The investment committee at Alhambra has been very busy these past 2 weeks analyzing the current world economic situation. Europe sits idle; they are mired in a financial crisis and engrossed in a political chess match. The rest of the world watches the drama and prays for it to end. For, resolution could ignite global trade and put their current balance sheet liabilities in the rear view mirror.

Europe:

Spain is now in the spotlight, checked by the EU. Last fall we saw 6.3% as a tipping point yield on Spanish debt–Alhambra Investment Partners 10/09/2011, low and behold here we are ending the week at 6.22%, down from a high of 6.66% at the beginning of the month. Spanish 10yr Bond Yields

As Jeff Snider so presciently pointed out last week, Spanish banks are having a difficult time. They are finding themselves short of capital and short of high quality collateral to post to fund operations. The heavy demand for high quality collateral can be seen in charts for US, German, Swiss or Japanese government bonds. And they are in high demand.

So we know that Spanish banks are in need of capital. They are struggling on a daily basis to stay solvent, or at least operating. The real estate market in Spain, like much of the world, is anemic. Non-performing bank loans topped out at just over 5.6% in the US, but are seen to be about 8.5% currently in Spain. The Spanish government finds themselves in no position to rescue banks from their current predicament. As I write, Spain has indeed requested EU support for bailout funds of Eu100bln it seems the EU will comply:

Eurozone agrees to lend Spain up to 100 billion euros

During times such as these, we are inclined to find analogies and somehow make comparisons in order to get a grasp on what is at hand. Two analogies merit discussion. We can first draw an analogy to our own country’s struggles dating to the late 1700’s and eventually leading to Civil War. The benefits of economic union experienced in this country, coupled with the current rhetoric and political history of Europe lead us to the second analogy. As the plot progresses, Spain as well as Greece and the others, could be viewed as just states in the union.

Joe commented this week that the idea of “The United States of Europe” traces back to at least the 1840’s and Victor Hugo, author of Les Miserables. Ben Valore-Kaplan of Syntrinsic Investment Counsel gave me the comparison to our own struggles with federalism culminating in the confederacy. We might also assume that the powers wanting a “United States of Europe” knew, just as played out in the US, that fiscal crisis is necessary in order to take another major step toward full economic unity.

So the political chessboard is set and we must examine the moves playing out in the political arena in order to discern likely outcomes and subsequent market reactions. On its own, Spain is insolvent. But, if one considers Spain to be merely a state in the European Union, they are in many ways better off than our own California. Spain’s government deficit is 8.5% of gdp. California, taking into consideration their per capita share of the federal debt, has a budget deficit of about 13% of gdp. In fact Europe, as a whole, is much better off fiscally than the US with debt/gdp=87% v the US at 103% and current gov’t deficits of 4.1% of gdp compared to our 8.7%. As for the banks, our commercial banking system has about $1.5trln in equity capital. Should the entire banking system of Europe need re-capitalized, Europe could still have debt levels below that of the US.

As Mario Draghi of the ECB spoke this week, it seemed apparent that he knew Spain was in a pickle. What he said was that current political mandates prevent him from doing anything to help them. But what he knows is that, given certain political concessions, the EU could solve their problems.

On our spectrum of outcomes we place the highest probability on the above scenario. Should events continue to unfold in line with this view, markets should react positively. Resolution means global commerce can increase. Unlocking an important funding mechanism to the world economy would be expected to benefit stocks globally, in the short term. Sentiment is negative, the market has sold off over 10% since early April and, from a long term perspective, we find stocks to be undervalued.

The above scenario is not a foregone conclusion. But, upon seeing market strength on Wednesday, we took our risk barometer back to neutral and purchased stocks in tactical strategies.

Global Opportunities:

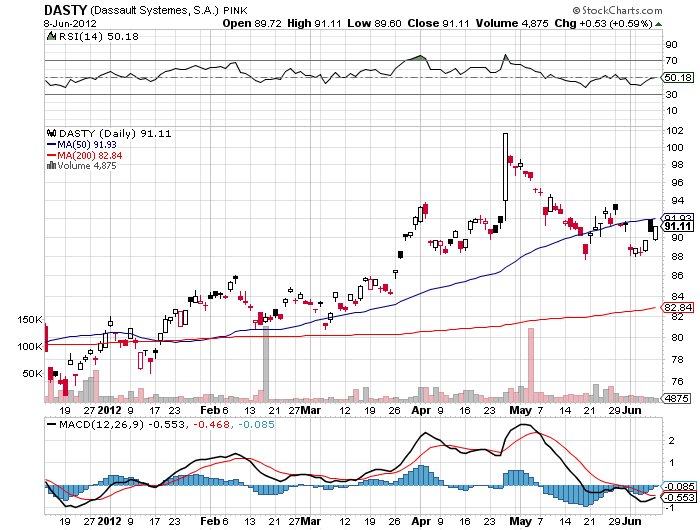

Add 3% Dassault Systems (DASTY). Dassault is a French company providing the global economy with 3D design capabilities. It receives half its revenue outside of Europe.

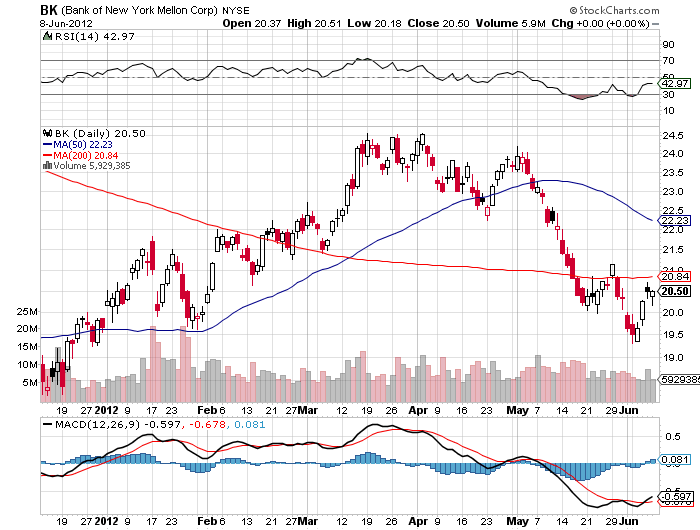

Add 3% Bank of New York Mellon (BK).

World Allocation:

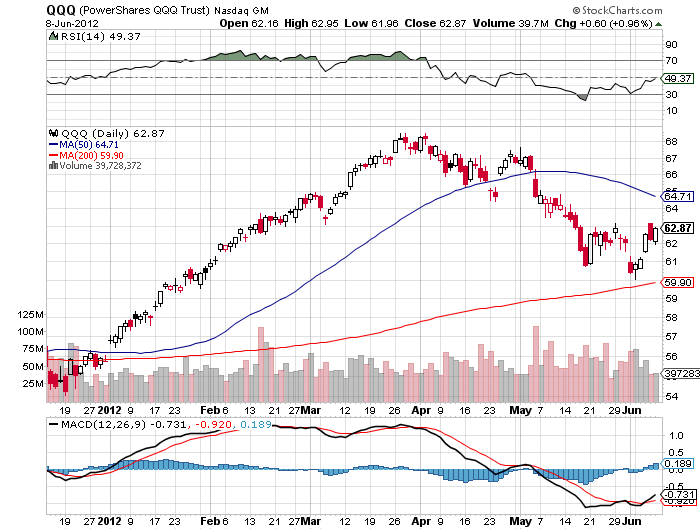

Add 3% Power Shares Nasdaq Index (QQQ). Invest is US innovation.

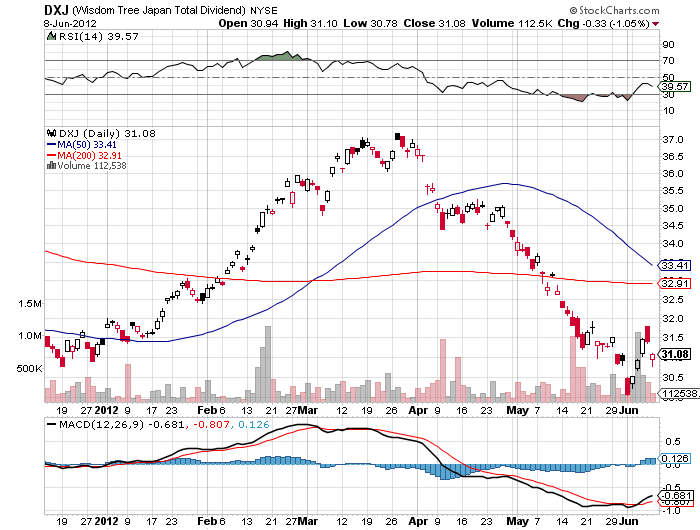

Add 4% Wisdom Tree Japan Hedged (DXJ). Japan is a country with lots of innovation and no population growth. We feel they may see currency devaluation as a strategy to combat their heavy debt load and demographic issues. Devaluation would likely benefit stocks, but currency translation remains the concern when investing here.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Douglas R. Terry, CFA is reachable at dterry@4kb.d43.myftpupload.com

Stay In Touch