Earnings season is in full bloom and markets care little about the details as long headlines continue to provide optimism. That’s a pretty low bar since “beating” estimates is a rigged game. However, revenues are much more difficult to tailor by accounting conventions, so they offer a more reliable (not perfect) window into the fundamental circumstances of each company. We can also add context to broaden the horizon of our interpretations.

I have selected four bellwether companies in distinctly different industries to give what I maintain is a fair representation of the economic climate. Obviously, given this anecdotal methodology, it opens potential criticism for cherry-picking and that is a fair sentiment. But given the uniformity of patterns here, I think there is value in reviewing both the results and the context in which they occur.

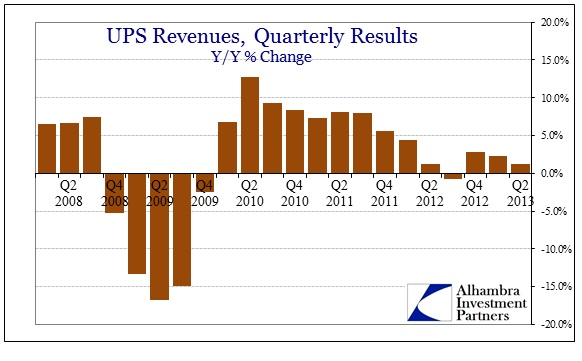

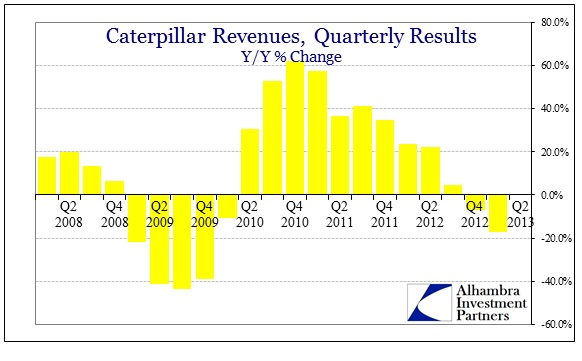

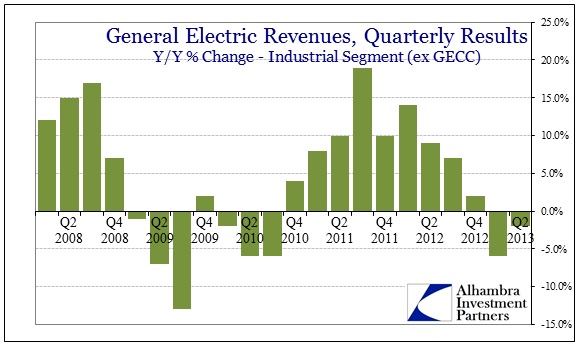

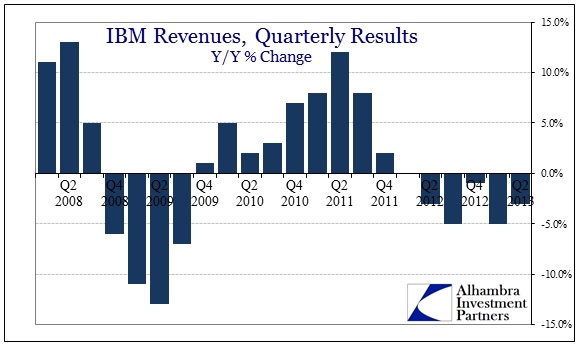

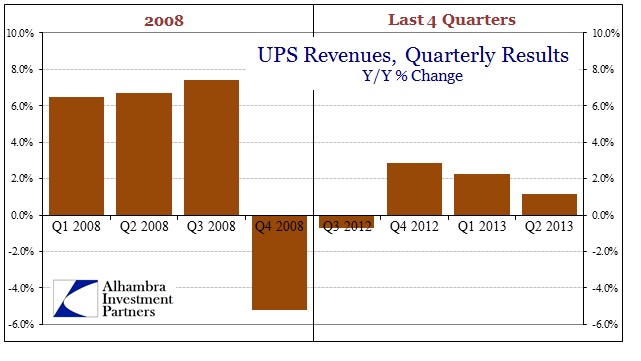

