissful ignorance are as valid as ever: 2012 is an inflection point leading either toward a sure cementing of the “Europeanization” of the U.S. economy, or, perhaps, a return to Misesian “capitalistic”, that is, pro-growth, policies (Mises’ outmoded descriptor is nonetheless accurate to describe policies conducive to economic growth, because the core to human progress is saving and the accumulation and formation of capital).

This then — a consequential U.S. Presidential election and how it affects the U.S. economy — is the primordial fact of 2012, and is the point of departure in analyzing the year ahead in forming investment strategies and business plans. A very close second factor in our analysis, if we do not indeed label the two as “1” and “1A”, is the unfolding denouement of the recession and debt deflations in Europe. China slowing, India in recession, war in Iran and Middle East/oil stability, monetary instability and currency volatility, Russian revanchism, Australian housing bubble collapse, and a host of other issues all factor into planning in any global survey as well. But the American election, the consequent U.S. economy’s direction, and the Eurozone are of capital importance in determining our collective future. While economic forecasting has as much credibility as tarot card-reading in terms of ex post success in results, and indeed can often serve to embarrass the forecaster far more than illumine his professional prowess, we nonetheless hereby submit ourselves to the jury of a candid world in laying out our views of how the year will play out in key areas. And, we are willing to be judged on these calls a year from tonight.

Review of the U.S. Economy in 2011: Lessons for the Future

Before turning to 2012, how are we to think of 2011? The U.S. economy, assuming 4th quarter growth of 3%, will come in at about 1.7% for the year, after 3.1% growth in 2010. Consumer price inflation should end up at around 3.5%, while unemployment trended slightly downward all year, and will end up at around 8.5%. Taking a longer view of the current recovery, more than 2.8 million private sector jobs have been created in the last two years. Consumer and industrial loan growth has been steady, if unspectacular. Indexes of primary economic activity such as for purchasing, manufacturing, and export/import volumes have shown solid, if not robust, levels of growth. Consumer and business confidence has not been good, but it has not been terrible, as it usually must before the onset of recession. Housing starts and sales volumes, while depressed from the levels of the bubble era, show a return to growth, even as prices continue to fall. And importantly, the slow process of both bank and household recapitalization has been underway for three years. Total debt in the U.S. economy, both public and private, peaked three years ago as a percentage of GDP, at 355%. It is now back down below 320% and declining slowly but steadily in a necessary deleveraging process, due wholly to zealous private household and business firm recapitalization (U.S. government debt outstanding continues to hit new record highs every hour of every day, by an additional $160 million). All in all, with the exception of control of federal spending, the U.S. has been making progress, however halting, in recovering from the market meltdown and panic of the fall of 2008 and concurrent recession.

U.S. equities, meanwhile, were basically flat in 2011, although the bond market rallied across the year. The Dow Jones Industrial Average ended the year up 5.5%, at 12,217.56, while the S&P 500 closed at 1257.6, literally down o.oo3%. The NASDAQ tech-dominant index finished at 2605.15, off 1.8% for the year. The fact that the Dow Industrials were up more than 5% while companion markets indexes were slightly negative is itself indicative of the extreme volatility in global markets this past year, and investor preference for the biggest, best-capitalized, most well-known names — a classic flight to quality. Overall the U.S, market P/E ratio traded in the 12.5 to 13X range, well below its long-term average of 15.9. The markets’ performance can be summed up as one exhibiting nervousness, after solid gains across 2009 and 2010, and certainly the trading volatility across the year exemplified this as well.

Lack of investor quiescence was also evinced in a rising bond market: the flight to quality in U.S. government bonds meant that the yield on the 10-year note fell to record lows in 2011 as its price rose: the 10-year note yield started 2011 at 3.29% and finished at 1.88%. The five year note likewise often traded below 1%, as the demand for safety outweighed the prospects for beating inflation or earning positive long term returns. One fear moving forward now is that the stratospheric levels of U.S. bond prices can only guarantee a hard fall and losses, if not a crash, but U.S. fiscal profligacy and Fed easings have left no wiggle room for a bond market soft landing, in our view.

