This week, one particular article sparked an intense internal dialogue about some of the global economic realities that have us concerned. The article is from Peking University’s Professor Michael Pettis. Prof. Pettis opines that Chinese citizens would rather save than spend and that Japan, who has recently run a current account deficit, would prefer to run a surplus.

In China, the government’s recent stimulus program involved projects like toll roads. These roads were built with about $350bln in debt financing; the maintenance depends on revenue from tolls. As we say, nothing comes for free. High fares, needed to pay debt service, are being passed on to consumers. Corruption is rampant, unauthorized toll booths are being erected and an estimated $3.6bln annually is literally being stolen. Tolls are quickly becoming a politicized item as the burden of the debt is passed on to consumers. Unauthorized toll booths not only siphon money but make the roads commercially inefficient. Toll cuts are likely coming and Beijing will likely take pricing power away from the provinces, holders of the debt burden. Projects like these leave Chinese banks holding local government bonds which could quickly become non-performing loans. The implications for Chinese bank balance sheets could be significant. Granted the federal government has plenty of room to recapitalize these banks and have in fact done so several times this past decade. But a binary event would not be smooth. There are 2 takeaways. First, there is the potential for credit default. Second, global demand from the Chinese consumer is not here at present. For these reasons, Pettis opines that Chinese consumers prefer saving over spending and therefore China would prefer to continue their export model.

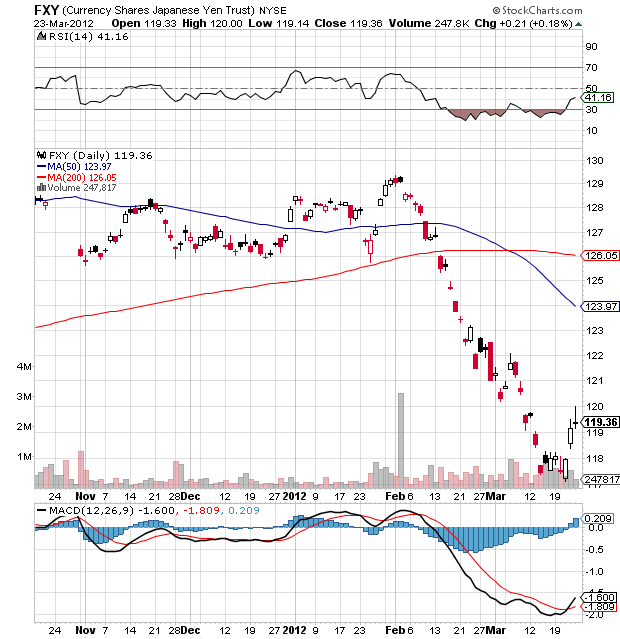

In Japan, Pettis arrives at a similar conclusion. The Japanese government is laden with debt, to the tune of about 195% of GDP. Japan’s current account recently dipped into negative territory, although it did rebound to surplus this past month. The implications of the recent current account deficit are the following. If Japan needs to turn to foreign sources to finance a current account deficit, this could be problematic given its current debt levels. Additionally, the recent deficits imply soft global demand; they are not finding willing buyers for their exports. The solution for Japan policy makers seems to be, currency devaluation. Japan would also seem to favor an export model, keep savings at home, and raise prices and taxes to pay down the debt.

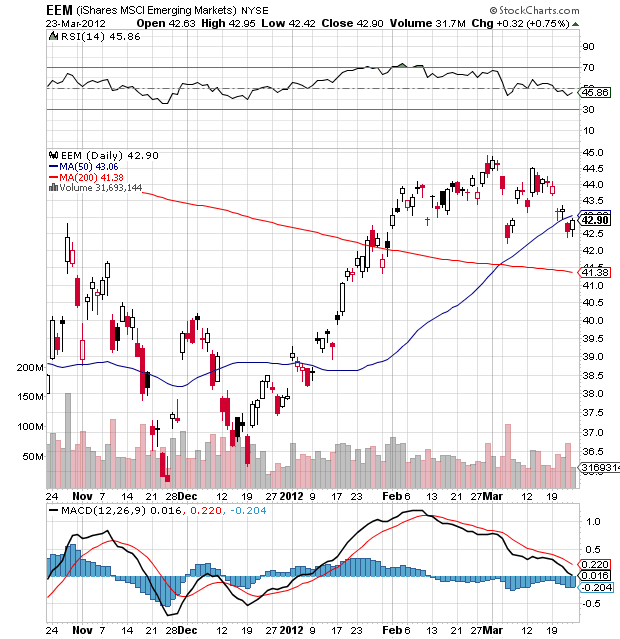

A step back allows us to look at the bigger global picture. Is/will anyone be the buyer of last resort? Europe has big problems and still future problems. Europe is the biggest market in the world and they are in no position to buy. It is looking less and less likely that the Chinese consumer will come to life in the immediate future. Also, China has its own debt problems from recent infrastructure spending which has the potential to cause bank balance sheet problems. Japan has government debt problems and is more interested in saving than spending. Australia, Canada, South America, Russia, Africa and Arab countries are predominantly resource economies who, for the most part, rely on the rest of the world to buy what they dig out of the ground. SE Asia is predominately a manufacturing hub for western technology.

With a few outside exceptions, that leaves the US. This is not an unfamiliar spot for us. Unfortunately, we are still busy repairing the damage done from the recent real estate crisis. But this is coming to completion and there have been signs of life in our economy. A second unfortunate circumstance is that US policy makers seem happy with a soft dollar policy, essentially saying keep your hands off the US consumer. We are skeptical that an Obama administration would be willing to change course and the probabilities of an Obama victory have risen. Recent Romney rhetoric, implicating China as a currency manipulator, does not instill much faith that his administration would embrace a strong currency.