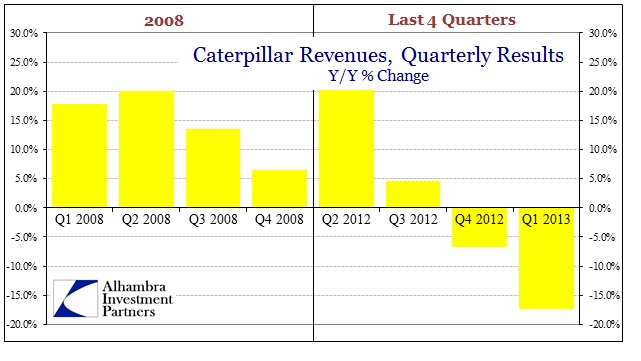

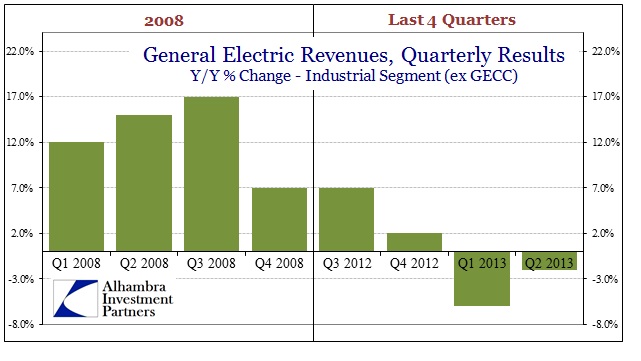

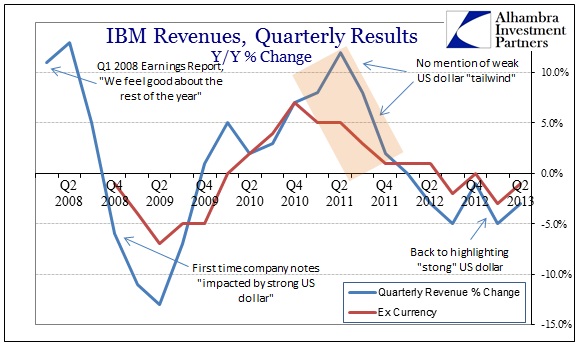

The four companies are IBM, UPS, Caterpillar and General Electric (minus GE Capital, just the industrial segment). The harmony among their revenue patterns is, as I said, remarkable:

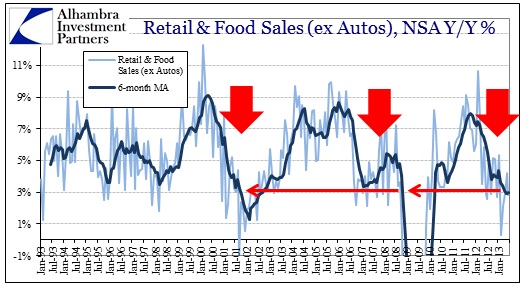

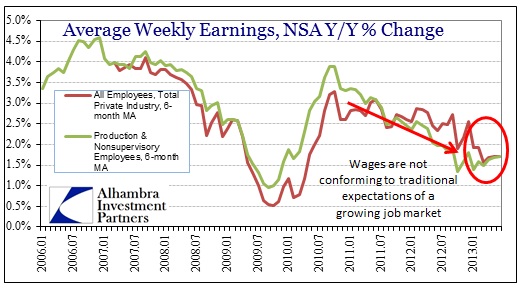

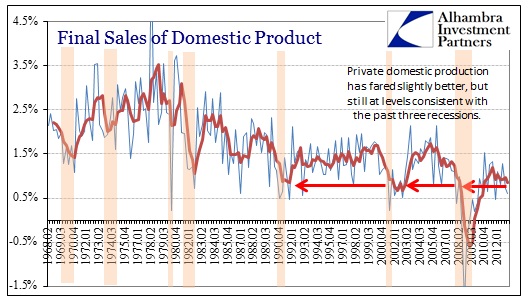

It is a pattern we have seen in so many other data points and series from many disparate sources and surveys:

It is a pattern we have seen in so many other data points and series from many disparate sources and surveys:

The four companies highlighted above are multi-national in nature, but they also capture their fair share of domestic business. Given this repeated pattern of revenues and economic accounts, that suggests highly the US domestic economy and the malfunction in the global trade economy are not so different at all. The US is not some “cleanest dirty shirt”, it is just as abysmal.

