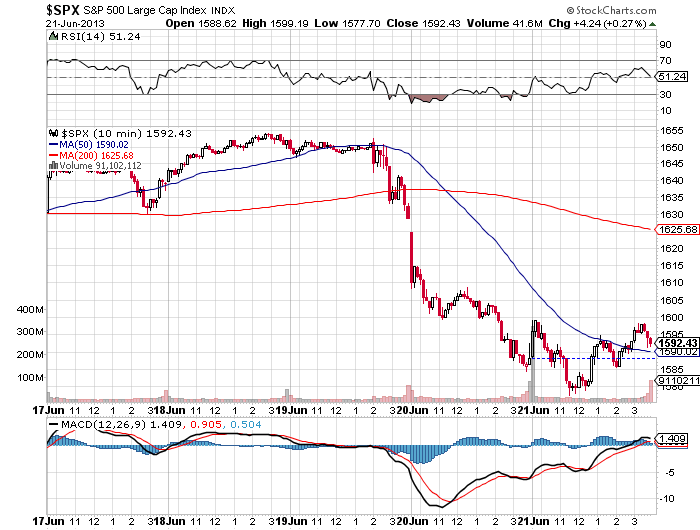

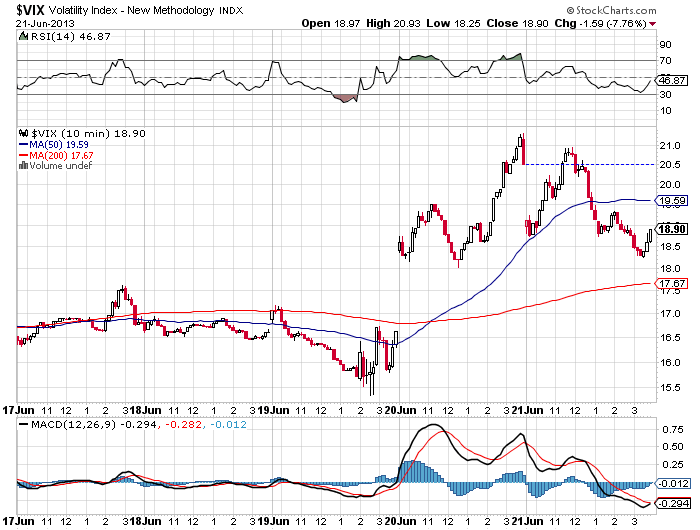

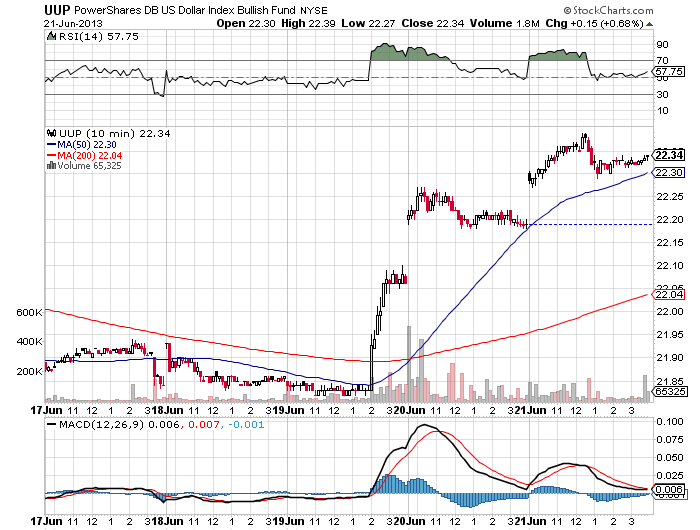

Better growth for the US economy is right around the corner, we can sustain higher interest rates, we don’t need artificial assistance. Oh shit, sell everything. The US stock market was off 4% from Wed announcement to Thu close. In fact every major asset class was down during this period, including short term US treasuries. Investors were not looking for safe havens. In a leveraged world, on a day when risk is repriced, there are no safe haven asset classes. For long only investors looking for a place to hide, there were 2 types of investments that were up during this period, volatility and US dollar denominated cash. We did not expect the Fed to back away from the belief that they would taper their asset purchasing program (QE), and they did not. We expected volatility coming out of the meeting announcement and that is precisely what transpired.

