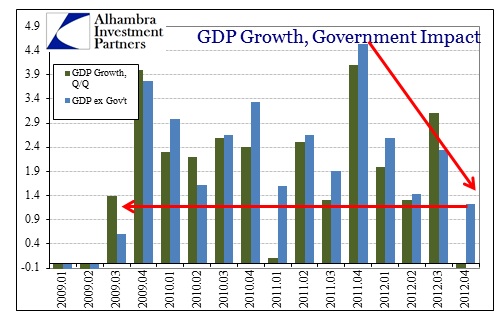

Government spending and inventory builds were good in Q3, according to economists, when they pushed GDP accounting above expectations. Those same two economic accounts dramatically reduced economic activity in Q4, so economists are now intimating that the resulting contraction is something other than real.

On the part of government spending, it probably should be ignored and certainly GDP is a flawed metric since it adds government activity to its measure of economic progress. Less government spending should actually be good over the longer-term (which remains to be seen if that holds), so I am fully onboard with the “ignore government” position.

Unfortunately, even without the government drawing down military spending (after a hefty increase in Q3 – no good explanation for the timing of defense activity volatility), preliminary Q4 GDP looks to be the worst since 2009 (it should be noted that the same was true of Q3 preliminary GDP until inventories were revised well higher). So the private economy ex-defense may actually be slightly above zero, but depressed by any measure.

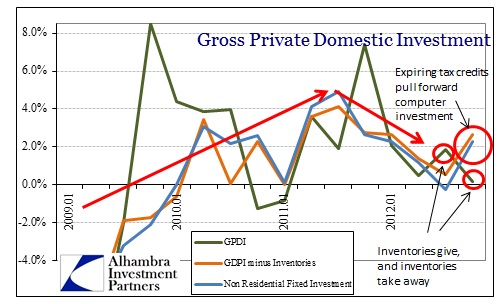

There was a rebound in business investment after Q3, mostly related to computers and software. Investments in transportation and industrial equipment, however, were only slightly better than Q3. It is also likely that the high rate of computer and software purchases will be a pull-forward, meaning this quarter’s gain is next quarter’s loss.

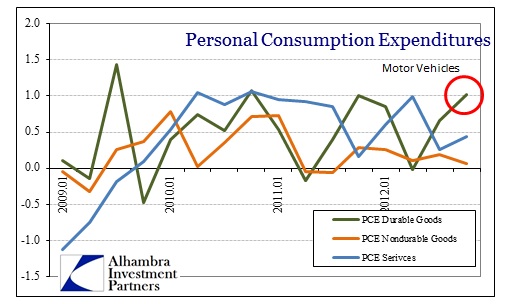

Personal consumption expenditures also rebounded, but only with the low bar of this recovery would they be considered “good”. The nominal Q/Q rate of change in Q4 was 0.85%, only slightly better than the 0.79% from Q3. That means that a lot of the advance in real PCE was due to lower inflation estimates, which were evident in segments like energy (gasoline), rather than organic, income-driven growth. For frame of reference, quarterly nominal PCE growth throughout the entire 2001 recession averaged 1.01%. The low standards of this recovery are astonishing.

More than 40% of PCE increase was due to spending on motor vehicles. Since this is the one sector that has been most evidently impacted by cheap and subprime credit expansion, it should be noted in light of QE’s and ZIRP. The preliminary Q/Q estimate for personal expenditures on motor vehicles was a robust 26.6%, but again some context is needed for that. The average advance in auto sales for the recession year of 2001 was 21%. The average for 2012, including Q4’s jump, was a bit less than 10%. Economic activity based on motor vehicles is inordinately volatile, so it is not necessarily a solid foundation for future activity. In fact, historically, a large increase in motor vehicles in one quarter is typically offset by weakness in the very next.

