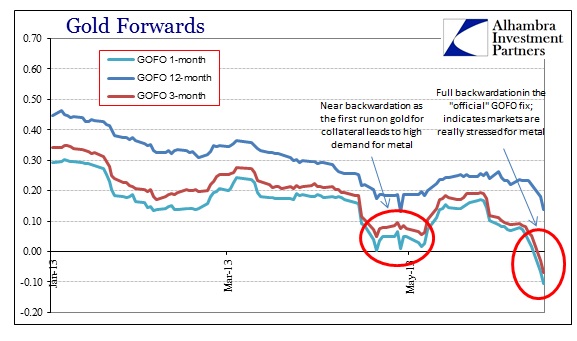

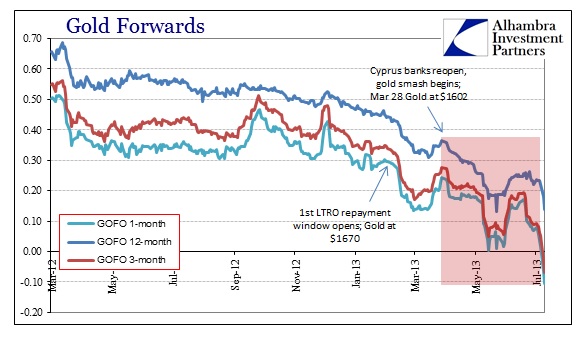

The key benchmark rates for gold as collateral in borrowing US dollars are the gold forward rates (GOFO). Like LIBOR, GOFO is a “fix”; a survey of LBMA “contributors” of the cost at which they proclaim to exchange gold for dollars. There is no transactional information which accompanies GOFO, so it is often misconstrued as a “market” rate.

The appearance of a negative GOFO rate, then, indicates very strongly the shortage of physical gold available in the markets. The futures markets have indicated shortages for some time, as backwardation has been apparent (difference between the basis and co-basis) in even the December contract (which will not expire for 170 days). Therefore, the fact that GOFO now shows backwardation is both confirmation of market signals from futures trading (the lack of arbitrage activity to close the discount in the futures prices) and indicative of the severity of the physical shortage.

The only explanation where we can plausibly account for both this physical shortage and the counterintuitive behavior of gold prices is through systemic dollar liquidity. Basic economics proclaims that shortage of the physical metal should be price positive, but the exact and dramatic opposite has occurred. That would only be the case where gold has been used to obtain US dollar cash in lending arrangements in size.

The appearance of desperate shortage, then, is nothing more than the other side of the transaction. The more gold has been used as collateral (perhaps rehypothecated in paper gold; likely unallocated in physical) the more demand there will be to close out these synthetic “short” positions. If any bank has been using client gold in unallocated accounts for their own collateralized funding, for example, at some point the bank will need to replace that gold for client access.

What I think this confirms more than anything else is the continued fragmentation across global funding markets. US dollar cash is available – the Federal Reserve has taken care of that and then some. But cash stocks are only half the liquidity equation; there has to be a means to move it and turn it into effective flow.

Before August 2007 unsecured lending in the wholesale dollar markets (both federal funds and eurodollars) took care of any marginal needs for liquidity, but since those markets froze and counterparty risk became a priority, collateral has been the key to effective liquidity. Without the ability to appeal to unsecured wholesale markets for marginal spikes in liquidity needs (for whatever reasons) collateral markets become the bottleneck in liquidity, appearing severely stressed when liquidity tightens. That is even more the case as central banks through their various “stimulus” (money stock) programs have locked up usable collateral (the technical term is collateral “silos”).

If this interpretation is correct, and, again, I don’t see any other explanation for both recent price action and backwardation, then it dovetails into the idea that US dollar funding is acute in so many markets – fragmentation of effective liquidity. Negative repo rates in the UST 10-year (and other tenors)even in to the triple issue are very much the same as negative GOFO in terms of collateral desperation.

Dollar stress started long before “taper”, indicating that the funding system has again been malfunctioning for some months – going back to LTRO repayments, Cyprus and volatility across Asian bond markets. There is no way to pinpoint exactly why or how US dollar liquidity is so stressed, but there is no shortage of candidates: China, the Bank of Japan, PIIGS, and, most of all, global growth falling dramatically. This even feeds into the growing emerging markets currency problems as the dollar shortage puts upward pressure in terms of exchange price, further devaluing already weakened currencies (and affects the direction of flow).

As I have said for months now, the smash in gold is not confirmation of Bernanke’s great work in laying a successful foundation for the economic future, but rather the dramatic re-appearance of trouble on the horizon. Backwardation in both gold and UST collateral markets is a very visible confirmation that US dollar liquidity is drying up. This typically does not end well for indirect asset markets once liquidity problems begin to feed margin calls and haircut adjustments. The technical term for that is “fire sale”.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch