Mandates are tricky enough when it comes to interpretation of how to best and most efficiently achieve them. This is especially true when the act of fostering a mandate or moving a system toward the desired outcome is disruptive. The evaluation process of the mandate and the policies meant to push toward it inevitably descends into some kind of cost/benefit analysis that acknowledges or even emphasizes the possible disruption(s) involved.

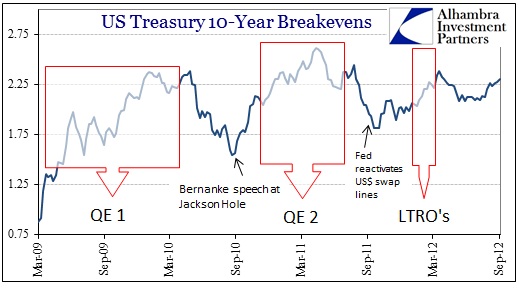

This is particularly true as we try to assess why the Federal Reserve feels compelled to expand its balance sheet for the third time in the past four years, on top of “temporary” monetary regimes that are now, in some cases, moving toward five years of semi-permanence. ZIRP, for example, was instituted with the assurance that monetary policymakers understood the ramifications of intentionally distorting the vital credit/risk nexus for more than short bursts. That was also true of the first two QE’s; thus the limitations and finite expiration.

Obviously something has changed in the past year or the FOMC would not be experimenting with Einstein’s assertions of insanity. My position has been that the economy is in far worse shape than is readily recognized, particularly from labor and income standpoints.

In their statement heralding the new extension of QE (3 or 5?), the FOMC explicitly linked the purchase of mortgage bonds (from the GSE’s, no less) to jobs. There might be a mishmash of economic and financial processes in between, but there is no longer any mistaking the Fed’s intent and to which mandate has now assumed primacy (which was rather clear in the November 2010 op-ed by Bernanke announcing QE 2, but just in case there was even the slightest ambiguity then it has now been fully exorcised). As a matter of monetary history, the Fed will always side with the employment mandate (see Inflation, Great).

The Fed proclaims two mandates, inflation and full employment, the latter stemming from the Employment Act of 1946, but the unofficial third (money elasticity) always remains close to the minds of policymakers. The banking system’s ability to remain “liquid” was the reason the Federal Reserve system was instituted in the first place in 1913. The “evolution” of banking and the “science” of economics placed that unofficial mandate (money elasticity) in close alignment with the second mandate (full employment), often at odds with the first (inflation). As long as “liquidity” and fractional credit advanced, it was believed that control over that process would foster some kind of economic growth, harmonizing at least two of the mandates.

The operative theory of monetary policy has been that low interest rates and liquidity will lead to full employment, thus the QE’s have always been theoretically linked to jobs. Lack of success after the first two programs, however, has not in any way led to a new course of monetary thinking. Instead, the Fed, and other central banks, has redoubled its “stimulative” efforts of balance sheet expansion, money printing, etc.

The Bank of England (often a model for policies adopted by the Fed) in its legal formulation of QE describes it as:

“The Bank purchases these assets predominantly from non-banks, but banks act as intermediaries in the process. The Bank pays for the assets purchased by creating central bank reserves and crediting the accounts of the banks that act as intermediaries. Those banks will in turn credit the accounts of the non-banks from whom they obtained the assets. They will either spend the money on goods and services, which directly adds to overall spending, or purchase other assets, which will tend to boost the prices, and hence lower the yields, of those assets more broadly.” [emphasis added]

In other words, create new money (reserves) from nothing and spending or higher asset prices result. Apparently those are the only uses and processes of newly created ledger money. There is no reset button here, it is an infinite loop without an exit clause; this is a shampoo policy of rinse, repeat.

The persistence of high unemployment, or more specifically the inability of monetary policy to achieve the second mandate, is never attributed to the extraordinary intrusions of monetary policy itself despite the fact that the emergence of extreme central bank activism is one of the few governing dynamics that changed ex-2008. Inside the practical extension of academic economics persists this notion of money neutrality – namely that changes to the supply of money have short-run impacts only. Any monetary policy is assumed to be neutral to the longer-term, thus only “real” economic factors can explain variables like employment. It is the license to print money on a scale unimagined only a few years ago.

Operating under this assumption gives central banks free reign to intrude into short-run monetary systems as much as they wish; none of it will have lasting impacts. And if that is your assumption then there is absolutely no way for you to formulate a link between monetary policy and malaise in the real economy. Without the theoretical cause in place, or at least acknowledged, economics will always look elsewhere while at the same time always producing the same prescription: more monetary intrusion. It’s a trap.

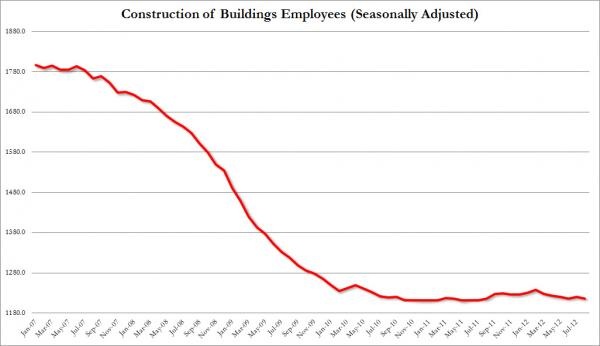

Monetary mistakes die hard – it took fifteen years for the Fed to connect the dots between its bank reserve efforts and inflation during the Great Inflation, despite the internal discussions, research and history. I have little doubt that nonneutrality will eventually be recognized inside the academic halls of the Federal Reserve since it has already been incorporated into conventional wisdom and common sense – the millions of empty houses and condos (wasted real resources that are a drag), on top of the millions in construction jobs (wasted labor resources that are a drag) that will never return, stand in stark contrast to the insane idea that monetary intervention has no lasting imprint on the larger economic system.

Where this becomes problematic is certainly when the practicing monetary agent panics at a moment of rising duress. If we have already arrived at the endpoint of nonneutrality and markets sense that monetary policy is impotent at exactly the short-run moment it is expressly “needed” because of past intrusions, then we would expect the eventual rejection of any incremental shampoo in the form of follicle malaise and retrenchment.

Stay In Touch