Easy money, especially quantitative easing, presents unique challenges for investors. The FED has lowered the cost of credit, therefore lenders make less. The other side of the accounting ledger is that debtors pay less. But, the risks of lending money have not changed to justify the lower return you receive. In fact, the FED has artificially lowered the rate because the default risks are(were) elevated.

Given this risk/return equation in fixed income, lower returns and the same or higher risk, an investor looks elsewhere for places to put his money and garner an acceptable return. Investors may buy property or stocks, this is a desired outcomes of QE. Bernanke is trying to ignite our animal spirits and force us into taking more risk than we would normally accept.

One of our primary objectives as advisers is to manage risk. In order to take smart risks, one must recognize a poor risk/return profile and not fall prey to the impulses caused by an artificially low interest rate environment. For portfolios, this has meant staying away from bonds, especially longer term bonds, for the better part of a year. The shortest maturity, least risky bond available is cash. No one desires to hold cash for return reasons. But when one looks at cash from the risk management perspective, it’s utility as an asset becomes more clear. As many have noticed we have been holding an elevated amount of cash, as high as 25% cash in moderate portfolios for the better part of 9 months.

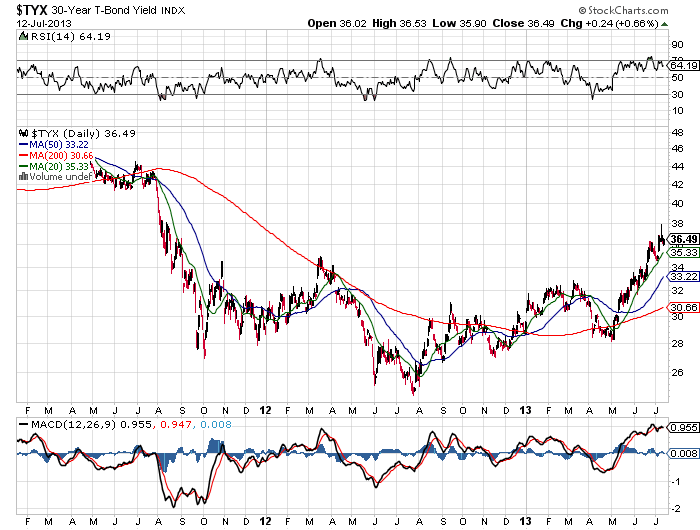

Interest rate risk is perhaps the most primary risk factor in bond investing. As interest rates rise, the price of a bond goes down. 30 year interest rates were yielding 4.6% at the beginning of 2011. By the middle of 2012 they were yielding as low as 2.5%. Just recently (the last quarter), coinciding with QE, tapering discussions, 30 yr yields have risen back to 3.6% (see the yield graph below).

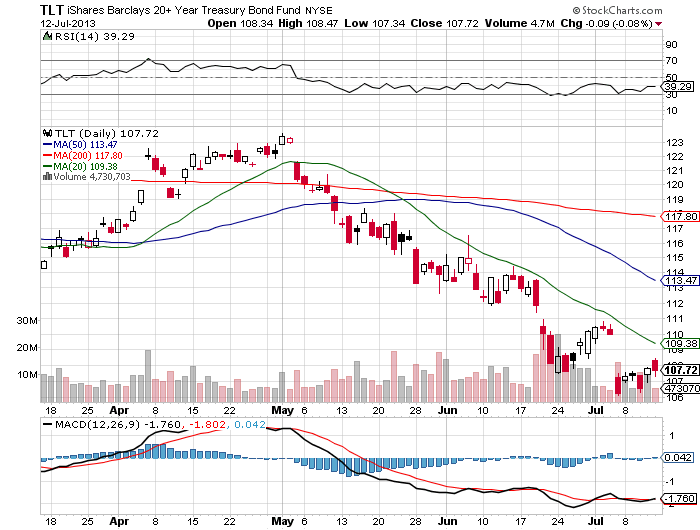

Here is a look at the price return of the long term bond ETF for the last 3 months, it is down 15%. Imagine, thinking you were being conservative and investing in long term bonds only to lose close to 15% of your wealth in a 3 month period.

