The idea of recession in the context of a “recovery” is somewhat maddening from a conventional standpoint. A recovering economy is not supposed to be subject to a reversal, particularly in the presence of so much “stimulus”. However, there is precedent for just this sort of pattern, including Europe right now.

In our own experience, the 1930’s offered exactly this kind of narrative. There was a recovery after the initial collapse finally subsided sometime in late 1932, early 1933. The banking system was largely re-financed and the economy experienced a reflation in no small part to that monetary expansion. Then, in 1937, it all fell apart again despite the conspicuous absence of a monetary/banking component.

It was the relapse in 1937 that made the Great Depression such a durable part of our imagination. It took decades to recover lost activity and previous trends, leading to a whole range of economic, societal and even governmental changes. The failure to recapture the 1929 peak was an important factor in determining much of the rest of our history.

That is why recession in 2013 is a paramount question. It’s not some academic discussion for the NBER to debate cyclical peaks and troughs, it is a vital clue to how the next decade and perhaps longer will play out. It speaks to chronic unemployment, lack of growth opportunities in business, corporate earnings and even investor expectations. The presence of recession in the near future (if not already) feeds into the growing structural abyss that was presented in the 2001 recession.

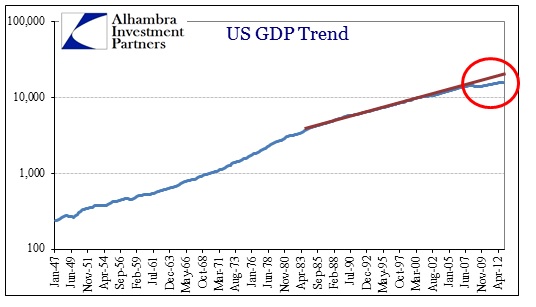

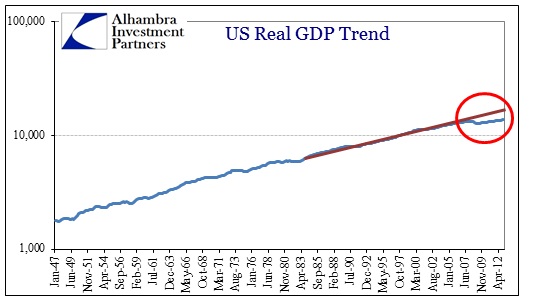

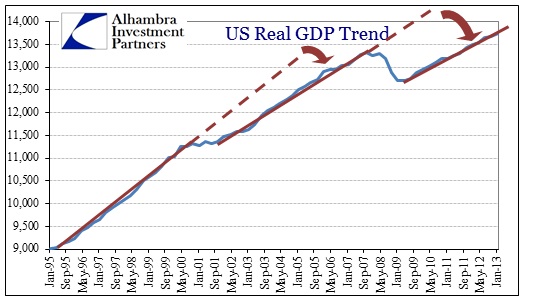

On a longer horizon, this structural problem is readily apparent.

There was a clear change in trend after 1982, but that largely related to inflation. To remove that as a potential factor, we can use real GDP rather than nominal.

Even here, the trend in growth was largely stable until more recently. That is a pure departure from the behavior of recessions in the post-war era up until the 21st century.

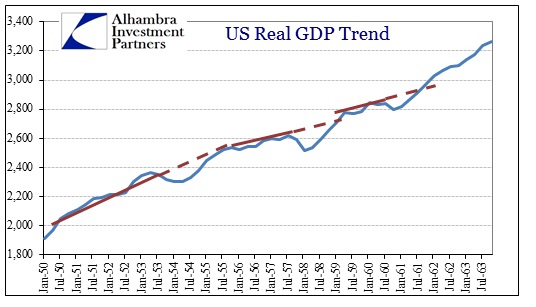

Recessions in the 1950’s were shorter and sharper, and took very little time to return to the previous “boom” trend.

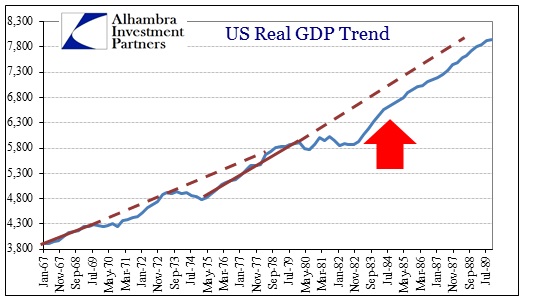

The same was true for the 1970’s, with an exception for the double dip of the early 1980’s.

There certainly is an artifact of inflation in the 1975-79 growth rate, so it may not be a fully suitable comparison. Even with that irregularity, the robust recovery in 1983-84 narrowed the gap significantly rather quickly. Thereafter, the growth rate pretty much matched previous trends, recapturing a secondary trend extended from the late 1960’s and early 1970’s.

The 1990-91 recession was slightly different, coming up short in the recovery area as it took the economy quite an extended period to return to the previous boom levels.

During that time, it should be noted, monetary expansion and management had become an increasing feature in the economic functioning. It was the first major test of interest rate targeting, and the low rates and balance sheet expansion (in commercial banks and the nascent but growing shadow system) essentially backfilled economic activity in the absence of robust organic recovery. That was as planned.

However, it also led to undetected asset inflation and eventually the dot-com bubble and the early stages of the housing bubble. The recession/recovery cycle in the 21st century is unambiguously different than the entire post-war history.

In each recession/recovery case, economic activity is “supported” by the supplementation of asset inflation and related credit growth. Yet, neither recovery has come anywhere near matching previous levels. That suggests that asset inflation itself is a factor – as in the previous trends were artificially supported but not representative of organic growth.

If that is the case, there is little wonder that asset inflation and “stimulus” have diminishing efficacy toward closing this perceived “output gap” (in formal economics parlance). The increasing proportion and presence of credit-driven activity pushes the economy further from its natural trend, and each progressive recession are attempts to revert away from the artificiality (or malinvestment).

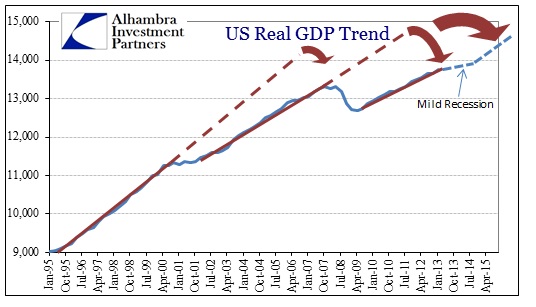

Another recession in this string would be a serious challenge to the domestic economic system, not unlike the 1937 relapse. I’m not claiming an equivalence in terms of severity, but in terms of how it affects the long-term growth trajectory of not just the US economy but also having far-reaching implications for the global system. If the US were to return quickly to trend, would China or Brazil, for example, be under such strain?

We are well aware of just how far the recovery has “underperformed” relative to “full employment”. How would even a mild recession impact everything that would follow from such a continuing divergence? It’s not just an economic adjustment, it would have to be incorporated into everything from governmental functioning to corporate decisions about investments. Currency wars would certainly intensify as the impulse to export out of the malaise would be too much to bear in many more places than are currently enthralled.

It would push the next true “boom” period that much further into the future, and likely extend the secular bear market that has plagued us since the change of millennia. These factors are, in fact, wholly related. It is not coincidence that artificial growth, lack of recovery and the bear market have all intersected in this current century.

So much of our system depends on assumptions about the future economic trajectory, but unfortunately it is far too clouded by unrealistic expectations that do not account for these obvious divergences. In that respect, recession is far more than an academic exercise.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch