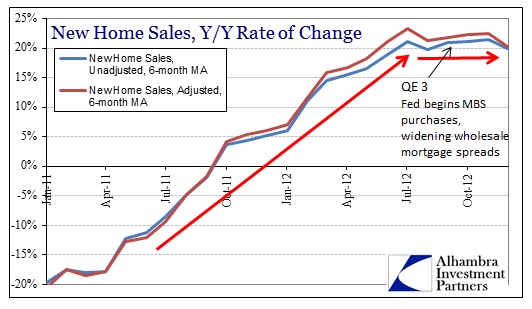

December sales of new homes was disappointing in that the adjusted pace did not keep up with previous months. From May 2012 through October 2012, year-over-year increases in new sales levels stayed consistently above 20%. That drove expectations that the trend in residential real estate had finally turned. Given available data, that does seem to be the case.

Economists and financial experts have begun to extrapolate all sorts of positives into econometric equations to capture what a real estate turnaround might do for the struggling recovery. Such calculations have become far more important to offset recent weakness in personal income and indications of contraction in the goods economy (showing up in declines in capital goods orders and a hefty increase in wholesale inventories). Big ticket goods relate to consumer and household discretionary spending, so an indirect monetary intervention through rising home sales and therefore prices might offer some “wealth”-driven relief, at least theoretically.

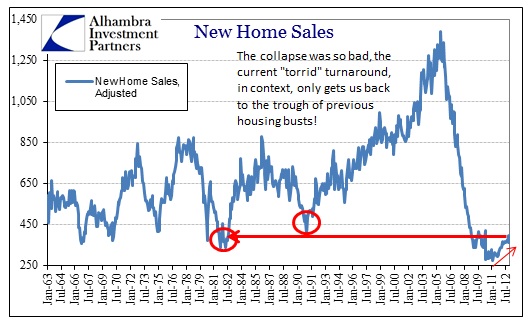

Before getting too far ahead, context is extremely important. While the pace of home sales has certainly reversed sign from collapse to rebound, the scale is far less impressive. Even the torrid 20+% trend from the middle of this year has only brought home sales in line with the previous cycle lows. Adjusting for population and GDP growth, new home sales (in concurrence with construction and overall sales) are still well off what might be considered a “normal trend”. Therefore, any direct economic impact is likely to be minor outside of price.

According to the Census Bureau, medium home prices bottomed in October 2010 at $204,200. There was some improvement in prices until that May – October 2012 surge in sales activity, bringing the medium home price up to the $250,000 range. That was impressive price action given the low volume (relative to historical and bubble levels), and is only slightly below the $262,000 registered in March 2007.

Given the rapid rise in pricing, coincident to economic weakness including incomes, it might not be unexpected to see new home sales begin to fall off. A softening economy is certainly a factor, but the lack of follow-on loosening in mortgage availability and lending standards, coincident to a price surge, may contribute to limit the overall upward channel. No market can maintain an upward surge without a broadening purchaser base or a flood of new money.

Is that perhaps one of the factors in the Fed’s QE 3 decision? Recent results certainly point in that direction, though there is probably some volatility that can be explained on Sandy (everything else is).

If nothing else, this is simply another challenge for the struggling real estate sector. At the same time it points to the still-fragile household environment where the long-sought successful rebound in prices may actually end up pricing prospective buyers out. That is the danger of too much monetary interference with price clearing mechanisms (both QE 3 and the intentional downshift in foreclosures).

It is certainly too early to tell if 2012’s success ends up becoming burdensome on 2013. We will know more as we swing into the heavy spring buying season.

Stay In Touch