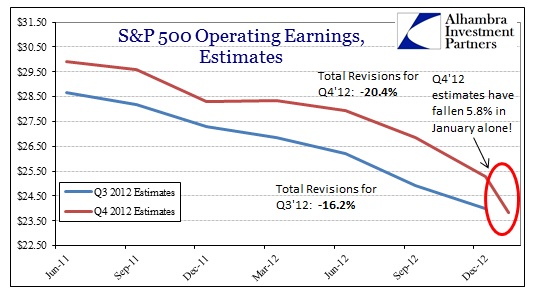

Through January 31, about 54% of companies had reported and digested earnings announcements. Current estimates for operating earnings have been trimmed all the way back to $23.83 for S&P 500 companies, representing a year-over-year change of 0.42%. However, given the lack of momentum and the number of companies that have lowered and preannounced lower, Q4 is likely to see a negative comp. That would mean two consecutive quarters of negative earnings growth.

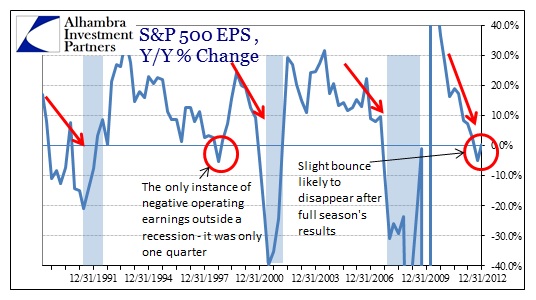

We have not yet seen two consecutive quarters of earnings declines outside of a recessionary environment; again this is analysis of operating earnings that strip out one-time charges. There was, in fact, only one instance of earnings contraction not related to recession – a one quarter blip in 1998. Given that Q3 earnings appeared to only have fallen 1.4% at this same point in the reporting period, the fact that the total quarterly decline ended at 5.1% and the pace of the decline for Q4 just seen since the beginning of January (see below) suggest that the total contraction is likely to be significant.

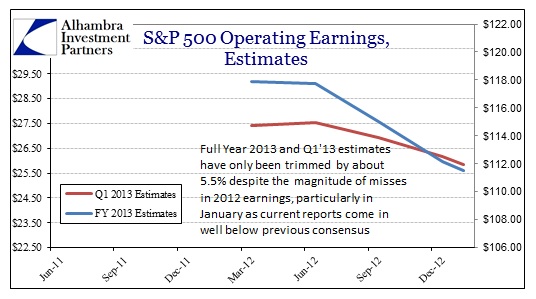

Expectations have been overly robust for the better part of 18 months as analysts, much like the economists that feed them forecasts, have been unable to anticipate anything other than straight line growth rates. As bad as Q3 was, Q4 is actually worse in terms of the pace of reduced expectations. In January 2013 alone, again with only about half reporting, estimates have dropped by nearly 6%.

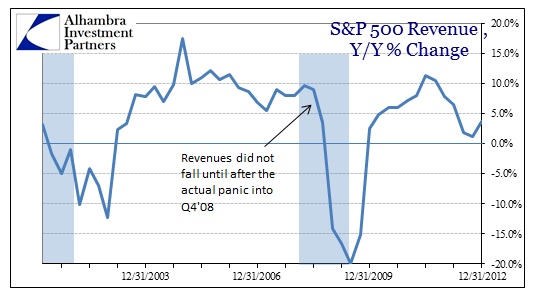

Revenue growth has been weaker than during 2007 & the first half of 2008.

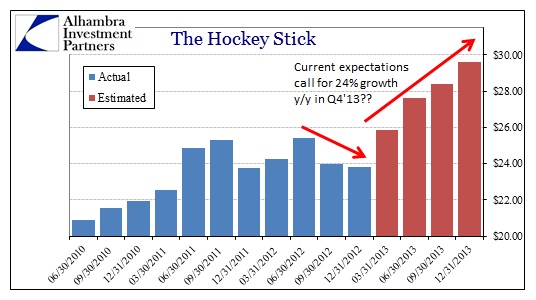

Despite all the downward momentum, analysts and economists still expect a robust turnaround (even after being so far off in their 2012 estimates). It may defy rational belief, but analysts still look for Q4’13 to be the total opposite of Q4’12. Currently, estimates are for a massive 24% y/y surge in earnings results.

Not only would such results be totally out of character given the pattern seen not just in 2012, but really since the middle of 2011, it defies even the current pattern of expectations for 2013.

On a trailing twelve month (ttm) basis, operating earnings growth is currently only 1.1%, falling from 8.56% in Q2 and 2.92% in Q3. Not only is the trend moving in the wrong direction, the only periods where ttm growth has been at such weak levels previously saw a sustained drop into recession in the quarters following (0.83% Q4’89, 3.95% Q3’07).

Despite the expectations of a surging rebound into 2013, both momentum and history are clearly against such estimations. I have little doubt that the backbone of this optimism is monetary “stimulus”, but recent history should have dispelled such faith with prejudice. Given that 1998 is the only time where we have seen such a sharp turnaround in corporate and economic fortunes, perhaps there is something to be gained from the comparison. However, there is a world of difference between the economic health of 1998 and the ongoing dysfunction of 2013. LTCM and its systemic liability was still a very new concept, and the economy had yet to experience the full mania phase of the dot-com bubble while still capturing the first phase of what would become the housing bubble. In other words, there was actually capacity available for monetary experimentation to “stimulate” activity in the face of fundamental weakness.

If nothing else, analysts should be more chastened by their recent (and repeated) failure to incorporate inflections into their expectations. Missing Q4’12 by 20% is not a rounding error. Perhaps more important is investor expectations based on all this analyst-driven optimism. While it is clear that stock prices have cared little about the slowing pace of earnings, we have seen this all before. We need only go back to the second half of 2007 to see such a disconnect between earnings results and stock prices, though at that time earnings declines were fully financial. But even then, sustained earnings erosion could not be ignored. This time, earnings weakness is driven by the real economic sectors.

Stay In Touch