Inflation hedges generally did well, however unconcerned investors were with dollar-denominated consumer and industrial price volatility for the moment: gold, the historic indicator of market views on monetary policy, rose 10.2% to close at $1565.80 per ounce, after trading above $1900 this fall. And crude oil, which began the year at $91.38, closed up 8.2% to finish at $98.83 per barrel.

Finally, while a critique of Federal Reserve policy is a subject worthy of an entirely-dedicated essay, we note that the one sole metric over which the Fed has unambiguous control is the growth of the monetary base — the “raw stuff” which forms the basis of money and credit creation. And from a start of $1.983 trillion, the base grew 29% to end 2011 at $2.559 trillion, down from its all-time high in July of $2.725 trillion. While well over half of these reserves sit “virtually” in Fed vaults as excess reserves, they do represent — in our view, however minority it is — a harbinger of inflation and higher interest rates in a stagnant future, a threat to which we will recur many times this year. For now, the Fed’s various “quantitative easing” programs may be said to have been ineffective at best, if their aim was to stimulate economic activity and spending velocity. And when the base stood at $846 billion just four years ago at the end of 2007, the counter-intuitive result of what can only be called out-sized Fed easing may well have been to heighten investor nervousness about the state of the economy. The explosion of money creation coupled with its parking in excess bank reserves — earning interest while idle, in a perverse counter to the Fed’s obvious wish to have lending increase sharply — may well be indicative of the best of intentions gone awry, and had the perverse effect of increasing, not decreasing, investor nervousness.

Adding all this up, why were incomes stagnant this past year, the stock market stalled, and growth sluggish, when the data on economic activity per above were generally positive, if not searingly so? Why were P/Es stuck in the 13 range, when a return to a more normal 15 would add $2 trillion in market capitalization to U.S. equities — a 15% gain that would lead to millions of new jobs here in the U.S.? And, we might add, when corporate profits as a percentage of U.S. GDP reached an all-time high of 10.3%, and while nearly $2 trillion in cash sits on corporate balance sheets at the moment?

To ask the question is to answer it, as former University of Washington economist Robert Higgs has done at several points in his research career: regime uncertainty. The panic of 2008’s effects may well have subsided, but subsequent policies and political infighting inside the Beltway (including such circus acts as no Senate budget for over 900 days, a U.S. debt downgrade and loss of triple-A status [however symbolic], the calling of the Bowles-Simpson Fiscal Commission and then the wanton ignoring of its year of work, and in the end, a debt ‘SuperCommittee” that did nothing), coupled with a visibly nervous Federal Reserve (which this fall strongly and with unusual candor hinted at a broad recession in 2012, and outlined global headwinds highlighted by Europe), have combined “to cause capital to go on strike.” This thesis has been attacked by economists such as Paul Krugman, who argues that a “confidence fairy” does not exist and that market nervousness over exploding debt and deficits is a chimera. But it is Mr. Krugman, a rank inflationist who is hyper-energized in favor of exploding federal spending, who ignores the teachings of both economic theory and empirical reality: corporate net investment has not only not recovered back to pre-recession levels in the United States, it has now plummeted back to an aggregate amount not seen since 1975 (as a percentage of GDP), according to the Boston Consulting Group. In this sense, as Professor Higgs points out, the post-2009 recovery has been very much like the 1930s, when fear of Roosevelt crippled investment in the United States. And, it is worth pointing out that to be precise, it is fear, and not uncertainty, that we are talking about here.

In summary, if investors’ “animal spirits” can be re-ignited, or had they been for 2011, economic growth could have been a more normal double what it was.

Predictions for 2012

Given the above, that is to say, given the slow recapitalization and improving balance sheets and P&Ls of American business, but cognizant of investor nervousness about multiple issues of concern (U.S. economic policy, coming tax hikes and interest rate hikes; elections; China; India, Iran, et al.), we propose the following inter-related courses of events as likely for 2012:

i. Obama is finished on November 6th. The powers of incumbency are considerable, and Mr. Obama is a formidable campaigner, with high personal likability ratings. Further, the trend of an improving economy as outlined in the data above shows no signs of abating, and it is conceivable unemployment will move toward 8% or lower by election day, along with rising growth in the U.S. this year. If Europe is held together via some TARP-type facility, and Israel keeps away from Iran and vice versa so that oil stays reasonably-priced (in the sense that $100 oil is more reasonable than $200), can’t Mr. Obama claim things are finally turning the corner, and that his policies both staved off a depression and are now moving us back to an era of “strong growth,” led by his wise investing prowess (e.g., Solyndras that are profitable) and fairness in protecting the “99%” from exploitation by the “1%”?

Unfortunately for him and his supporters, no. The internal contradiction that has always riddled Mr. Obama, and that will finally surface and explode into the open this year, is that he is fundamentally anti-capitalistic — in the sense of that term employed for economic analysis, connoting policy disdain for capital accumulation and the investment that drives growth — and redistributionist, while the broad sweeping majority of Americans are pro-(capitalistic)-growth and hence anti-redistributionist. This is not a moral judgment, and we mean to cast no aspersions on the President, whom we take on faith sincerely believes that his paradigm for America’s future, which he recently said is derived from FDR and LBJ, is the very best one. But empirically, what FDR, LBJ, and now Mr. Obama believe to be true about the political economy of the welfare state, and specifically its capacity to engender economic growth, is now being played out in the streets of Athens, Rome, Lisbon, and one cannot forget Madrid and its 20% unemployment rate. Indeed, one struggles to understand Mr. Obama’s commitment to his policy preferences, because whereas FDR and even LBJ could claim to be working from textbook theory about welfare state policies and their efficacy, Mr. Obama and his economic team are privy to the vast empirically-evident differential in the standard of living in the United States and western Europe, where people are 30% to 50% poorer. Or even more pointedly in his own term, leaving aside the harsher life one finds when paying $11.43 for a McDonald’s Combo Meal in Copenhagen that costs $6.00 in Chicago, it is a mystery why Mr. Obama and his advisors seem so keen on emulating a European economic and social welfare model that is now manifestly breaking apart as we speak, due to its own internal contradictions.

That the United States was founded by waves of hardy souls — who braved an ocean in rickety wooden boats three and four hundred years ago to come to American shores in search of a self-determined life and its concomitant, property — is a fact as alien to Mr. Obama as it is core to American culture. But regardless of the reasoning, the Obama agenda has always entailed development of the European-style welfare state here, trading off the explicit 30% gap in standard of living (which implicitly is closer to 40% or even 50% when all is factored in in terms of cost of consumption items, quality, and the 24/7 service levels available in the U.S., that are alien to Europe) with at least an attempted provision of cradle-to-grave security. But to effect this fundamental transformation of American society, Mr. Obama had to count on a majority of Americans buying into the bureaucratism and sclerotic economic growth that have defined much of Europe in the post-War era. And this will no longer play next November here in the U.S.: Americans have come to realize that unless they evict Mr. Obama in 2012, he will cement and expand fundamental changes in the U.S. economy that are flatly unwanted here.

No better examples of the President’s miscalculation of the tenor of American culture can be drawn from his many decisions than the “forced” Chrysler recapitalization and Keystone XL pipeline controversies, respectively early and recent in his tenure in office. In early 2009 the U.S. government prodded Chrysler into a bankruptcy that, in non-standard fashion, would be worked out via government-sponsored receivership rather than through normal channels pursuant to private sector bankruptcy law — which, incidentally, is rooted in 800 years of English common law. The Chrysler bond-holders, who would have acquired control of Chrysler assets once all equity-holders were wiped out, were shunted aside by the President, and assailed as “greedy” in the process — this in spite of the fact that hedge fund who owned Chrysler bonds often invested on behalf of widow, orphan, and union labor clients. These bond-holders were seriously diluted in the bureaucratic decrees handed down by the Obama Administration, in favor of the United Auto Workers (UAW) and other constituencies. The unilateral abrogation of bond-holder rights, by an otherwise unconstitutional fiat decree, has had a deeply chilling psychological effect on the investment climate in this country, yet was merely a harbinger of the extensive cronyism that was to ensue under Mr. Obama.

Fast forwarding to late 2011, the Keystone XL pipeline, a $7-billion and 20,000 jobs energy project that had been studied intensively for nearly two years and would transport synthetic crude oil from Alberta to various refineries in the U.S., was postponed by Mr. Obama until 2013. This was another transparently cronyist maneuver that paid off Obama-allied groups such as the Natural Resources Defense Council, Sierra Club, National Wildlife Federation, Friends of the Earth, Greenpeace, and the Rainforest Action Network, all of which are environmental activist entities and key constituencies supporting Democrats in political power. Their objections have been definitively proven to be erroneous, as the clean energy nature and design of the pipeline has been thoroughly vetted. But a venture in a critical industry that would yield thousands of new high-paying jobs, and billions in new capital investment, languishes in limbo in order to placate anti-growth political supporters.

These discrete anti-business, anti-progress incidents, although steeped in unfairness, do not show up in explicit polling feedback. While only the highly visible skirmishes such as these or the stoppage of Boeing’s non-union plant in South Carolina (now quietly dropped by the NLRB) have received big media attention, dozens of other lesser deals like them have been reported on inside the Beltway and taken their toll, and for Mr. Obama, who’s spent all of ten months in the private, for-profit sector his entire life, they spell his doom. There is by now a latent dislike for the President among tens of millions of tax-payers and small business owners who are dismayed or even horrified by this, and by the willful pushing of American society into distinct new directions (e.g., ObamaCare) that are deeply unpopular nearly two years after passage. And fundamentally on this point, the American people, having now apprehended Mr. Obama’s “Europeanization strategy,” have no interest in lowering the trajectory of their standard of living in order to achieve greater levels of income equality, however dubious its achievement, via wealth redistribution.

Despite conventional wisdom of a tight race, we think the final electoral tally will be at least 317-221 in favor of the Republican. The Bush 2004 electoral map will be replicated at the least, and the Republican will carry the entire Midwest except Minnesota and Illinois, trade-off New Hampshire and New Mexico, and perhaps pull an upset in Maine. Michigan will likely go Republican for the first time since 1984, and Republicans have a real shot at the 20 electoral votes in Pennsylvania for the first time in 28 years as well (implying a 337-201 margin if so). For political junkies, we cannot fail to report that we agree with the widespread Beltway rumor-turned-conventional-wisdom that Hillary Clinton and Joe Biden will switch jobs for the second term, in part to shore up performance in November with a more popular running mate for Mr. Obama. We see no change in result due to this, however.

ii. The 45th President, and 76th Treasury Secretary. It matters little who Mr. Obama’s opponent is, as the result will be the same. However, the odds are strong that the 45th President will be former Massachusetts Governor Mitt Romney, with an outside chance of a busted convention and a (say) Draft Paul Ryan movement. While there is only a 10% chance or so of the latter happening — for the first time since 1948 and 1952 for Republicans — it is possible, if other Republicans split votes in the South and Midwest and deny Mr. Romney 50.1% of convention delegates on the first ballot.

We have no particular affinity for Mr. Romney who, after backing Democrat Senator Paul Tsongas for President in 1992, has as many similarities to Mr. Obama as he does differences. Mr. Romney has shown a propensity to favor a big and activist government in many areas including industrial policy, protectionism, environmental regulation, progressive taxation and a healthy corporate income tax (25%), as well as VAT taxes applied on top of income and other excise taxes. Like Mr. Obama — and after an adult lifetime of studying the federal government — Mr. Romney cannot name a single federal program or department specifically that he sees as redundant and ripe for elimination. Further, Mr. Romney has threatened both new and renewed war in central Asia while admitting he has no current security clearance, and without thinking through the consequences of spikes in already-elevated oil prices. In a 59-point “plan” for the economy, the Federal Reserve and monetary policy are not mentioned once, even though 40-years’ worth of monetary instability is the root cancer behind our current torpor. Indeed adding this all up, the story could just as easily be about Nelson Rockefeller’s son as it is George Romney’s.

We mention the foregoing because a President Romney may well not be the panacea for economic growth the anti-Obama forces crave, and one senses they know this now, which is why Mr. Romney cannot seem to break out of a narrow range of support hovering around 25% in polls. And equally so, this is why a busted convention leading to a President Paul Ryan is at least a remote possibility, helped by the first several primaries being proportional delegate apportionment. But many after April are winner-take-all, and Mr. Romney has the money to compete everywhere, and the nomination and election are his to lose.

We do expect Governor Romney to choose Florida Senator Marco Rubio as his running mate, and Senator Rubio will accept this. He will help the Republicans explicitly in Florida as well as in many other states such as New Mexico and Colorado, and in general “rally the base” who are far less enthusiastic about Mr. Romney’s quasi-statist approach; once in office Mr. Rubio would become a champion of the pro-economic growth paradigm of laissez-faire policy. Further, Mr. Romney may in the end surprise on the upside: his key economic advisor is Columbia Business School’s Dean, Glenn Hubbard. Mr. Hubbard is one of the great economists of this era, and would likely be Treasury Secretary under a President Romney. On the off-chance Mr. Hubbard reads these words, we can only say we hope that much currently unspoken by the Romney camp — but which we know Mr. Hubbard believes in and knows well — with respect to the importance of a (1) strong dollar; (2) low marginal tax rates on capital, income, and corporate profits (a la a Bowles-Simpson framework); (3) complete repeal of job-killers and capital-destroyers ObamaCare, Dodd-Frank, and Sarbanes-Oxley; (4) unrestricted free trade; and (5) a regulatory overhaul that returns economic rationality to the denizens of the Beltway who are in civil service — is all put into practice by a Treasury Secretary Hubbard in 2013. For Mr. Hubbard, it would be the capstone to a magnificent career and afford him the chance to go down in American history alongside his hallowed predecessors such as Alexander Hamilton or Andrew Mellon. For the challenges he would face in this position — and the chance to end America’s march to calamity and drowning in the red ink of trillions in unfunded liabilities — both will confer an opportunity for historic immortality upon the successor of the hapless Timothy Geithner.

iii. U.S. stocks rally at Supreme Court overturn of ObamaCare. The Patient Protection and Affordable Care Act, better known as ObamaCare, was signed into law nearly two years ago, as the signature achievement of the Obama Administration. Compared to other landmark legislation that changed the “social contract” in the United States (e.g., Social Security in 1935, the Civil Rights Act in 1964, Medicare and Medicaid in 1965, Medicare Part D in 2003), it was passed in an intensely partisan manner: the key votes to pass the legislation were 60-40 in the Senate and 219-212 in the U.S. House, with not one Republican in either chamber voting Aye. All the other aforementioned historic legislation had bipartisan support, often significantly so. The law is the subject of a veritable revolt at the state level, where an unprecedented 26 states have filed a class action suit against the U.S. Government to remand the statute, and it remains deeply unpopular with the American people, with a majority (53%) still favoring complete repeal.

What the Obama Administration has failed to understand throughout the health care debate and legislative wrangling is the effect all of it has on efficient capital markets, which are remarkably good at pricing future cash flows in consequence of legislation. And so part of the reason for the market’s current discount below long run earnings multiple levels is that the true cost of Obamacare is reckoned to be far higher than the published “neutrality”, or even the ex post admission of the Congressional Budget Office that it erred in scoring the bill back in 2009. Even the Republican objections at the time — that Obamacare would add at least $100 billion per year to federal spending in its first ten years, are now recognized by most analysts as too conservative.

Hence a rejection of the legality of Obamacare in June, by a strike-down of the law by a 5-4 vote in the U.S. Supreme Court, will have a very positive effect on U.S. equities — and bonds. We expect a decent rally that is sustained as a result of a Supreme Court overturn. And why are we confident that this will happen? Because Justice Anthony Kennedy, destined to break a 4-4 tie, will not be immune to the pleadings of Justices Scalia, Alito, Thomas and Chief Justice Roberts. Obamacare, as legal scholar Randy Barnett pointed out, is “the first time in American history that Congress has claimed to use its power over interstate commerce to mandate, or require, that every person enter into a commercial relationship with a private company.” There’s also never been a court case which said Congress can do this, so it will be precedent-setting, but Justice Kennedy is not deaf and blind to the public opinion landscape, nor will he be swayed by the flimsiness of the U.S. Government’s assertion, ex post, that the law is an excise tax — when they explicitly said it was not during passage. We expect a significant market rally once this decision is firm, and/or signalled as such.

