Thinking Things Over March 18, 2012

Volume II, Number 11: The Fatal Conceit of Politicians

By John L. Chapman, Ph.D. Washington, D.C.

The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design. — F.A. Hayek, The Fatal Conceit

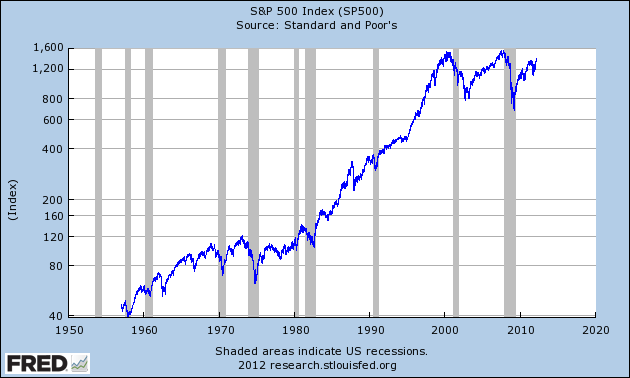

On March 15 the S&P 500 Index closed at 1404, up above 1400 for the first time since June 5, 2008, and piercing the 1400 level that had first been breached on July 5, 1999. As Chart I shows, investors have had a wild ride in the last 13 years to get back to summer 1999 valuations, and in inflation-adjusted terms, have seen virtually no increase to their capital wealth:

Chart I. The S&P 500 Index, 1957-Present (Log Scale)

The question, of course, is where will the market, up nearly 12% so far in 2012, head from here? Back at the turn of the year, we predicted 1375 for the S&P Index by the end of 2012, but will be glad to have been proven overly-pessimistic in the months ahead. And indeed, if S&P earnings hit $104 per share over 2012, as seems possible, with an expanding forward multiple past 14, there is still room to run for U.S. equities. But at this point we are nervous, because our view is that in spite of occasional panics that set in and, for example, lead to an over-correction such as was reached in the secular low of March 2009, markets are broadly efficient in the long run. That is to say, stocks are, over time, fairly-priced, and move largely due to changes in the policy and macro-environment. And on this point, the political class continues to be cause for concern.

Chart I represents this fact admirably in terms of the sustained climb in stocks between 1983-2000. During that 18-year period, which encompassed both Democrat and Republican Administrations, real GDP growth per annum averaged nearly 3.7% in the United States, and was above 4% in nine of those eighteen years. The tenfold rise in U.S. equities from 1983 through 2000, coming after the 70% real drop in share values between 1974-82 seems quite “correct” in hindsight, when considering the major improvements — by which is meant, conducive to prosperity — in fiscal, monetary, trade, and regulatory policies beginning in the Reagan era. In other words, good — or pro-growth — policies will beget a prosperous economy, and rising stock prices.

But sadly, the converse of this is also true, and can often be highlighted almost daily in an election season. Our solons inside Washington’s Beltway often display a penchant for preferring policies that confer short-term political — as opposed to long-term economic — benefits, and Barack Obama is nothing if not a gifted politician. Running for re-election in a year when the economy is worrisome, the President has very skillfully been moving the terms of the debate, painting his opponents, as he did March 15 in Prince George’s County, MD, as anti-female neanderthals, stuck in a retrograde past of dying technologies and old modes of production:

Lately, we’ve heard a lot of professional politicians, a lot of the folks who are running for a certain office who shall go unnamed — they’ve been talking down new sources of energy. They dismiss wind power. They dismiss solar power. They make jokes about biofuels. They were against raising fuel standards. I guess they like gas-guzzlers. They think that’s good for our future. We’re trying to move towards the future; they want to be stuck in the past.

We’ve heard this kind of thinking before. Let me tell you something. If some of these folks were around when Columbus set sail, they must have been founding members of the Flat Earth Society. They would not have believed that the world was round. We’ve heard these folks in the past. They probably would have agreed with one of the pioneers of the radio who said, “Television won’t last. It’s a flash in the pan.” One of Henry Ford’s advisors was quoted as saying, “The horse is here to stay but the automobile is only a fad.”

There always have been folks who are the naysayers and don’t believe in the future, and don’t believe in trying to do things differently. One of my predecessors, Rutherford B. Hayes, reportedly said about the telephone, “It’s a great invention, but who would ever want to use one?” That’s why he’s not on Mt. Rushmore, because he’s looking backwards. He’s not looking forwards. He’s explaining why we can’t do something, instead of why we can do something.

The point is, there will always be cynics and naysayers who just want to keep on doing things the same way that we’ve always done them. They want to double down on the same ideas that got us into some of the mess that we’ve been in. But that’s not who we are as Americans. See, America has always succeeded because we refuse to stand still. We put faith in the future. We are inventors. We are builders. We are makers of things. We are Thomas Edison. We are the Wright Brothers. We are Bill Gates. We are Steve Jobs. That’s who we are.

What the President has begun to assert is that his Democrats represent and will pursue policies intending to bring us a prosperous future based on the technologies of tomorrow: wind and solar power, or “biofuels” (which sounds more avant-garde than saying “seaweed and algae”). Further, the Obama Administration is loaded with enlightened bureaucrats who are adept at mandating needed and beneficial change, such as the new fuel economy standards announced last year mandating that all vehicle fleets sold in the United States in 2025 must achieve an average of 55 miles per gallon (among other things, one wonders why the mandate was not set at 100 MPG, since that would be an even bigger improvement from today’s 27 MPG rule).

This is a very clever line of argumentation, and against what will very likely be a weak Republican opponent, it may even work. But in suggesting that his policies are progressive, and akin to what was accomplished by Christopher Columbus, Thomas Edison, Henry Ford or their modern-day dreaming-inventor analogs in Bill Gates and Steve Jobs, Mr. Obama is guilty of an association fallacy, as well as a case example of a class of logical errors known as Post Hoc Ergo Propter Hoc (“After this, therefore because of this”, signifying that if X happens, then Y happens, Y must have occurred because of X).

Indeed, there is nothing remotely similar about the examples Mr. Obama cites in the quote above to his government-centric spending and “investment” policies, save for the partial funding of Christopher Columbus’ maiden voyage by the Spanish Crown. But even in that case, it was the venture capital supplied by merchant bankers in Florence and Genoa who provided the major part of the needed funding, and bore the commercial risk that returns on capital would be forthcoming one day. But whether in the cases of the great inventors and industrialists of yesteryear (e.g., Edison, Ford, Alexander Graham Bell and telephony, Philo Farnsworth and RCA’s pursuit of television) or their modern-day counterparts in information technology, all were backed by profit-seeking private sector-based capital. Mr. Obama wants to associate his policies with such dramatic breakthroughs in commercial history, but more appropriate and correct examples for him would of course be found in any great disruptive technologies developed in the Soviet era, or in modern-day European welfare states.

For reasons well-articulated by the great Austrian economists, such examples are few and far between, and indeed none come to mind here. As F.A. Hayek pointed out, the knowledge used in raw material form that leads to these breakthroughs is usually dispersed, often tacit, always congruent with supply-and-demand conditions in far-flung global markets, and best-coordinated through incentive-based mechanisms that are profit-oriented. Conversely, government bureaucrats sitting high atop the U.S. Energy Department’s headquarters building on Independence Avenue in Washington, D.C. cannot possibly have the requisite information, let alone the incentives, to seek out and coordinate the vast amounts of data and resources needed to commercialize the technologies of tomorrow. When politics trumps economics, in fact, Solyndra-type results are the norm.

Mr. Obama’s “fatal conceit” on this point is best illustrated via Leonard Read’s parable of pencil production. Who among us, Read’s famous 1958 essay demands, could produce a simple — and quintessentially “low-tech” — pencil? Where does the wood for the shaft, the graphite lead core, the paint for the pencil’s label, the rubber for the eraser, and the brass for the ferrule — not to mention the glue that holds it all together — come from? And how are all these part “machined” and formed into the final product? Who coordinates the buying and transport of lumber from (say) the Northwest, iron-ore (from Africa?), graphite, rubber (from Malaysia?), and in turn dozens of other raw material inputs that go into the machinery that is used in pencil production? Who invests in the countless warehouses around the United States that are mere weigh-stations in the transport of pencils from factory to retail store?

What Read meant to convey is that even the simple, pedestrian, and lowly “Number 2 lead” pencil is produced, ultimately, by faceless thousands of different people, who not only do not know each other, but may well hate each other. Further, these pencils cost pennies at retail, yet payment for them in turn is apportioned all the way back to each and every producer in the vast lattice-work of producers and distributors who cooperate — totally anonymously and unknowingly — in bringing pencils to retail markets, in highly economical fashion.

Such was and is the miracle of market-based production and wealth creation as evinced in free, competitive, and unhampered economies. The great mistake, or again, the fatal conceit of President Obama and indeed most all politicians lies in their quite erroneous understanding of how this great fly-wheel of production in a market economy works, how it seemingly produces order out of what would be “uncoordinated chaos” if not, in fact, for the coordinating properties of the free market’s invisible hand. To say this differently, we have irrepressible confidence in the boundless creative energies of entrepreneurs operating as moral and economic free agents, and the halcyon days of 1983-2000 can indeed be repeated once again, along with U.S. equity market performance that would then move beyond the flat-lining of the last 13 years. What shakes this confidence, ultimately, is the intellectual vacuity of a political class that seems not to understand how this market process works, and indeed undermines both economic progress and the wealth creation that signifies it, as embodied in sustainably rising equity prices. For only the most naked of emperors would assert that what Thomas Edison and Henry Ford accomplished is parallel to episodes like Solyndra, and that anyone who cannot agree with this must believe in a flat earth. This mentality, more than torpor in the Eurozone or war-drums in the Middle East, is what leads to caution now as the S&P advances above 1400.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, John Chapman can be reached at john.chapman@4kb.d43.myftpupload.com. The views expressed here are solely those of the author, and do not necessarily reflect that of colleagues at Alhambra Partners or any of its affiliates.

Click here to sign up for our free weekly e-newsletter.

Stay In Touch