The volatility stems from:

- Investors’ reassessment of asset prices given their assessment future US treasury rates (a proxy for the risk free rate).

- Investors’ reassessment of where they want to position themselves given the prospects of higher future rates.

- The amount of leverage in the system.

- In general, “Uncertainty.”

We live in a world based in many ways on perpetual debt. When interest rates rise, the cost of the future rises. This not only affects the price of equity, but also asset class preference. With interest rates at 2%, you may prefer to take more risk, borrow money and buy a rental property. With interest rates at 5%, you may prefer to lend money to a property buyer, take less risk and just collect 5%.

So, for insight into the markets one should be asking themselves some questions. Is the rise in interest rates a fantasy wall of fear? Is it a trend? Will it be orderly, the Fed navigates the economy to normalization and a return to principled growth? Or disruptive, a sharp cycle? How long will the process take and how high will interest rates go? What stresses can result?

As always, I do not believe the answers to be binary or discrete. They are to be viewed as the probabilities of future events. The volatility index is telling us that the range of possibilities is more dispersed. A move to cash tells us that there is an inferred benefit or opportunity to waiting. There may be a higher probability of downside price action or even just an emotional benefit from removing oneself from uncertainty. The relative performance of more developed countries tells us there is a higher probability of future problems in countries with less savings or less of their own capital. Market movements Thursday are also very indicative of speculative risk in the markets.

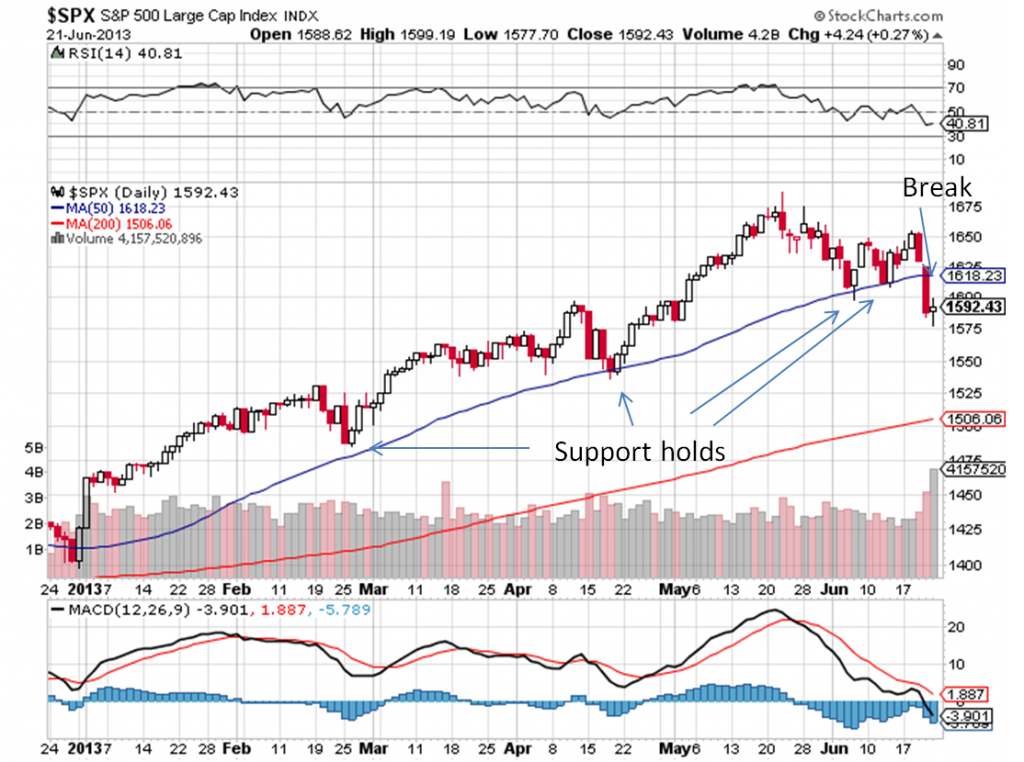

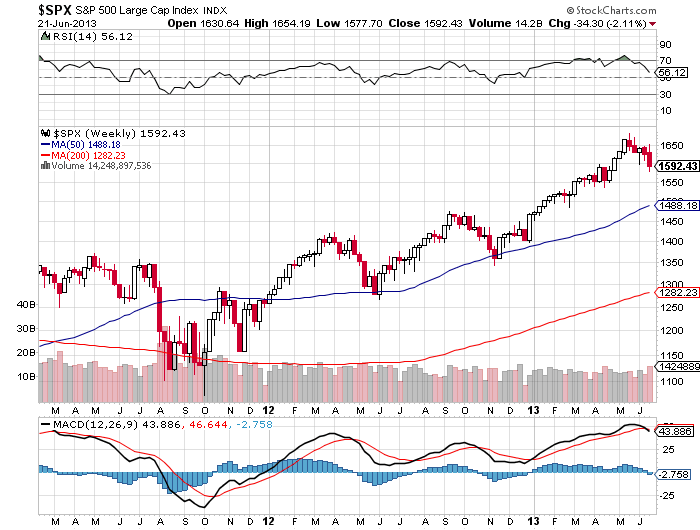

The markets are sending signals that caution is warranted. The breadth of weakness, the S&P500’s breach of the 50 day MA, and the first derivative of this moving average turning negative are all signals to put in steeper risk controls. We There are additional stresses showing up in less developed markets, with overnight lending rates in China shooting up over 13%.

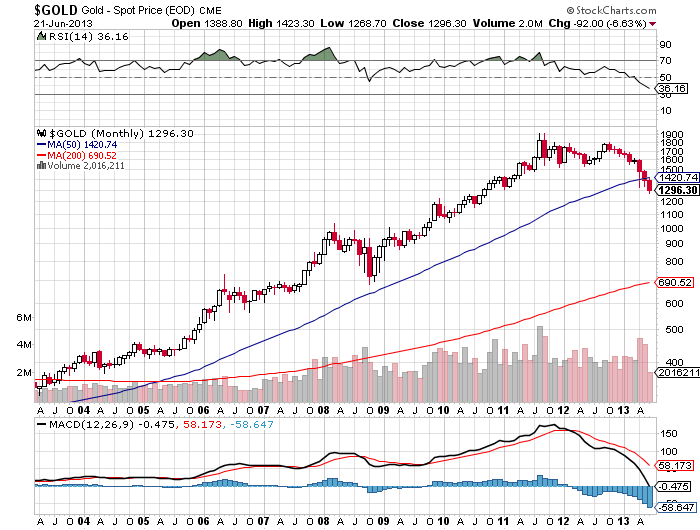

A look at these longer term charts shows just how high some of these markets are versus long term averages. Here is a weekly chart of the S&P500 and a monthly of Gold.

Portfolio moves:

Global Opportunities:

Sell PM:

The dollar is rising, interest rates are rising. Phillip Morris derives revenue from overseas, dollar strength hurts translated revenue. Phillip Morris has borrowed more than the value of company assets, ie book value of equity is negative, rising interest rates hurt future refinancing needs and eventually affect margins. PM gives a technical sell signal.

Sell GoldCorp:

Sell on Gold weakness and technical breakdown.

Add to Nokia position:

A turnaround story with strong assets., take over/merger rumors from different firms, great potential, positive momentum.

World Allocation:

We are already positioned conservatively, but further risk controls are in order given events of Thursday.

Sell GDX — Added on cheap valuation, a break down of reverse head and shoulders technical signal.

Sell 1/2 the gold position — Gold as collateral, transfer of Gold from weak, speculative hands. (see above chart)

Sell 1/3 S&P position — Rising interest rates and a technical top (see above charts)

Sell the balance of the emerging markets position — Riots in Brazil and Turkey. Currency devaluation,capital flight.

As always, please feel free to contact me with any questions or concerns.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

Disclaimer: The information, data, analyses and opinions contained herein (1) include the confidential and proprietary information of Alhambra Investment Partners LLC, do not constitute investment advice offered by Alhambra, are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and are not warranted to be correct, complete or accurate. Except as otherwise required by law, Alhambra shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use.

Stay In Touch