In the past, a pulse of global economic activity has rippled from a strong dollar and the buying power of the US. US businesses and consumers purchase goods and services. In turn China, for example, buys copper from South America and construction equipment from the US. South American mining companies buy drilling equipment from the US and the cycle continues. Perhaps policy makers are skeptical, in today’s indebted world would a global cyclical boom even result from a strong dollar policy? Perhaps they fear the debt burdens of the world would merely absorb any stimulus provided by a strong dollar, much in the way our banking system and housing sector have absorbed recent government stimulus. Why waste capital on a system so over burdened with debt, especially when the debt is not your own.

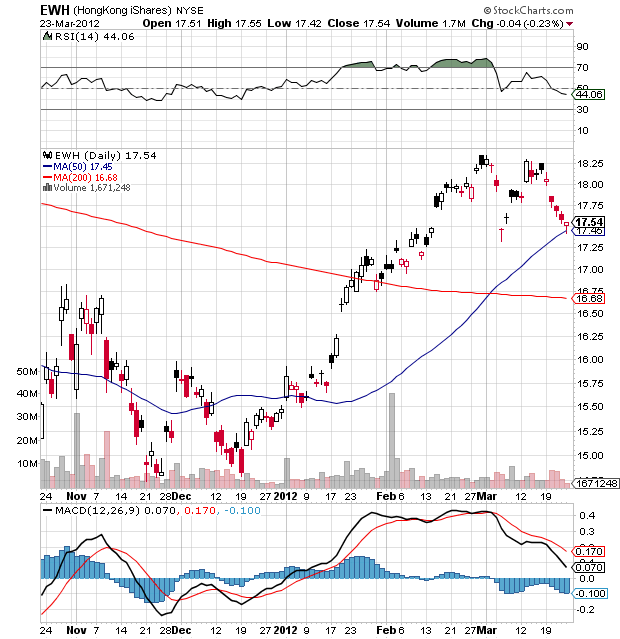

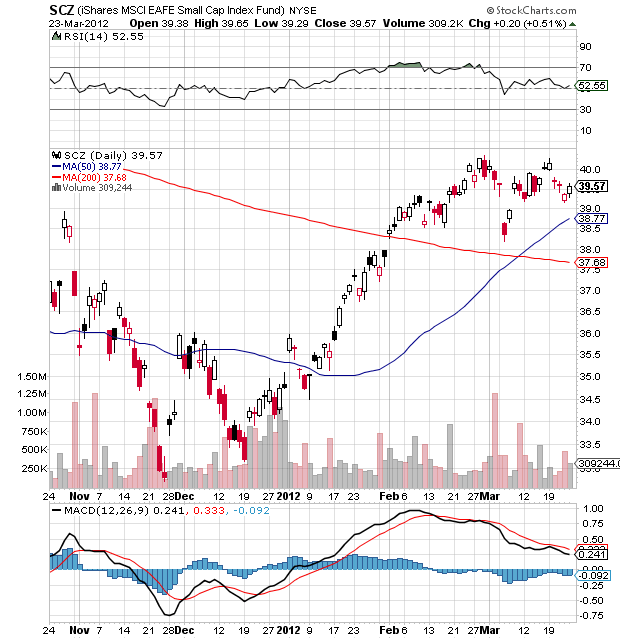

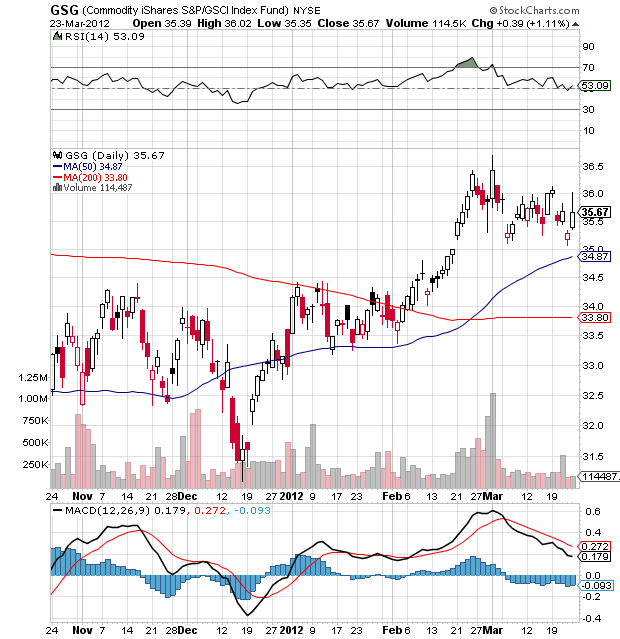

These are some of the issues we see in the world today. We have therefore moved from neutral on the world economy to cautionary. With the recent strength in markets we were again small sellers this week. We pared holdings in Hong Kong, Singapore, Emerging markets, commodities, and EAFE small caps. All tactical risk asset portfolios reside approximately 5-6 percentage points below baseline risk targets. As always, feel free to call me to discuss our outlook and asset positioning. I have linked Professor Pettis’s article here for anyone interested: http://www.mpettis.com/2012/03/20/the-japan-debt-disaster-and-chinas-nonrebalancing/

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Douglas R. Terry, CFA is reachable at dterry@4kb.d43.myftpupload.com

Stay In Touch