iv. Eurozone Agonistes: a recession, and some surprises — though not a meltdown — yet. There are only bad and worse choices left for Europe. We have watched the unfolding tragedy there with great sadness, but at the same time anger at the elites in Brussels and Eurozone capitals who will always protect their own sinecures long before doing the right thing. The right thing in this case is bank recapitalization — by willing private investors, and not European taxpayers — followed by radical state restructuring, and an “indigenous Marshall Plan” consisting of reforms of state involvement in the economy, and pro-growth tax and strong currency policies such as those that were employed by the Adenauer government in 1948, during the original Marshall Plan. Additionally, the Eurozone should move swiftly to abolish all capital controls and restrictions on foreign direct investment, and transform itself into a welcome haven for investment, rather than the bureaucratic labyrinth for investing it is at the moment. And of course reform of state (public sector) involvement in the economy will necessarily entail a break of current unpayable pension, benefits, and even current wage promises in the profligate countries — France included.

Of course all the above is non-operative in the bureaucratic state’s halls of power, and so the Eurozone will now struggle in years of economic torpor. We do not expect the currency union to survive in its present form in the long run — the “math does not add up” for this. But, while guarding against an analytical bias in favor or recency, we nonetheless think all parties will try for one more year to preserve the unpreservable. This is so if only because the costs of transition for countries like Greece out of the Eurozone are too harsh for decision-makers there to contemplate (from capital controls to bank asset commandeering to, say, Euro-to-drachma conversion logistics, to the sorting out of cross-border debts, to property rights protection, and many others). The bottom line for investment analysis is this:

- Eurozone bourses, down in double digits in 2011, will be down again in 2012. The entire continent is a “short” for now.

- Exposure to the U.S. may well be more psychological than financial, but will be more severe than the optimists think. Hence part of the U.S. equity market performance in 2012 is predicated upon what happens in Europe; a melt-down there would lead to a big swoon here.

- We think the European Central Bank (ECB), whose balance sheet has ballooned to 3.55 trillion Euros (a 20% jump in the last three months), will support sovereign borrowing far more explicitly in 2012 than they have let on so far. It will not contain but will cap borrowing costs for the periphery countries, and in time will engender long term stagflation in much of the Eurozone. But the key point near term is that the ECB will help to forestall a meltdown in Greece or Italy near term, and Spain or Portugal later.

- Having said that we confess this is a “weak-form” conviction on our part. That is to say, investors should understand the real risk and implications of, say, an Italian default. $2.4 trillion in Italian debt at the moment, with $500 billion needing refunding this year as well as new spending needing deficit financing, pushes Italy closer to a point of no return. Again, we expect ECB “help”, and some ramp-up of the back-stop funding mechanisms (the ESM and EFSF) as well as IMF support, so 2012 may pass as did 2011.

- In the long run, the laws of economics cannot be annulled, however. Much of the Eurozone must suffer absolute declines in standard of living, and a wave of defaults in the banking sector, and likely more than one of the countries, seems certain. The future is ultimately unpredictable there but the 17-nation Eurozone will not survive intact, and long-term torpor and social unrest seem assured for many countries there.

v. U.S. equity markets will be up around 9.5% in 2012, along with GDP growth at 2.5%.* The reader will note that we have an asterisk by this assertion, which we include to make clear our assumptions: we expect the price of oil to rise only modestly, with dollar inflation countervailing declining European and global demand from 2011 levels. And, we also expect the above-described “muddle along” scenario in a stagflating Europe that nonetheless does not witness a sovereign default there in 2012. If European bank failures are multiplied by a sovereign default(s) there, leading to a deeper recession, the U.S. economy (and equity markets) will be more severely affected than for mere psychological reasons that kill animal spirits. Similarly a war between Iran and Israel would cause a huge spike in oil prices, and induce potentially serious economic harm here in the U.S.

