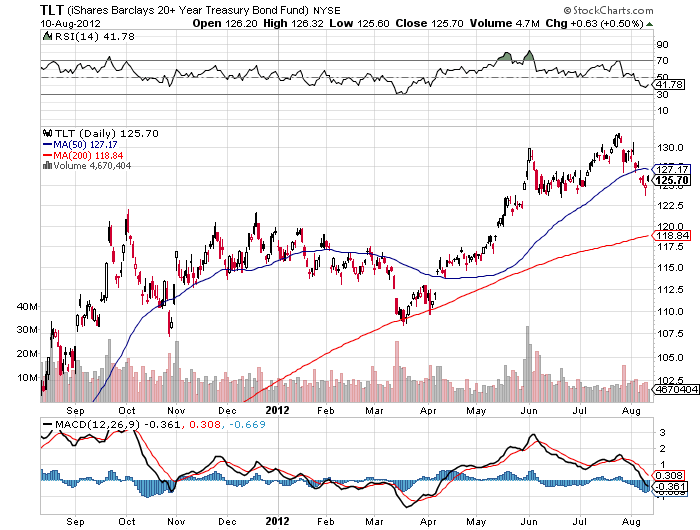

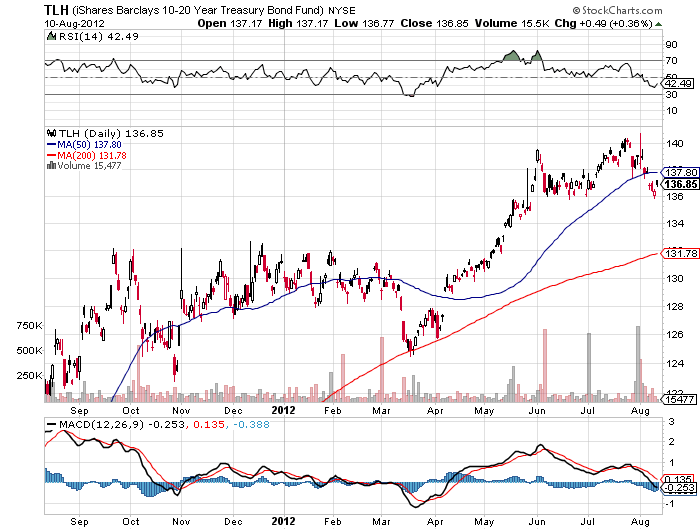

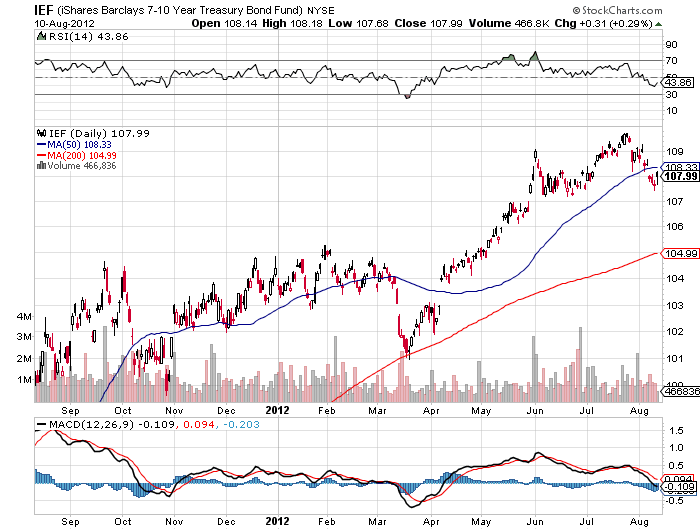

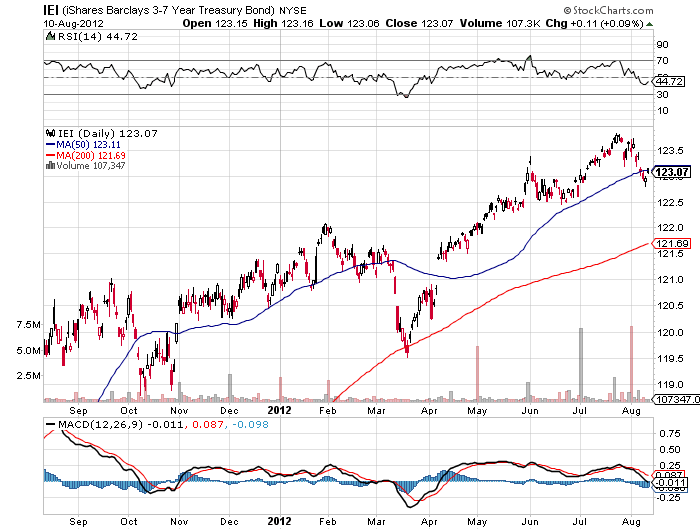

Is there an interest rate bubble? Has the bond market topped?

It is something that has been on our mind for the past year and especially at the long end of the curve during Operation Twist. If and when bond yields normalize, the capital risk to investors is large, about 8.25-8.5% risk per 1% increase in interest rates at the 10 year time horizon and 18% loss of principal on a 1% interest rate rise at the 30 year time horizon.

It is something that has been on our mind for the past year and especially at the long end of the curve during Operation Twist. If and when bond yields normalize, the capital risk to investors is large, about 8.25-8.5% risk per 1% increase in interest rates at the 10 year time horizon and 18% loss of principal on a 1% interest rate rise at the 30 year time horizon.

Stating the obvious, bonds have been a safe haven through the recent storm. But, the Fed has been intervening in the bond market and rates are at all time lows. In our opinion there is a high probability of mean reversion in interest rates which are well below there natural level.

This week, the bond rally showed signs of tiring and we made an incremental move, selling longer duration securities and purchasing shorter duration securities in fixed income strategies. There is obviously a tax consequence for taxable accounts to this adjustment, but we feel the risk of loss of principal takes priority here.

World Bond:

Sell Emerging Market Bonds

Buy Floating Rate Notes

Tax Free:

Sell High Yield Munis

Sell Intermediate Term National Municipal Bonds

Buy Short Term National Municipal Bonds

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

Stay In Touch