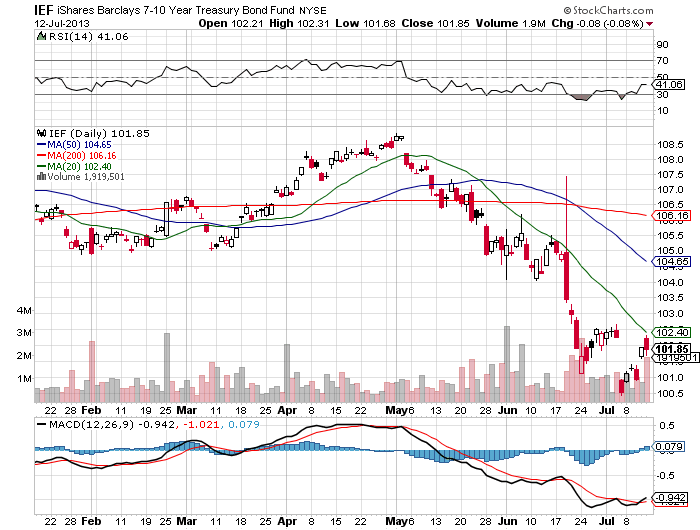

We actually think bonds are finally priced more fairly. As compensation for lending your money, one would expect to retain buying power and make a small return, perhaps in line with the real growth that the economy is able to attain using these borrowed funds. In fact, historically, over the long-term, this is exactly what bonds have returned, nominal GDP. Nominal GDP is currently running about 3.2%. As the US has become bigger and more mature, our growth rate and our cost of capital are lower. At the longer end of the curve, bond yields do appear to compensate us for the current level of inflation and growth. Further risks to both of these factors do exist; so, this is by no means a green light to buy bonds. But, we feel this is an opportunity to take a small step back into fixed income.

Portfolio Strategy moves this week:

World Allocation:

Add Intermediate Term Treasuries

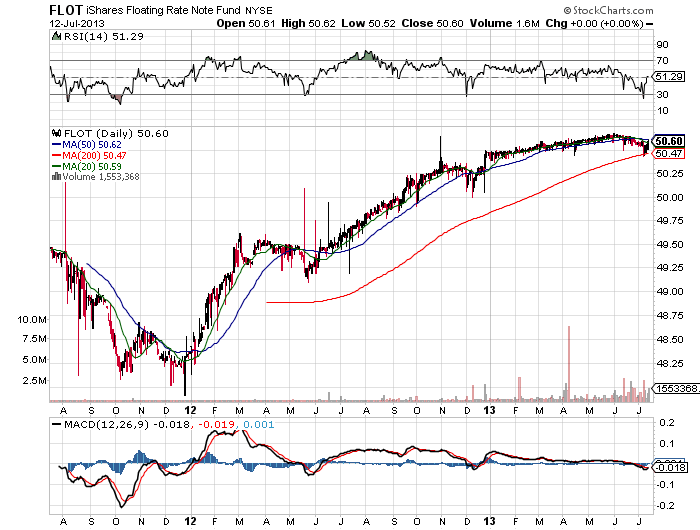

Increase High quality Floating Rate Bonds

Global Opportunities:

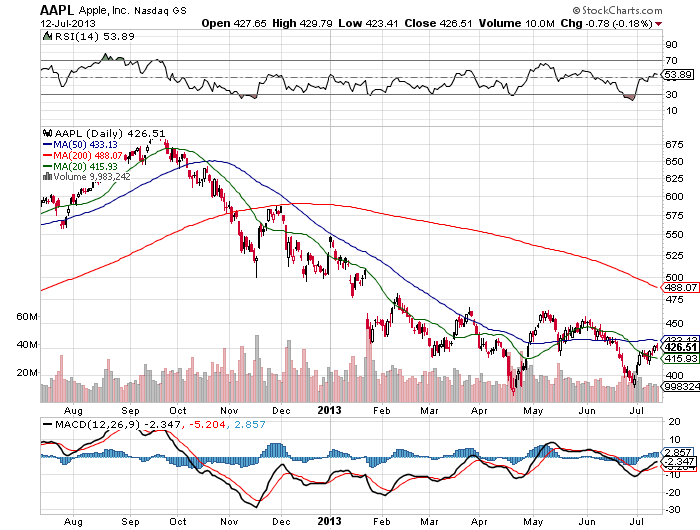

Increase AAPL:

