Economies either grow or they shrink, though shrinking is a misplaced word here. A real economic system is always moving forward, even during recession and dislocation. The word dislocation is used in modern economics where it probably does not belong, as well. The entire idea of a dislocation is antithetical to a real economy, being an abnormal separation (emphasis on abnormal). Therefore, it is entirely appropriate inside the mainstream economic canon (that encompasses both Keynesian and monetarist ideology).

A recession is not negative growth or even its absence, it is the re-establishment of longer term economic health through market discipline. The weak and feeble businesses and projects, those that drag on an economic system, are displaced and destroyed. It hurts and the public largely suffers as a result, but it is a necessary process to establish both a positive growth trajectory and the preconditions to innovation.

As investors cheered again yet another tepid employment report, not on its merits but on how that might make monetary policymakers “feel” about their distortive efforts, this economy seems to be stuck in some sort of stasis. It is not an organic or natural state at all, but an engineered turn against economic nature.

The economy after 2007 wanted to recess and needed to recess, but was not able to do so in full measure. The economic carnage as it proceeded was difficult to bear, but the marginal economic pathways and channels that existed in the housing bubble needed to be expunged fully. That source of marginal economic “expansion” was, in the long run, deleterious toward a healthy economic trajectory. Growth cannot be based on asset inflation for too long, as it always ends exactly the same.

Yet, and one can understand this impulse, policy has been designed specifically against recession. Contraction is a bad word in the modern economic lexicon in the belief that business cycles themselves are superfluous to modern soft central planning through central banking. Recession is not a necessary component to growth for central planners, it is a problem in need of management.

So we end up with an economy that still features too much remnant of the previous artificial paradigm (a banking system that still benefits itself the most through bubbles consisting of overwrought credit, as well as investor expectations of largely the same) propped up by the “extraordinary” efforts of the same policymakers. Set against that is financial and economic gravity, the necessary recession path toward long-term health.

The result is what we saw from Friday’s jobs number. In any context outside of 2009-13, Friday would have been a major disappointment, but in the titanic struggle between the artificial and natural gravity it is seen as progress. There were not even enough jobs to keep up with the “official” pace of the labor force, but central banks use it as justification because their goal is really the absence of recession and the elimination of “tail risk”. As Gordon Gekko once said, the rest is conversation.

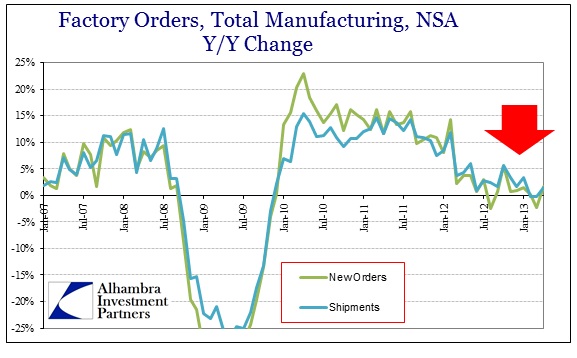

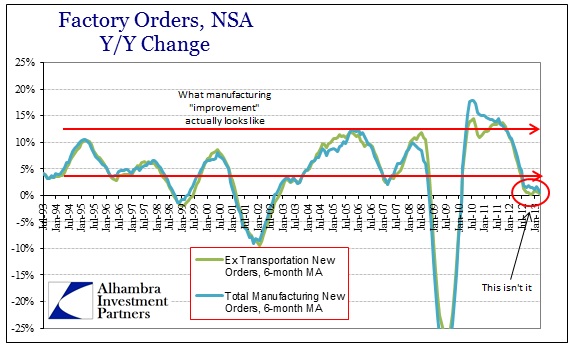

There is more to analyze in due course about the particulars of the latest jobs report (the ongoing structural decline in wage rates and job quality), but it is also noteworthy in this context of a system set against itself. Last week also saw the release of factory orders and shipments across the US. There was a small bounce in some of the categories (again, just the absence of decline) but overall it was largely as disappointing as they have been since the middle of last year.

Where total orders (ex transportation) had declined by 1% Y/Y in February and 2% in March, in April they were up 0.7%. Shipments were close to the same (as you can see in the chart above). So it appears as if the manufacturing economy, and factory orders include both durable and nondurable goods in production, has followed the same static path as jobs.

With a wider historical perspective, that is exactly how it appears – not contracting but not growing either, seemingly caught in some kind of economic Purgatory.

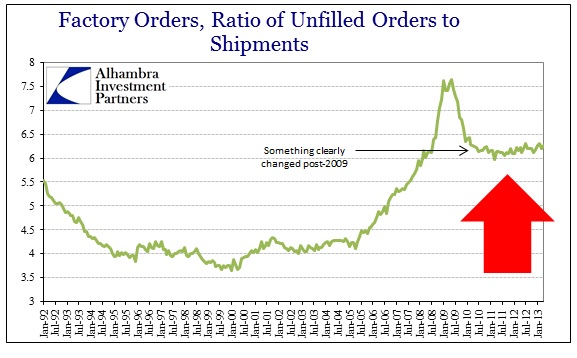

That is not the only oddity to note, either. Looking at the various ratios, such as inventory/shipments, something else sticks out. In the ratio of unfilled orders to shipments across durable goods, it is absolutely clear that there has been some structural changes after 2009.

Logically, it would make sense that a higher ratio of unfilled orders to shipments portends further manufacturing strength. After all, if factories cannot ship fast enough to keep up with orders then the ratio would rise – a good problem to have. But we have seen the exact opposite, where a lower ratio occurs in the best economic times.

Now, the ratio is stuck around 6.25 and rising slightly. The trajectory of unfilled orders is not all that different from shipments (meaning unfilled orders have fallen in rate just as shipments have) but for some reason the data never “normalized” after the Great Recession as it had after the dot-com recession of 2001. That either means something is wrong in the statistical data collection, crunching and analysis, or that the durable goods economy is seeing a huge and sustained uptick in order cancellations. Those are the only two explanations.

In either of those cases, economic growth isn’t really there, it just appears that way. If we step back and look at economic growth as it actually is (as opposed to how it is presented) the same kind of illusion coalesces. Factory shipments of autos grew 27.7% in the first four months of 2013 over the first four months of 2012; light trucks +13.8%. Consumers can buy all they want with credit flowing through outlets such as Ally Financial, anywhere subprime autos are back en vogue.

Heavy truck shipments fell 15% in the same period. There is a world of difference between consuming and a real economy. In a healthy economy, consumption is but a symptom. In a managed economy, consumption is the primary goal; the economic cart is before the business horse.

Perhaps Dante had this economy in mind when he wrote of the second terrace of Purgatory:

That river starts its miserable course

among foul hogs, more fit for acorns than

for food devised to serve the needs of man

What central banks devise and disperse is not fit for the economic needs of man. What flows from it is not economic growth in any meaningful way, as recession is a vital part of the health of the whole system; in other words recession from this point would actually constitute progress. While it appears instead to be in stasis, this economy is really just falling into disrepair that will get recognized (including the unfortunately necessary downward revisions to nearly every economic data series) once the artificial illusion is lifted. There is no growth, only the forces of economic nature overwhelming monetary ideology. For $85 billion per month (on top of MBS reinvestments) the Fed is literally getting nothing for its “money” except stalling real growth potential.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch