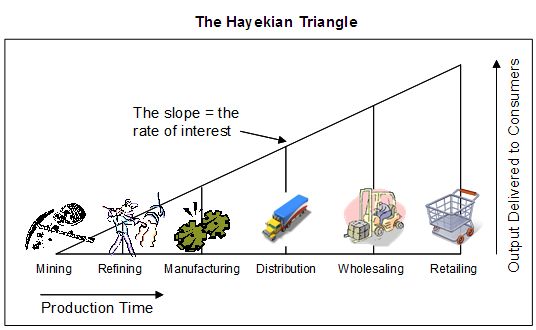

In 1935 Friedrich A. Hayek presented the following diagram of the productive stages of an economy’s production.

The insights drawn from this depiction of an efficiently allocated economy form the basis of Austrian Business Cycle Theory.

A voluntary decrease in consumption and commensurate increase in savings lowers the slope of the hypotenuse, thus the real rate of interest. The combination of lower interest rates and increased savings offers an environment conducive to increased investment in earlier stage production. The investment will increase productivity and pave the way for higher levels of future consumption.

What has occurred in our country for the past decade would be the exact opposite. Resources allocated to fighting a foreign war, purchasing goods from abroad and dumping savings into real estate are increases in current consumption. This increased allocation to later stage goods, causes the triangle to become taller and fatter. The slope of the hypotenuse increases, interest rates rise and there is less investment going into productive resources.

And, I might add, we borrowed the money to effect the above scenario.

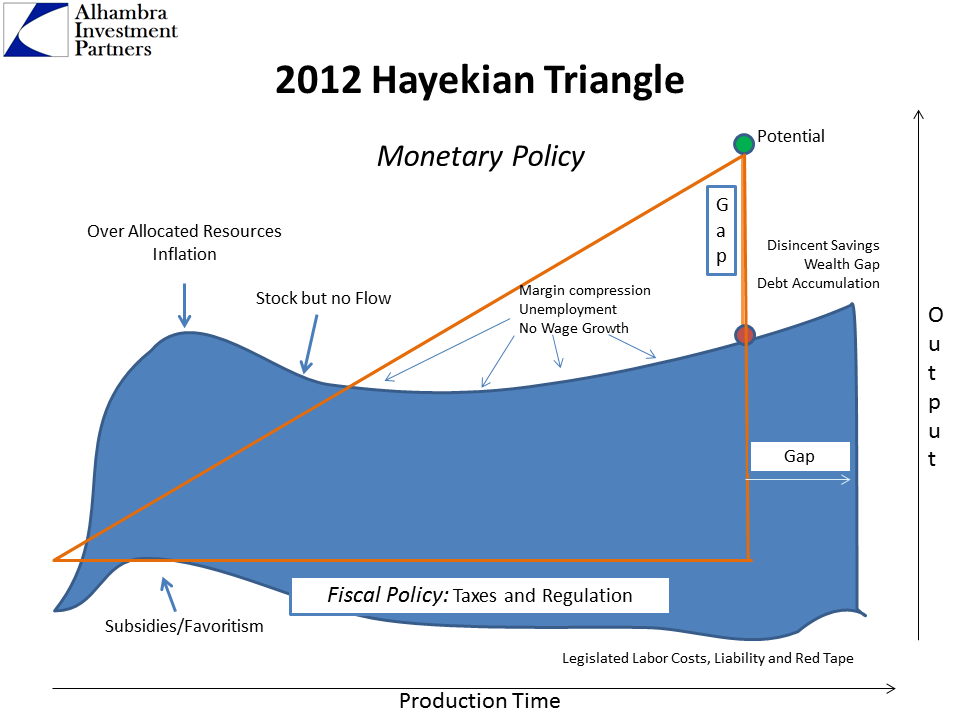

In the years following 2008 we’ve uncovered and added more distortions to this geometric graph. These distortions stem from the fiscal and monetary policy “solutions” of our leaders.

On the fiscal side, subsidies and other favoritism continue to run rampant in policy making. The addition of mandated health care coverage raises costs. The expectation of higher taxes doesn’t help matters. And, dubious regulation further detracts from allocating resources toward investment, savings and consumption.

On the monetary side, the Fed as manipulated interest rates lower and inflated the money supply. This completely distorts the market’s pricing mechanism for efficiently allocating the economy’s resources. The visual depiction would be a triangle with a non-linear hypotenuse.

The resulting malinvestment will, over time, destroy capital and shrink the size of the economy. This renders society less able to save, less able to invest, less able to produce and less able to consume. We are shrinking our triangle.

Commodities, fracking, and farms rule the day; while grocers can’t seem to get out of their own way. Here is my view of the current state of our triangle.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

Stay In Touch