Technically, Apple has been consolidating and showing strength. Apple is cheap, with a P/E under 10. They have a ton of cash and yield around 2.75%. Technology and design, Apple hires Yves Saint Laurent CEO, Paul Deneve as VP of “special projects.” What might the new product cycle bring?

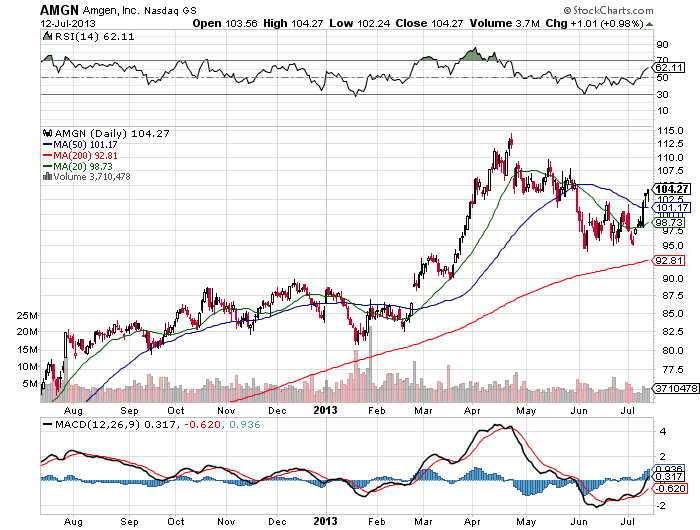

Increase AMGN:

A good current roster of products and a nice pipeline. We feel AMGN is undervalued in the marketplace and, after some consolidation, is poised for another move higher.

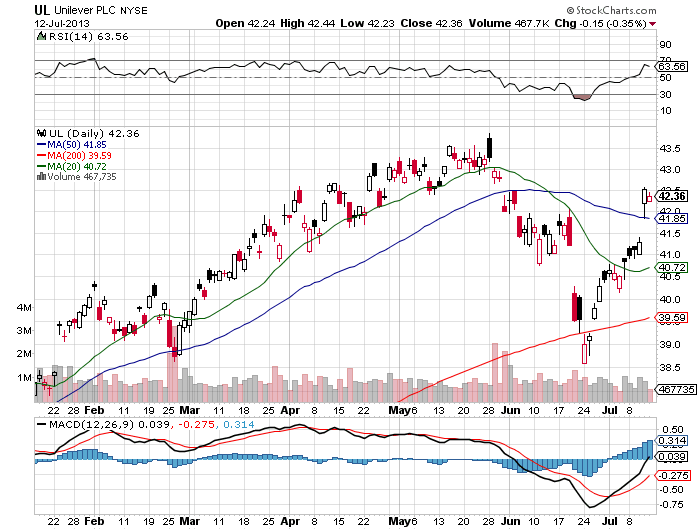

Sell UL:

Selling products to a growing middle class in emerging markets is not a primary investment factor for us today. Unilever was an early adopter in the emerging middle class strategy. This has benefited UL, 55% of sales currently come from the developing world. Today, we have some concerns about near term growth in developing markets. UL has a P/E north of 20, has reached our target price and was sold.

As always, please feel free to contact me with any questions or concerns.

Click here to sign up for our free weekly e-newsletter.

For information on Alhambra Investment Partners’ money management services and global portfolio approach, Douglas R. Terry, CFA is reachable at: dterry@4kb.d43.myftpupload.com

Disclaimer: The information, data, analyses and opinions contained herein (1) include the confidential and proprietary information of Alhambra Investment Partners LLC, do not constitute investment advice offered by Alhambra, are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and are not warranted to be correct, complete or accurate. Except as otherwise required by law, Alhambra shall not be responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use.

Stay In Touch