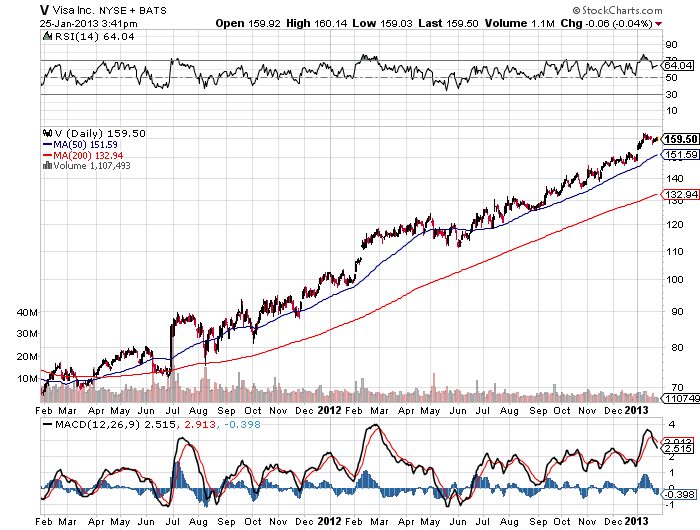

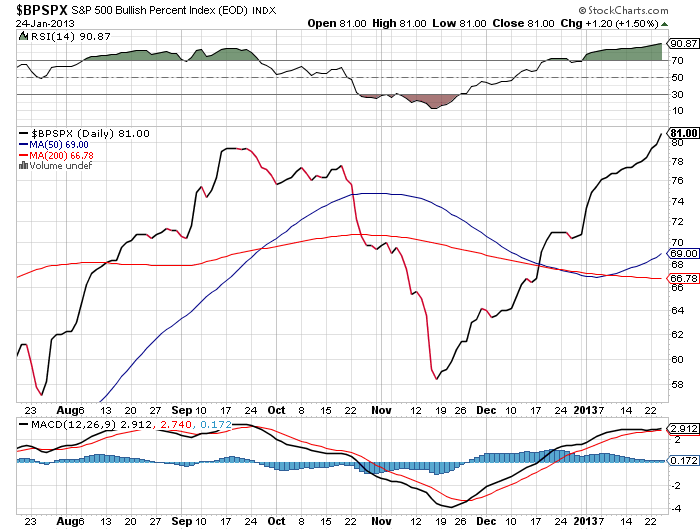

For clients in our Global Opportunities portfolio, we have seen quite a run in our largest holding, Visa. Visa has doubled in the last 18 months. This out-performance has pushed Visa’s exposure in the portfolio to close to 1.5 times it’s target weight. Though the stock has been a very good performer, concentration in any one name causes a portfolio to become more risky. Visa’s has a trailing 12 month P/E ratio of 51 and forward P/E above 20. In combination with frothy sentiment and extended market internals, we felt it an opportune time to take some profits and re-balance back to target weight. Depending on the length of time in the portfolio, this is as much as 30% of your position.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

Stay In Touch