We think there will be no war with Iran in 2012, and hence see oil rising to no more than $110 on the pick-up in U.S. inflation and dollar velocity (the stability of Iraq’s oil production is also open to question, but again we cannot foresee a shut-down in 2012, before much political infighting there has run its course).

S&P profits will climb from $97 to $100 per share (we are more conservative than most here), and an earnings multiple expansion will leave the S&P 500 at 1375 a year from now, a 9.4% increase from this week’s start. The Dow will rise about 12% to close at 13,700, and the Nasdaq will end the year at around 2840, up 9%. We see gold up another 10%, the 12th consecutive year of increase, to finish at $1725, while the bond market will finally recede from its top: the yield on the 10-year note will rise to 3.4%. We think U.S. inflation next year will be 4%, and the unemployment rate will decline (meaning, improve) to 8%. GDP growth should register a steady if unspectacular 2.5% growth.

Driving these improvements to economic and market performance will be rising corporate profits, continuing advances in productivity via new technology application, a pick-up in capital investment, continued loose monetary policy, and a “psychological lift” from a growing awareness of the demise of Mr. Obama’s political fortunes (a similar situation occurred in 1980, when the S&P 500 climbed 32.5% for the year, as growing confidence in a Reagan Presidency materialized). Additionally, there will be some “front-loading” of economic activity in 2012 as investors and corporate managers are aware that interest rates and inflation will be on the rise in 2013 (along with taxes, if there is no policy change). We should note that our analysis is not as bullish as some (e.g., Brian Wesbury at First Trust Advisors predicts a 1450 S&P 500 and 14,500 Dow Jones average), but is more optimistic than others (Goldman Sachs predicts a 1250 S&P 500 and only 1.7% inflation in the U.S. due to a near-recession here). In a nutshell, while factors driving growth per above will lift equities, the countervailing pull of Eurozone troubles, another million housing foreclosures, state and municipal fiscal challenges, slow-downs in Asia, and continued geopolitical instability will cap the upside.

vi. 2013 Warnings. We do not envy a President Romney taking the oath of office on January 20, 2013, or for that matter President Obama for his second term. Tax increases are set to take effect next January that would stunt growth, and Eurozone forestalling on some sort of painful rearrangement (or partial break-up) can’t continue beyond another tortured year. Most ominously of all, however, the Federal Reserve will be forced to move on interest rates next year, and this is likely to lead to a slowdown, if not recession in the U.S., absent related policy changes.

Higher interest rates are axiomatic in the U.S. both as growth picks up, raising the demand for loanable funds (the “good kind” of interest rate increase) as well as to temper or forestall a run on the dollar as inflation heats up. This is to say that the Bernanke Fed’s massive quantitative easing and balance sheet expansions in recent years cannot pass without a toll, which will begin to be paid by next year in higher inflation and interest rates, and a reprise of 1970s-style stagflation. Here there are no easy answers in the short run, as the Fed can only shrink its balance sheet by selling assets that will both cause rates to rise and lead to some bank balance sheet impairment. But the converse policy of continued easing cannot last, as it saps saving and investment in the U.S., and leads to both continued dollar weakening and later, inflation. The danger lies in the potential for a terrible miscalculation by the Fed, which has assumed that it can use (abuse?) the dollar’s reserve currency status to expand its balance sheet with relative impunity: the demand for dollars for global trade is a permanent reservoir in Mr. Bernanke’s mind. But sadly, this is likely not true much longer, if ever it was. Dollar use in international transactions has fallen from over 90% to 63% of all transactions in the last few years, and there are serious and active discussions to develop alternative reserve currencies in many foreign capitals around the globe. The Fed’s arrogance about the perpetuation of the dollar being king of trade at the same time the euro is slowly self-immolating is also mis-placed: there are now serious questions about long term U.S. fiscal viability that will lead to a rise of alternative arrangements.

