Thinking Things Over April 1, 2012

Volume II, Number 13: Say’s Law and Stimulus Spending to End Recession: Why It was Doomed to Fail

By John L. Chapman, Ph.D. Canton, Ohio.

So then you get the argument, well, this is not a stimulus bill, this is a spending bill! Well, what do you think a stimulus is? (Laughter and applause.) That’s. The whole. Point! (Laughter.) No, seriously! (Laughter.) That’s the point. (Applause.) Then there’s the argument, well, this is full of pet projects. When was the last time that we saw a bill of this magnitude move out with no earmarks in it? Not one. (Applause.) And when you start asking, well, what is it exactly that is such a problem that you’re seeing, where’s all this waste and spending? Well, you know, you want to replace the federal fleet with hybrid cars. Well, why wouldn’t we want to do that? (Laughter.) That creates jobs for people who make those cars. It saves the federal government energy. It saves the taxpayers energy. (Applause.) — Barack Obama, 2/06/2009

When the world was plunged into a global depression in the early 1930s, unemployment moved from under 4% in 1929 to close to 25% by early 1933 in the United States. Conditions were not as bad in Europe, where unemployment averaged in the low teens, but they were bad enough that a rancorous debate developed in the economics profession about the proper corrective policies to be taken. John Maynard Keynes became the leading advocate for activist government intervention, pressing for what we today call “fiscal stimulus” – that is to say, government spending (that would involve growth in debt and deficits) – on a wide scale.

Keynes argued that the classical economists, led most prominently by Jean-Baptiste Say, had failed to apprehend how markets work, and that there was nothing inherently “self-correcting” in a market economy:

From the time of Say and Ricardo the classical economists have taught that supply creates its own demand…..meaning [that] the whole of the costs of production must necessarily be spent in the aggregate, directly or indirectly, on purchasing the product.

…..Say’s Law, that the aggregate demand price of output as a whole is equal to its aggregate supply price for all volumes of output, is equivalent to the proposition that there is no obstacle to full employment. If, however, this is not the true law relating the aggregate demand and supply functions, there is a vitally important chapter of economic theory which remains to be written and without which all discussions concerning the volume of aggregate employment are futile.

Keynes was referring here to his new theory of aggregate demand, which he sought to show supplanted the inferior classical theory of Say, Ricardo, Adam Smith, and J.S. Mill. In short, Keynes held that all these writers were wrong, that there was nothing inherent in a market economy that equated spending on output to cover the costs of production at full employment. Hence, said Keynes, mass unemployment was quite possible in a market economy.

To the casual observer who perceived mass suffering, Keynes’ theory seemed to “fit the data” of the mid-1930s perfectly, and his remedy, massive government spending on public works projects to “plug the gap” in aggregate demand between underemployment and full employment output levels, became standard macro-economic doctrine for policy to combat recession. Hence when Barack Obama took office in January 2009, his key advisors (Jared Bernstein, Lawrence Summers, Christina Romer, Austan Goolsbee, and Paul Volcker) were unanimous in support of a massive spending stimulus to ensure aggregate demand would return to “full employment levels” in 2009. Unemployment was to top out at less than 8% and be under 6% today, three years later, and Mr. Obama’s loudest critics came from people like Paul Krugman, who argued that a then-$862 billion spending bill and permanent increase in the federal spending to GDP ratio from 22% to 25% were not nearly big enough, and “at least $2 trillion” in new spending would be needed.

In short, the Keynesian mindset, that spending drives aggregate demand, thus begetting economic activity and wealth creation, and ultimately utilizing any idled resources on the way to full employment, is alive and well in Mr. Obama’s economic doctrine and policies: three years into his Presidency, the Obama Administration has set post-war records for spending as a percentage of the total economy, and U.S. gross nominal debt will have increased by nearly a third in just his four years.

Equity markets in the U.S. have ostensibly loved the spending spree, combined with the Fed’s extraordinary easing of monetary policy: the S&P 500 has doubled since its March 2009 lows. But per capita disposable real incomes in the U.S. have fallen in three of four years now, and are still off their 2007 peak. Unemployment, which climbed to 10% in 2009 in spite of the stimulus, was over 9% for three years and still hovers above 8.3% a full eleven quarters into the recovery (it would be close to 11% if the labor force participation rate were the same today as it was on Mr. Obama’s Inauguration, and there are at least 5.3 million fewer workers today than there were four years ago). And as Chart I below shows, in the last ten quarters post-recession end in June 2009, GDP growth has averaged 2.45% per annum:

Chart I. Last Ten Quarters of GDP Growth (Q3-2009 through Q4-2011), Average of 2.45% Annualized Growth Per Quarter

What If Keynes was Wrong, and Say was Right?

At this point, three years into the Obama spending enterprise, it is fair to ask, why is economic growth so anemic, and the recovery so fragile? After all, post-war growth through 2007 and indeed, the period between 1900-2007, both saw growth average nearly 3.4% in the United States. Further, 44 of the last 91 years saw U.S. GDP growth above 4%, and prosperity was sustained over long periods of time, too: the 18-year period between 1983 and 2001 saw GDP growth average 3.6%, with short six-month recessions only in 1990-91 and again in 2001-02. What can be learned from earlier periods that inform the desultory economic performance in these recent years of high Keynesianism?

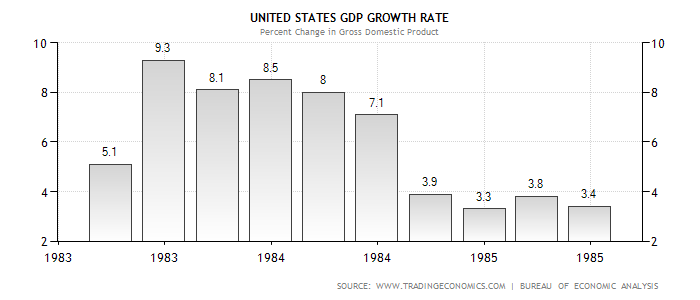

Milton Friedman once stated that while the natural and social sciences differed dramatically in that the latter offered no opportunity for laboratory-like controlled experiments, there were nonetheless occasions where “natural experiments” could be observed that approached observable differences in scenarios. For example, comparing economic growth and wealth creation in East and West Germany, or North and South Korea, where demographic and physical/geographic characteristics were so similar, and where only the political regime and level of economic freedom differed, afforded observable outcomes that yielded strong conclusions about the comparative efficacy of very different economic policies rendered on behalf of the same people. And so we have such an opportunity here, as some have discussed, to compare the first ten quarters of recovery under Mr. Obama, with those from a very different policy mix under President Reagan. In contrast to the anemic GDP growth shown above, Mr. Reagan’s first ten quarters post recession averaged 6.07% annualized growth, as shown here in Chart II:

Chart II. First Ten Quarters of GDP Growth after 1981-82 Recession (Q1-1983 through Q2-1985), Average of 6.07% Annualized Growth Per Quarter

The similarities in the two eras are palpable, and at least close enough for analyzing comparative efficacy: Mr. Reagan inherited a recessionary economy with 21% prime interest rates, 13% inflation, and 7% unemployment. Investment had been moribund since hitting a post-war low in 1975 thanks to a weak dollar and monetary chaos, and unemployment topped out at 10.8% at the end of 1982 — higher than Mr. Obama’s peak of 10%. Deficit-spending had spiked through the 1970s, and the debt-to-GDP ratio would climb above 23%. Tax rates and tariff levels were both far higher than today around much of the world including the United States, yielding an economy in as deep a mess, broadly speaking, as Mr. Obama inherited in 2009.

But Mr. Reagan summarily rejected the central tenet of Keynesianism, that deficit spending and monetary inflation can greatly reduce, if not fully eliminate, unemployment. And further, Reagan was a staunch adherent of Say’s Law, which had been bastardized into an ill-conceived straw-man by Keynes (per the false thesis above, “supply creates its own demand”) in the 1930s in order to justify government spending. Instead, Say had held that

….[T]he encouragement of mere consumption is no benefit to commerce; for the difficulty lies in supplying the means, not in stimulating the desire of consumption. And we have seen that production alone furnishes those means. Thus, it is the aim of good government to stimulate production; of bad government, to encourage consumption.

In other words, Say held that — and his “Law” should be stated as being that — production is the source of demand (which is to say, demand does not emanate from fiat money created out of thin air and placed in government checking accounts via bond sales to the central bank). A corollary of Say’s Law, properly understood, is a point good economists should never tire of making: we produce in order to consume, and hence spending is an effect, and not a cause, of economic growth.

This truth as propounded by Say is not only a canonical law of economics, it is perhaps the most important axiom in all of macro-economic theory properly construed. And the policy mix that flows from it, as pursued by President Reagan, is nearly diametrically opposite that of Keynes, in combating recession. For J.B. Say recognized and never forgot the seminal teaching of Adam Smith: the prosperity of any economy lies in inverse proportion to the size of government’s “footprint” in it (i.e., government spending as a percentage of the total economy or GDP, the degree of regulation, taxation levels, promotion of private sector-led capital formation). And hence Mr. Reagan, following Say, offered deep marginal tax cuts on income and capital, lower levels of regulatory burdens, a strong dollar that signaled stability of value in order to encourage investment in the U.S., and an intention to lower the level of government spending in the economy (and as a percentage of GDP, Mr. Reagan accomplished this in spite of growing nominal deficits — real non-defense spending grew only 0.5% per year across the Reagan terms).

The entire Reagan package was geared to promote entrepreneurship and capital investment in job-creating ventures — that is to say, the “production” that Say recommended, that yielded real income for spending on consumption. And indeed, there were 21 million new jobs created in the U.S. between 1983-90. The Obama economy, by contrast, is still down a net five million jobs so far, and is moribund for the same reason Keynesian policies produced no sustainable growth when first tried under President Roosevelt in the 1930s: higher levels of government spending; more onerous regulatory burdens that increased costs for businesses; and the threat (or, actualization) of higher taxes on capital, income, and profits, coupled with a dollar de-linked from gold and/or poorly managed by the Federal Reserve, all combined then — and are doing so now — to stifle investment and entrepreneurial dynamism. Investment levels are further depressed thanks to the literal waste of trillions in capital (ultimately) that government spending represents, along with, in general, a heightened level of uncertainty (or, better said, fear) among corporate managers and decision-makers.

So, What Should Investors Do?

We still think GDP growth in the U.S. will end up around 2.5% for 2012, and the S&P 500 will end up higher than where it began the year (1257 — in January we called for 1375 by year end). But the denunciations in the past week of Paul Ryan’s “Path to Prosperity” budget plan (which passed the House last Tuesday) by Obama acolytes, matched by calls for yet more stimulus spending (by, among others, Paul Krugman and Nouriel Roubini), show that the current Administration is now thoroughly and deeply invested in the core Keynesian trope: spending begets wealth creation and economic growth, in this view (and conversely saving, which the Reagan program encouraged in order to induce the formation of capital, is looked down upon).

For better or worse, however, the United States has for the last hundred years, and will for the next hundred, lead the world in terms of progress, and stagnation here guarantees stagnation virtually everywhere else. A recession in the Eurozone, slowdown in China and its supplier country partners, prolonged and fitful slump in Japan, and uncertainties in emerging economies as well as the Middle East all give rise to a situation that, best case, portends quasi-permanent sclerosis with respect to growth and the creation of conditions leading to prosperity, in the U.S. and around the world. A correction in equity markets around the globe, particularly in the U.S., which saw a strong first quarter, is eminently possible as the high-frequency data pull back some in the months ahead (though again, we remain optimistic about 2012 for gains as a whole).

What the global economy needs most now is leadership, of the kind Mr. Reagan, a student of Say, provided: a strong dollar, lowered tax levels on companies and individuals at the margin, lowered levels of regulation, and of course a relative decline in spending as a percentage of the total economy. Amidst the hue and cry heard in a fretful world, destiny beckons a former governor of Massachusetts, and bids him comprehend these ancient verities of economic growth, once enunciated so well by Jean-Baptiste Say precisely two centuries ago.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, John Chapman can be reached at john.chapman@4kb.d43.myftpupload.com. The views expressed here are solely those of the author, and do not necessarily reflect that of colleagues at Alhambra Partners or any of its affiliates.

Click here to sign up for our free weekly e-newsletter.

Stay In Touch