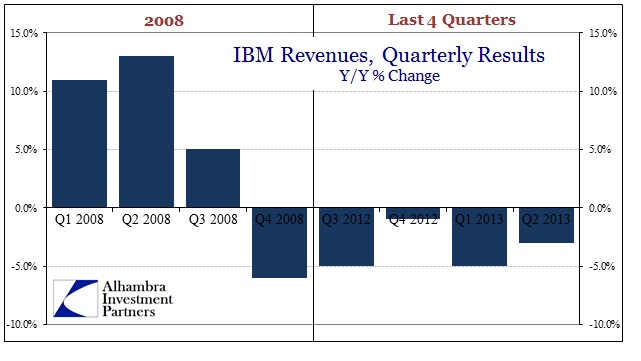

But in some respects that doesn’t tell the full tale either. Comparing the last four quarters of revenue results to CY 2008 is quite revealing in its measurement of what counts as abysmal:

In every case, revenue growth is running far below the first stages of the Great Recession. What should be very worrisome is simply ignored because nobody believes it is possible. The context of the current period is lost in both seasonal adjustments (on the economic accounts) and perceptions of “recovery” driven by narrowly-focused and often mistaken assessments of how all this data fits together. Since everybody seems to believe, quite implausibly given the four full years distance to the last recession, that the US economy will suddenly shift to full recovery any day now there cannot possibly be anything but growth.

Part of that hidden context is due to the appeal of authority. Both the economics profession and the Federal Reserve say that things are getting better, so they must be contra all indications. Further, that feeds into corporate proclamations and even forecasts. Back in the middle of 2012, Caterpillar noted its expectations as such.

“While we will not hesitate to act if we need to, we believe that actions needed for better world economic growth for the future have already begun. Brazil started easing monetary policy with lower interest rates in late 2011, and we are now seeing improvement in our business there. China has started taking action, and we expect that further monetary easing and investment initiatives in China should help economic growth in late 2012 and 2013. In the United States, we were pleased to see the passage of a transportation bill that provides our customers more clarity through fiscal 2014.”

Caterpillar has been caught almost completely off-guard by the collapse in its business, focusing instead on the hope of monetary prowess globally. In that respect, the company’s expectations were similar to what IBM saw after the first quarter of 2008.

“IBM is a different company today, with a number of unique advantages: our global reach and scale, our strength in profitable growth segments, strong recurring revenue and profit streams, products and services that create real value for clients, and the discipline and financial strength and flexibility that enables us to adjust our business model as conditions require.”

They ended that sentiment with famous last words, “we feel good about the rest of the year.”

So in that sense the corporate mouthpieces are just echoing economic expectations driven by badly modeled economic assumptions. Added to that is the very real currency imbalances embedded in these corporate numbers. As we can see from IBM’s breakdown, there was certainly a tangible “benefit” to results from the weak dollar-QE 2 period. However, that has not been as apparent lately (global dollar shortage putting upward pressure on the dollar) as the “tailwind” now turns into a “headwind”.

Furthermore, the weak dollar in many ways hid the inflection in revenue growth (at least for IBM). Absent favorable currency translations, the downturn in growth appeared much sooner than perceived and the “recovery” much less robust. While I have highlighted IBM, a similar pattern emerges for all the multi-nationals to some degree.

Without context these various data points and series cannot be fully judged or analyzed. What feels like a still-recovering recovery to so many looks far different in comparison to the real recession that was already in full swing in 2008 – the fact that so many companies and so much of the economy is running below 2008 rates is very revealing and startling in its implication. It should be even more remarkable aside the fact that QE 3 & 4 are right now being pushed into “markets”, and that a renewed housing bubble is building next to myriad other asset bubbles.

There is no hiding the fact that the global economy, including the US, is in full retreat. Investors and observers may choose to ignore it, but that just makes their game of waiting for recovery all the more curious.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch