There should be much closer scrutiny on attaining success through monetary means. As with the Federal Reserve in the United States, the ECB seems to be judged solely on the asset prices of a select group of asset classes. But somewhere, someone should be monitoring the actual efficacy of all of these interventions. I think it tends to get lost in the noise of unending crisis, particularly with the ghosts of the 1930’s still present, but all of this is supposed to create a robust global economy, right?

Even in Europe it still does not make much sense to save the banks only to destroy the real economy in the process.

• Industrial production in the Eurozone fell 0.4% from December to January, including a 0.4% drop in Germany. Capital goods production fell 1.4%.

• Construction spending collapsed in January, off 1.4% from December but down an alarming 7.3% Y/Y. Portugal, supposedly a “beneficiary” of the bank bailout regime, saw a 20.2% drop in construction spending.

• Unemployment across Europe increased by nearly 2 million people, to a record high of 11.9% in January. Unemployment in Spain continues to rise, now at an astounding 26% (officially). Italian unemployment at a record 11.7%, up from 8.9% in January 2012.

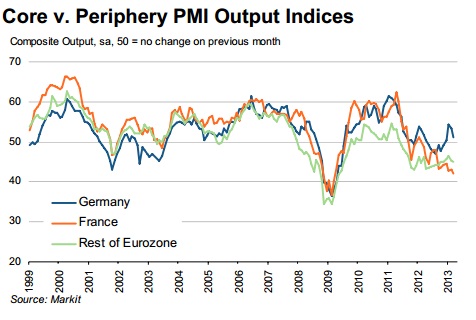

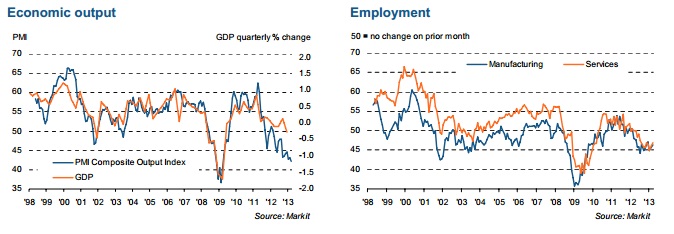

• PMI’s across the Eurozone (ex Germany) show accelerating drops in output and potential, suggesting that these January figures are set to get even worse.

• France continues to trend toward the periphery, showing disastrous numbers. The unemployment rate is well-above the 2010 high, and at 10.6% only fractionally below the 1997 all-time high.

• France Services PMI falls to 41.9 in March from 43.7, a 49-month low. Manufacturing unchanged at 43.9, but composite PMI down to 42.1, a 4-year low.

PMI and other anecdotal series indicate that the contraction is gaining momentum, rather than an inflection out into another recovery. For some of these countries, Spain and Italy in particular, there has been no real recovery to speak of out of the Great Recession. It has been one, long (and “unexpected”) contraction despite monetary measure after monetary measure. Saving the banks has not done anything toward saving these real economies, and that was supposed to be the whole point.

Asset prices have at least confirmed, apparently, the success of monetary policy at restoring liquidity. But are asset prices actually correct?

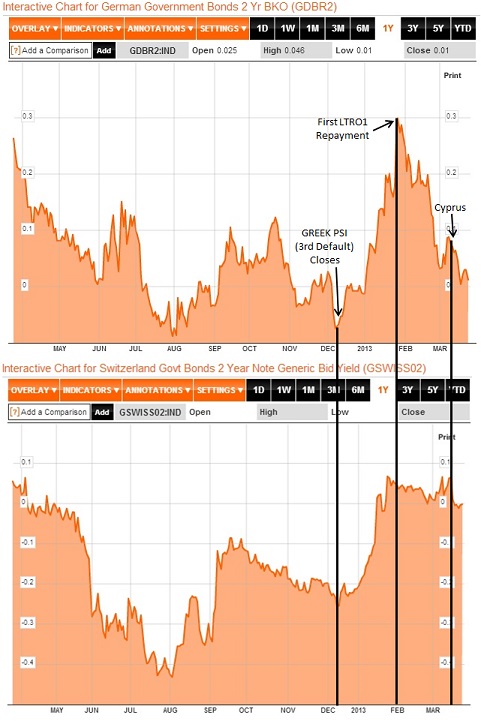

Beginning December 10, 2012, both Swiss and German bond prices lost their bid and negative yields disappeared. The drop in German bonds was rather sharp, bringing the 2-year yield back to +0.3%. The Swiss 2-year yield finally re-emerged back above the 0% line.

Beginning December 10, 2012, both Swiss and German bond prices lost their bid and negative yields disappeared. The drop in German bonds was rather sharp, bringing the 2-year yield back to +0.3%. The Swiss 2-year yield finally re-emerged back above the 0% line.

With everything seemingly improving on the credit/liquidity front, banks began to repay their LTRO borrowings on January 25, 2013. That also marked an “unexpected” inflection point in the German bund’s restoration of “normalcy”. German bonds began to bid back toward zero in the days and weeks that followed. For its part, the Swiss credit market stopped its own “normalcy” push as well.

Following the Cyprus fiasco the weekend after March 15, both sovereigns have seen a return of negative yields. In other words, safety is again being bid in exactly the place it was in the summer of 2012, and 2011, and 2010.

That raises the question of just how effective all this monetarism has been even in the financial restoration effort. As I wrote on Friday, markets only “buy” this normalcy routine for short periods of time. After the LTRO’s injected nearly €1 trillion in early 2012, we saw the same kind of “normalcy” appear in asset prices. Policymakers were so confident that the LTRO’s had ultimately “worked” that the ECB disclosed on April 20, 2012, a hidden €121 billion in ELA usage.

Markets did not react too kindly to the idea that peripheral banks were so far into hidden liquidity problems as to be so dependent on the ELA – and the bank “jogs” and Target II discussions began in earnest. Are policymakers making the same mistakes again this year?

It certainly appears that way. In addition to underestimating the severity of the insolvency problem, they do seem unusually or atypically comfortable with transmitting future deposit impairments. The long gaze of money confiscation has even descended onto Italy:

“Kramer relies on surveys of the European Central Bank. Net financial assets of the Italians therefore amounts to 173 percent of gross domestic product (GDP). This was significantly more than the net financial assets of the Germans, which corresponds to 124 percent of GDP, said Kramer Handelsblatt Online. “So it would make sense, in Italy a one-time property tax levy,” suggested the Bank economist. “A tax rate of 15 percent on financial assets would probably be enough to push the Italian government debt to below the critical level of 100 percent of gross domestic product.” [emphasis added]

Talk of deposit confiscation with a European economy in the midst of a sharp and robust recovery might have a remote chance of supporting such a drastic move. But the Eurozone is a disaster, contracting at a faster rate, ensnaring even the “core” nations that were supposed lead the way out of the crisis. The timing here indicates more than a tin ear to depositor angst, it shows, again, that policymakers actually believe that their policies have succeeded in ending the crisis.

If the current trends in Swiss and German sovereigns are a good indication of declining risk appetite (as interest in hedging away from euros advances yet again), then we have to ask, after so many years now, exactly what has monetary intervention actually accomplished? The economies of Europe are in ruins and even the asset markets cannot function for more than a few months at a time before decaying back into their bunkers.

Stay In Touch