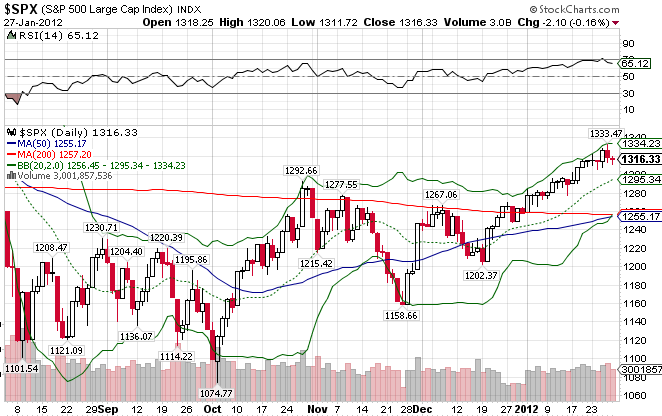

The S&P 500 continues to creep up on no news from Europe and further monetary easing here in the US. While the move up has been nothing to write home about, the markets do find themselves overbought, and sentiment is quite positive, which may signal at least a short term top.

The VIX index hit levels not seen since July 2011. But, as the market is overbought, it seems to have hit a bottom.

The US Dollar has broken its 50-day moving average but (so far) held its short-term uptrend. With news of the Fed holding rates low for another few years, that may be sufficient to knock it back into a downtrend.

Conversely, the Euro rebounded past its 50-day MA. Could this be the beginning of the end of the short-euro trade?

The Goldman Sachs Commodity Index bounced off its upward trend line, on the back of the weakening dollar.The index bounced off its 50 day MA, and crossed its 200 day before pulling back slightly. The index could be in for a nice run.

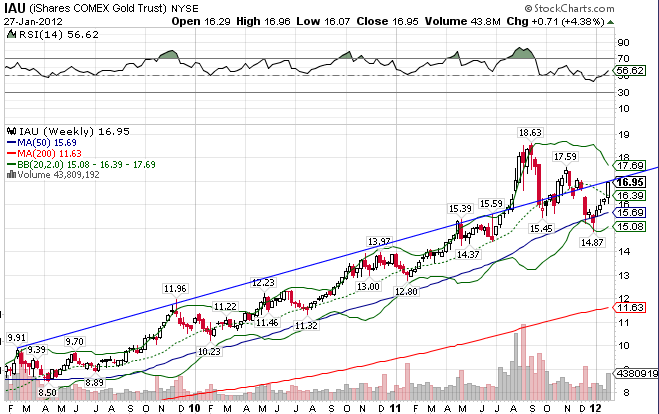

Gold blew through its short-term downtrend line on its way to the $17 level, as expected. Longer-term, the index is right under its upward trendline. It’ll need something big to push it across the level, such as a further weakening of the dollar…

Gold Long-Term

Stay In Touch