In the last update, the S&P 500 Cap-Weighted Index was at a crossroads. Well, the index proceeded to break support at the 50-day Moving Average before testing the 200-day. The index has returned 11.87% so far this year.

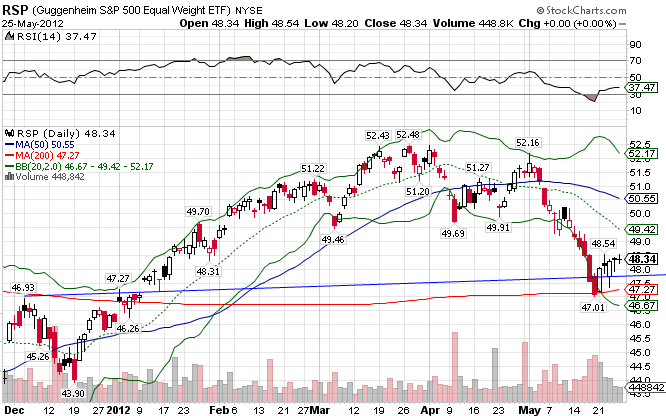

The S&P 500 Equal-Weighted index ((RSP)) is set up so that every stock in the index has the same weight, thereby eliminating market-weighting’s growth bias. As a result, the index tilts more towards mid-cap and value stocks, which accounts for much of the outperformance versus the cap-weighted index in the last ten years. The index is up 11.62% YTD.

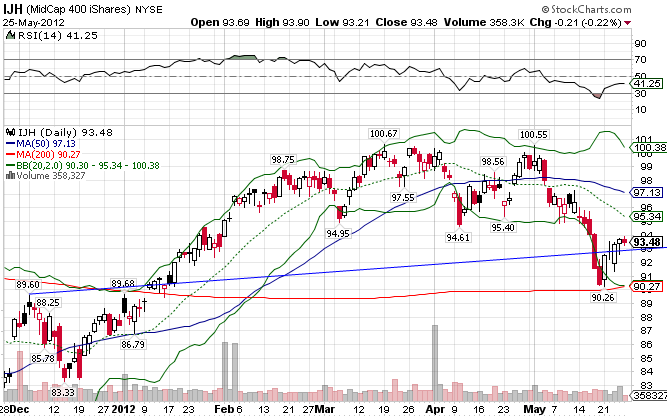

The S&P Mid Cap 400 Index ((IJH)) is almost identical to the US Large Cap index technically, just slightly more volatile, with higher highs and lower lows. The index bounced off the 200-day MA before breaking through short-term resistance. Look for it to test the 50-day MA. The midcap index has returned 13.13% so far this year.

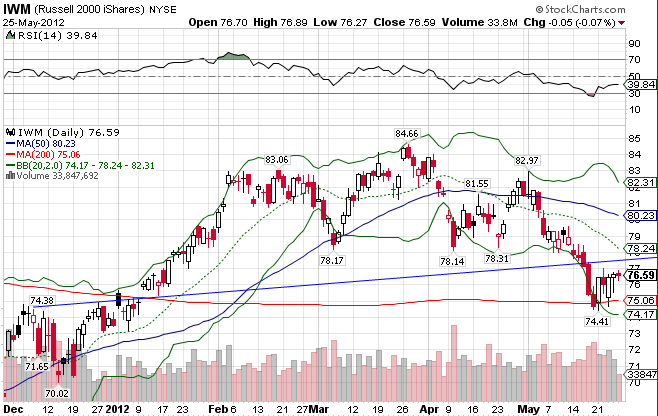

As mentioned in the last update, small caps tend to precede the overall market. And when the Russell 2000 Small Cap Index ((IWM)) started correcting and breaking support levels before the rest, it was evident we were in for a rough patch. The index managed to bounce off its 200-day MA, but that may be short-lived, as the index will encounter resistance 77 through 80 range. The index is up 10.80% YTD.

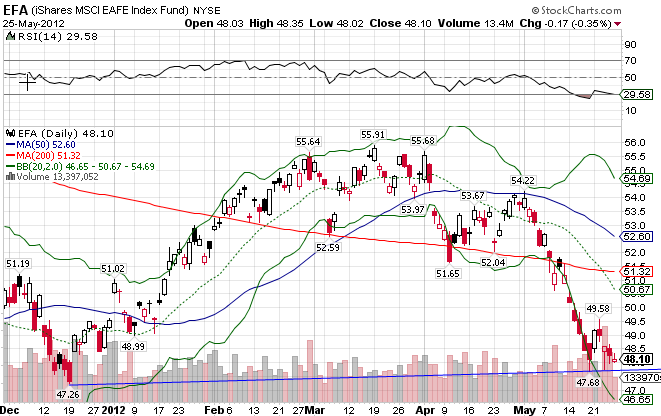

The MSCI EAFE Index ((EFA)) finds itself right at support, but momentum to the upside may be waning. If the level doesn’t hold, look out below. The index is up a below-par 8.52%

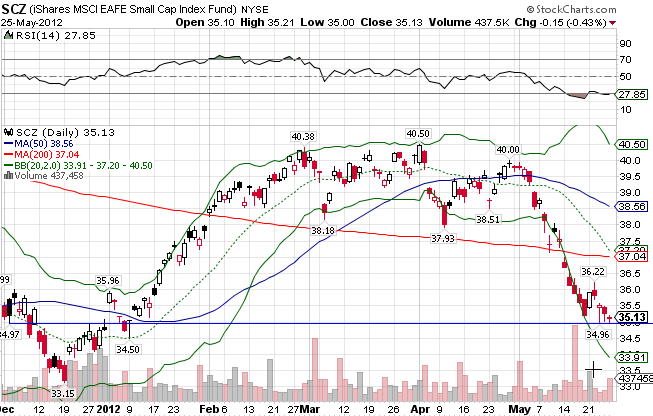

The MSCI EAFE Small Cap Index also finds itself at support, but has been outperforming the EAFE large Cap index by a wide margin. The index is the best performing of all, returning 15.45% for the year.

Stay In Touch