In terms of inventory subtraction, again economists feel that might be a good sign since companies drawing down stocks of unsold goods can lead to a future increase in production. But that would only be the case if the decline in inventory levels were greater than market demand. The metrics we have seen in the wholesale trade indicate that we might be experiencing the opposite case. These inventory/sales ratios (1.22 overall, 1.61 durable goods) are more conforming to cycle highs (and well above 2007) and levels where previous manufacturing expansions begin to reverse in trend.

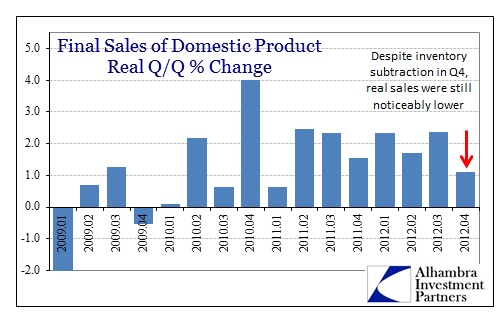

As such, the decrease in overall inventory levels, in a healthy economic system, is usually accompanied by a large increase in real final sales. In other words, the economic system pares down inventory through actual sales activity, leading to a restocking effect in subsequent months. That seems to be the narrative economists are forming surrounding Q4’s dismal retreat. Real final sales in Q4, however, were the softest since the “surprise” weakness of Q1 2011.

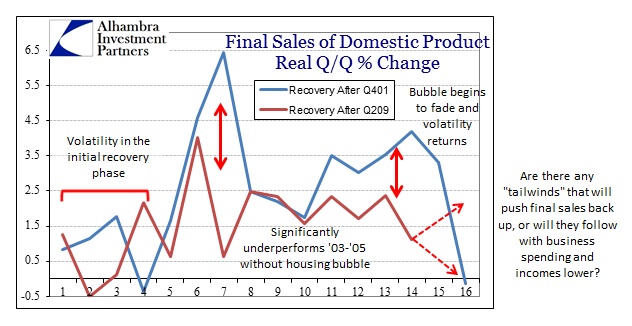

Compared to the previous “cyclical” recovery, final sales have been far shallower, meaning Q4’s results are even less impressive and less likely to be a building point for future growth.

The previous recovery, of course, had the housing bubble providing, in the parlance of Fedspeak, “tailwinds” to the economic course. It is noticeable in the comparison. Whereas the coincident quarter in the previous recovery saw final sales growth of 4.2%, we are currently stuck, despite inventory, at 1.12%.

Housing trends were undoubtedly positive, as residential real estate added about 0.3% to the overall growth rate. But that in itself demonstrates the diminished contribution of housing. Despite the best intentions of QE 3, the housing sector is so beat down it will take a huge bubble just to regain its historical proportions and context.

Instead of the housing bubble tailwind, the current economic climate, despite heavy doses of monetarism throughout the developed world, is suffering the headwinds of global trade collapse. Part of the weakness in final sales gets pushed into diminishing import activity (which is supposed to be GDP positive, but rather, in this context, is evidence of weak demand domestically), but that was more than offset by a rather large contraction in exports.

The year 2012 was a definitive change in the recovery trend away from the weak, but relatively stable, recovery pattern. There is no question that the recovery of 2010 & 2011 underperformed relative to both history and expectations, but that seems to suggest to many observers that it can only get better from here. I believe that the trajectory of 2012 is a direct refutation to that hope, and, given the data in Q4, that the changes of 2012 have accelerated toward the downside.

If nothing else, some of the purported strength, as mentioned above, was pulled forward. That was clearly the case with the income side (particularly dividends, but also other forms) that will come at the expense of Q1 2013. On top of that, the headwinds of global trade dysfunction may combine with the modest but very real FICA tax increase that will be hitting those least insulated. There was not enough in this GDP report, no matter if it was artificially constrained by lower defense spending, to suggest a turn in trend back toward 2011-type “muddle recovery”. In my opinion, 2012’s results confirm that we have already seen the best of this recovery, such that it was.

Stay In Touch