The S&P 500 ((IVV)) has had a nice run since its June lows, but with the impending fiscal cliff and the corresponding turmoil in Washington, and subsequently in the markets, all that is in danger of coming to an end. The index finds itself at a critical stage, having broken the 50-day and 200-day moving averages in the last month before rebounding back to the 50-day. It currently sits just below resistance at the 1420-1425 level, and needs to bump through that level if it wants to end the year on a good note. Given the climate in DC, the situation looks precarious at best. The S&P 500 is up 14.97% year-to-date.  Latin America ((ILF)) broke down at a much faster rate than its northern counterpart. This may be due to the region’s reliance on commodities and the world’s weakening demand for the aforementioned. On a positive note, the index did manage to close above resistance at the 42.30 level this past week, something that the US index wasn’t able to achieve. The index recorded a -0.66% loss so far this year.

Latin America ((ILF)) broke down at a much faster rate than its northern counterpart. This may be due to the region’s reliance on commodities and the world’s weakening demand for the aforementioned. On a positive note, the index did manage to close above resistance at the 42.30 level this past week, something that the US index wasn’t able to achieve. The index recorded a -0.66% loss so far this year.  The EMU Index ((EZU)), or the European Economic and Monetary Union, has one of the better-looking charts, as it still sits above both moving averages with both moving averages recording a positive slope. Despite all the negativity coming from the likes of Greece and Spain, Europe has performed markedly in the past few months. The index is up 17.68% for all of 2012.

The EMU Index ((EZU)), or the European Economic and Monetary Union, has one of the better-looking charts, as it still sits above both moving averages with both moving averages recording a positive slope. Despite all the negativity coming from the likes of Greece and Spain, Europe has performed markedly in the past few months. The index is up 17.68% for all of 2012.  The Middle East ((GULF)) continues to hold on despite a seemingly inevitable war over Iran’s nuclear ambitions and an ever-expanding and increasingly bloody civil war in Syria. Add in a brewing NATO-Syrian and Israeli-Hamas/Gaza/Iran conflict and you would think the markets in the Middle East would be in shambles. It’s just not the case yet. The index is up 6.28% YTD.

The Middle East ((GULF)) continues to hold on despite a seemingly inevitable war over Iran’s nuclear ambitions and an ever-expanding and increasingly bloody civil war in Syria. Add in a brewing NATO-Syrian and Israeli-Hamas/Gaza/Iran conflict and you would think the markets in the Middle East would be in shambles. It’s just not the case yet. The index is up 6.28% YTD.  After a stellar run into the 30s, Africa’s market ((AFK)) finally corrected, and now finds itself below its 50-day moving average. Despite this recent downturn, the index has been one of the better performers this year, gaining 17.40%.

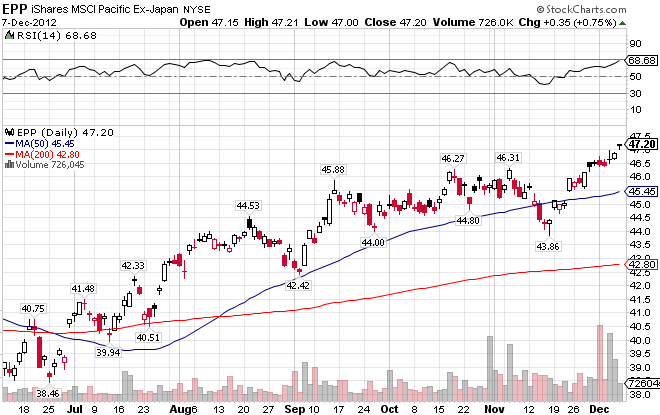

After a stellar run into the 30s, Africa’s market ((AFK)) finally corrected, and now finds itself below its 50-day moving average. Despite this recent downturn, the index has been one of the better performers this year, gaining 17.40%.  Despite a weakening economy in China, the Pacific x-Japan index ((EPP)) has performed remarkably. Unlike with Africa, it’s advance seems to be picking up steam. It has traded between the 44 and 46 range for a few weeks before finally blowing through the 46.50 level. The index is up 22.13%, easily outpacing the world on its way to being the best performing market this year.

Despite a weakening economy in China, the Pacific x-Japan index ((EPP)) has performed remarkably. Unlike with Africa, it’s advance seems to be picking up steam. It has traded between the 44 and 46 range for a few weeks before finally blowing through the 46.50 level. The index is up 22.13%, easily outpacing the world on its way to being the best performing market this year.  Japan ((EWJ)) was the worst performing market this year before the monstrous one-month run that began in mid-November. It finds itself above both moving averages after retesting lows set in July. Look for this bullish trend to continue. The index is up 3.36% YTD.

Japan ((EWJ)) was the worst performing market this year before the monstrous one-month run that began in mid-November. It finds itself above both moving averages after retesting lows set in July. Look for this bullish trend to continue. The index is up 3.36% YTD.

Stay In Touch