In our view, fundamental monetary reform is coming, and the only question is whether the U.S. leads on it pro-actively, or is swept up in events reactively, perhaps after a mini-version of Germany in 1923 and the death of the Papiermark. Given the performance of the recent debt SuperCommittee, or the Obama Administration’s willful scorn of its own fiscal commission that it spent millions and a year’s time to support, the sad likelihood is that the U.S. will end up reacting to events as they play out in coming years. This indeed is the next President’s greatest leadership challenge: can he (or she) point out to the approaching tidal wave off-shore, now clearly visible in terms of incipient negative cash flows in the entitlement programs, and equally show the $211 trillion (present value) in the total fiscal gap (this is Laurence Kotlikoff’s calculation measuring the difference in the present value of all future projected spending, including servicing the existing debt, and all future taxes — so it includes entitlements and all other spending too) as being worthy of attention? This coming fiscal breakdown will itself precipitate a monetary breakdown, if nothing is done. To say this differently, the U.S. is on the exact same path, and will suffer the same fate, as Greece, if policy does not change, fairly immediately.

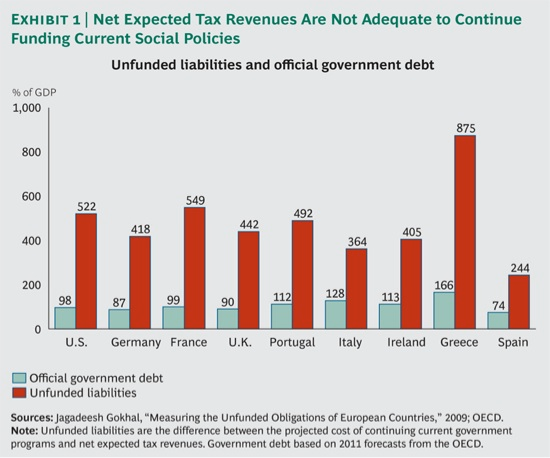

Indeed, the problem of a fiscal gap is endemic to the welfare state model, as shown in the Exhibit below, borrowed from a white paper by the Boston Consulting Group. Shown here are current debt/GDP ratios of select countries, along with total unfunded entitlement programs/current GDP (the U.S. figure of 522% of GDP, or $78.3 trillion, is for the medical and retirement programs only; Kotlikoff gets to $211 trillion by looking at the unfunded liability streams from all other government spending over an infinite horizon):

Courtesy: John Mauldin, “Thoughts from the Frontline”, 12/31/11, quoting the Boston Consulting Group

As can be seen, all these countries as well as the U.S. will have to reconfigure their social welfare programs, which have led all on a path to national bankruptcy. Doing this in a manner that still allows for economic growth — indeed, doing it in a manner led by growth — is the great and immediate need for all. And the unremitting reality is, this global reorganization of public fiscs, and global recapitalization, MUST be led by the U.S. For it to be successful, and for depression to be avoided, policies conducive to saving and the formation of capital, to investment and entrepreneurial initiative, to property rights and reasonable taxation and regulation — indeed, the venerable policies of a laissez faire economy — are those which must return to the fore of economic policy. And we cannot fail to add, the sine qua non of this entire policy mix is sound money, in order to promote trade and investment, and accurate economic calculation.

We will end on a hopeful note: as daunting as these challenges are here in the dawning of 2012, they pale in comparison to the genius and irrepressible energies inherent in free men. That is to say, the creative powers that have wrought the steam engine, the gigabit microchip, and everything in between will not be short to the task this time, if permitted free rein. The technologies now coming online promise a productivity revolution exponentially greater and more conducive to growth than the era just passed. But the key is to let it all happen via the “system of natural liberty” as expounded upon by Adam Smith. Economic growth at 2% in the next 15 years would take the U.S. economy from its current $15 trillion in GDP to $20 trillion. But GDP growth at the long run historic rate of 3.3% would yield a $24.5 trillion economy in 15 years: the gap would be $191 billion in output next year, and grow to more than a trillion by year 15. A staggering gain in standard of living awaits America and all the world, if the right policies are pursued; whether they will be is to be determined in the political battles that lie before us. For the outcome, a fretful world can only wait, in now moving out into 2012.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, John Chapman can be reached at john.chapman@4kb.d43.myftpupload.com. The views expressed here are solely those of the author, and do not necessarily reflect that of colleagues at Alhambra Partners or any of its affiliates.

Click here to sign up for our free weekly e-newsletter.

Stay In Touch