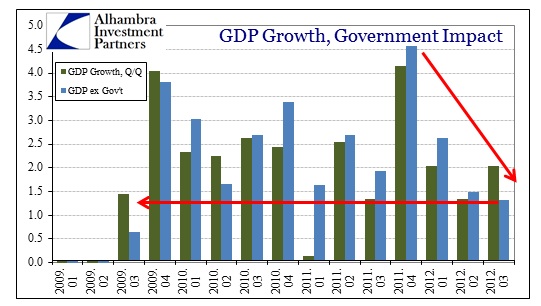

By now commentators have focused on the rather dramatic reversal in government “contributions” to GDP for the initial Q3 2012 estimate. Nearly all of that government spending came in the defense category, so that will get reversed rather quickly – sequestration or not. The private economy continues to move in the wrong direction, as GDP growth ex-government was the lowest level since the first reappearance of growth in Q3 2009.

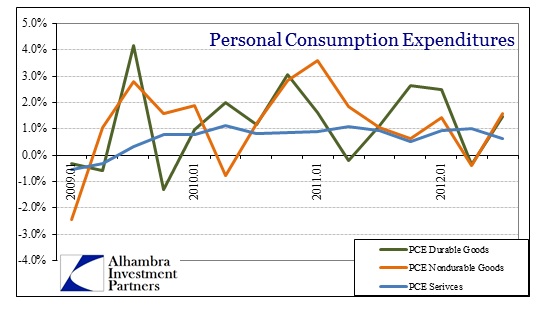

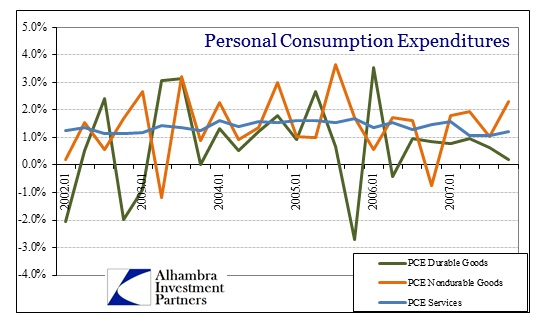

Economists might consider this a case of a loss of momentum, but I believe that structural reversion is still taking shape and acting upon key economic sectors. Consumer spending has not been the main driver of current weakness other than an inability of companies to derive or extract increasing growth rates in their top lines. Overall, households have been largely consistent, at least as observed from a top-down perspective. The evenness in PCE imitates what we saw in the artificial housing bubble period.

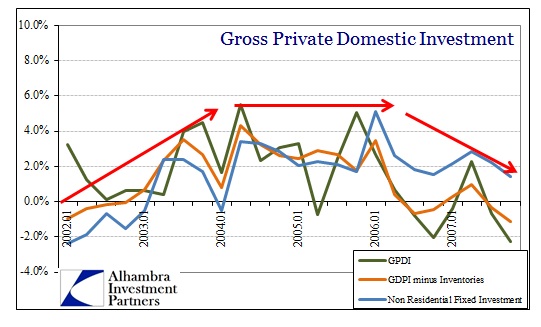

The primary downward pull has been in business investment. The trend for business expenditures contrasts with the last recovery rather starkly. Business capex out of the 2001 recession grew sharply, then shifted into a steady state growth period. Business investment out of 2009 also grew sharply, but has trended lower ever since. There has been no transition into a steady growth state.

Nonresidential fixed investment, which includes business investment in both structures and equipment, contracted (if only slightly) for the first time since 2009. That is little surprise given the now established downward pattern since the middle of 2011. This trend in the GDP data confirms and conforms to numerous additional data series we have seen this year, including the durable goods report from yesterday:

Total Durables (ex transportation, accounting for $162 billion) Y/Y Shipments +0.3%; Y/Y New Orders -4.63%

Capital Goods (ex aircraft) Y/Y Shipments -2.1%; Y/Y New Orders -9.99%

The indication of capital goods shipments and orders (ex aircraft) looks consistent with this GDP report on business investment appetite. It simply is not there. If anything, given the scale of the decline in orders, we can expect the downward trend to continue unabated. Anecdotally from earnings reports for Q3, we can surmise the revenue growth problem as a good part of the weakening picture.

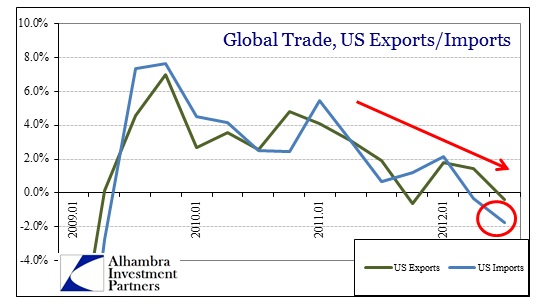

Beyond that, the global trade picture is alarming. Europe is a mess, but the entire global trade system is moving decidedly backward. Japanese exports were atrocious, and not only to China (-14% Y/Y) due to their recent political spat. Japanese exports to Europe were down by 21% Y/Y!

The global trade mess has been trending lower really since 2010 and the first rumblings of crisis, but Q3 2012 has seen the lowest combined trade growth. While import contraction is GDP positive in terms of domestic product estimations, the rather striking decline in import activity is a commentary on the US ability to purchase goods of any origin.

Regardless of headlines, these trends are all heading in the wrong direction at the same time. It is not simply a matter of Europe’s problems cresting on our shores, it is a combination of “bad” factors simultaneously acting on the domestic economy. Any economic system is resilient, but rebounding from shrinking corporate earnings, shrinking corporate spending and imploding global trade is perhaps too much to ask.

Stay In Touch