When contemplating the FED, one needs to be aware that monetary policy is not an exact science. The FED will definitely try to effect policy; but, to a great extent, they are a reactive bunch. The FED attempts to stay ahead of the curve and anticipate if/when the broader economy needs restraint or accommodation, but there are a few problems. First, the economy is a large animal, full of lots of hormones and inertia. FED policy initiatives to slow a charging bull, for example, will often be initially ineffective. Fearful that the animal will not tire or abate, the FED can over tranquilize the economy and it may then need mechanical resuscitation. Second the FED wants to be a nurturing institution. Knowing that its actions can induce mania or depression, it is careful about wielding its heavy hand.

Here are the important data points the FED has identified in its own self-evaluation over time.

- They are poor forecasters of when and how much they are needed

- It is hard to judge in the short term, and impossible to judge in real-time, the effect of an initiative

- They have large weapons, if needed, but prefer to use smaller ones

As such, the FED and all Central Banks have developed a manner in which they communicate to the world. If you’ve ever been a parent you will appreciate what the FED attempts to do. They want to establish explicit expectations and clearly communicate the paths that can be taken. Then, they broadcast the help or punishment forthcoming depending on how events transpire. They want you to know that there are no idle threats and that they can and will follow through.

Lastly, the FED will be there for you in your darkest hour.

So when investors analyze the FED and Monetary Policy, much that we take away is from experience, interpretting how Dad is likely to react given his past reactions and his current rhetoric.

The past 4 years provide a fairly good road map to the environment and to the role the FED is and will play given dynamic challenges in our economic situation.

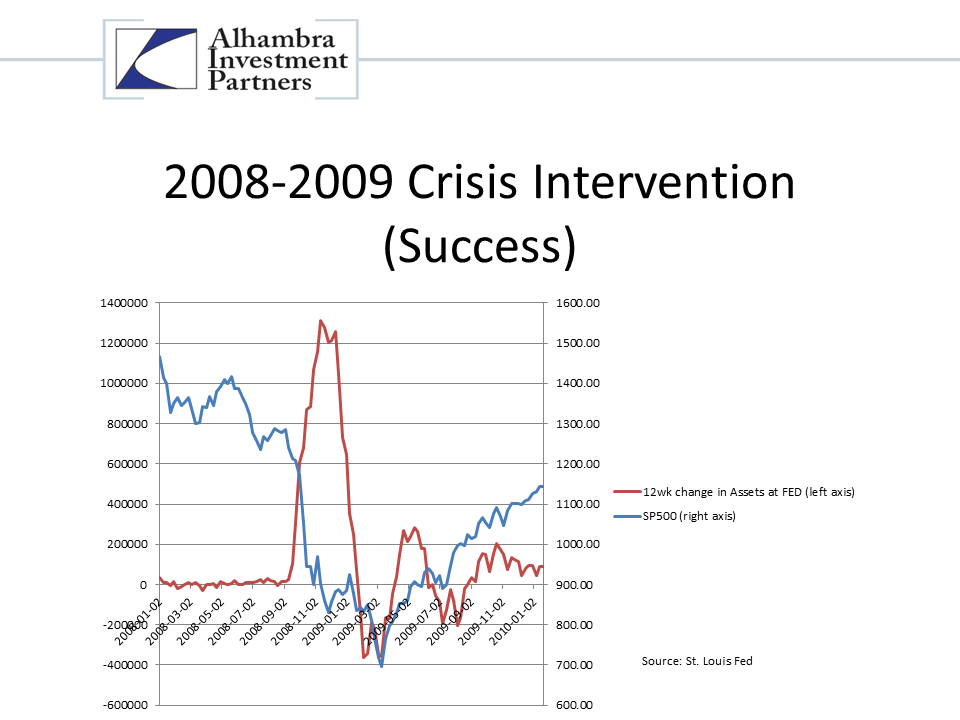

In 2008, there was a 911 call placed. Here is what it looks like when the FED is there in your darkest hour.

In addition to the direct government initiatives,

(Treasury opening its coffers to Freddie Mac and Fannie Mae, the Housing and Economic Recovery Act, SEC bans on short selling, the Capital Repurchase Program buying equity in banks, ESF-Exchange Stabilization Fund-money market guarantees, Emergency Economic Stabilization Act-establishing TARP-Troubled Asset Repurchase Program, Auto bailout and FDIC interventions)

the FED did the following:

- TAF, term auction facility and its expansion

- TSLF, term securities lending facility, also expanded

- PDCF, primary dealer credit facility, subsequently expanded

- Maiden Lane, credit facility for sale of Bear Stearns

- Line of credit for Fannie Mae and Freddie Mac followed by increases and extension to FHMLC

- Swap lines and increases with the ECB, BOJ, Bank of England and Bank of Canada, Reserve Bank of Australia, Sveriges Riksbank, Danmarks Nationalbank, Norges Bank, Swiss National Bank, New Zealand, Banco Central do Brasil, Banco de Mexico, Bank of Korea, and the Monetary Authority of Singapore

- Loans directly to AIG, followed by cash

- AMLF, asset backed commercial paper money market mutual fund liquidity facility

- Commercial Paper Funding Facility AIG cash for toxic debt swap, increase in swap lines, expansion of commercial paper funding facility

- MMIFF, money market investor funding facility

- Procurement of an IMF short term funding facility

- Conversion of financial institutions to Bank Holding Cos.

- Maiden Lane II, restructured AIG bailout LLC to purchase CDO’s and MBS’s

- TALF term asset backed lending facility, expansion of acceptable collateral, extension of duration

- GSE debt purchase program…

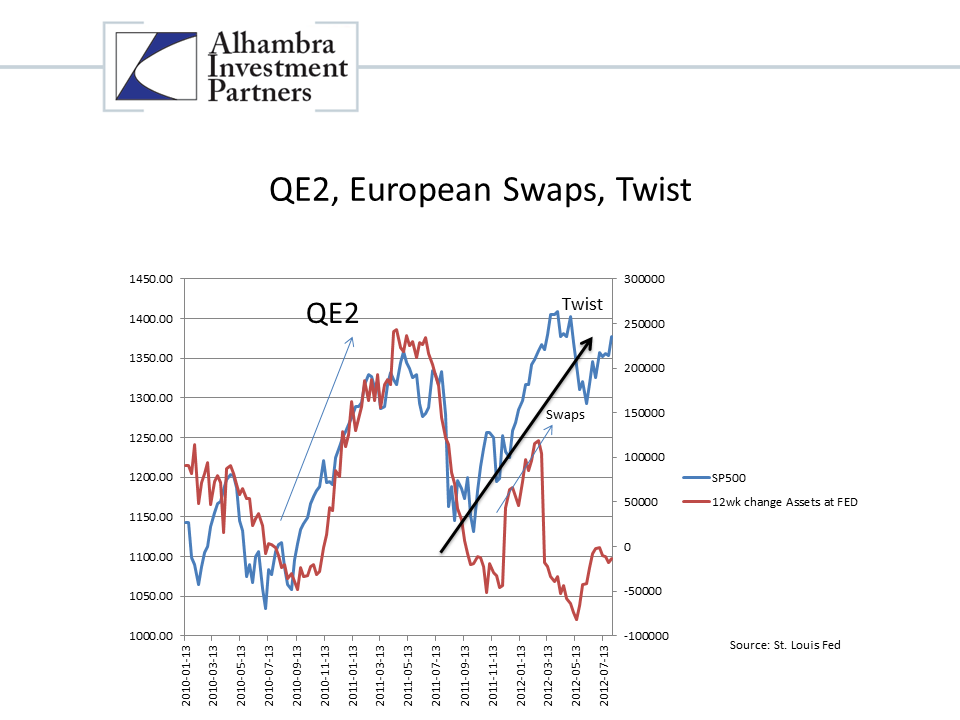

2010 saw QE2, an additional $600bln to facilitate market growth. 2011 saw the initiation of operation twist and swap lines extended to Europe to facilitate liquidity.

The progression of monetary intervention started with the FED as lender of last resort, essentially a fire fighter. It moved to facilitator of asset inflation. And now would be classified as aiding fire fighters elsewhere and inducer of short term activity.

We feel Operation twist was put into place to combat specific incentives in the market place. The FED’s massive intervention left it with a predicament; the forward curve was/is incenting banks to delay lending. The resulting structure of interest rates, indicative of inflationary pressures, means one can extract an excess return by lending one year from now rather than by lending today. Through the FED’s purchase of longer dated securities and sale of short dated securities, they have flattened the yield curve and eased the incentive to delay lending.

The FED did extinguish the real threats from the mortgage credit collapse. They supported asset markets. And they are now inducing activity.

Do we need QE3? We don’t think it is currently necessary. We also think there are very negative longer term ramifications. We would prefer the FED save its bullets in the current environment to utilize further intervention as a floor rather than a steroid. As mentioned above, watch the statements closely. Communications released from the most recent FOMC meeting indicate the willingness to use more open ended and less transparent intervention in the future.

As analyzed internally by our own Joseph Y. Calhoun:

Subtle change in language:

June 20th statement:The Committee is prepared to take further action as appropriate to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.Today’s statement:The Committee will closely monitor incoming information on economic and financial developments and will provide additional accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability.I could be wrong but this sounds to me like they are moving to a more open ended policy.

In the charts one can definitely see the positive effects of FED policy. Today’s economy doesn’t appear completely healthy, but the ole saying on Wall St is, “Don’t Fight the FED.”

If/when Europe decides to follow a similar program, prudent or not, who knows what might happen.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

Stay In Touch