Because of the way GDP is calculated currently, the latest release on the US trade deficit is going to boost GDP slightly for Q2 (and just as likely will get canceled by a downward revision somewhere else). The logic and methodology is sound, but that does not mean it is a perfect measure. The fact that imports declined so much in June is actually a signal of waning and contracting demand inside the US (which shows up in the GDP accounts for Final Sales to Domestic Purchasers).

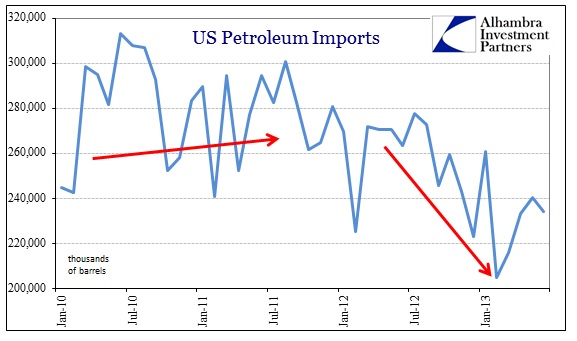

The most obvious explanation for the ongoing decline in imports is petroleum.

Tthere can be no doubt that the fracking and shale boom of the past few years is playing a role in the diminishment of imported oil. However, given the overall pace of the decline it would be wise to search for other economic factors as well.

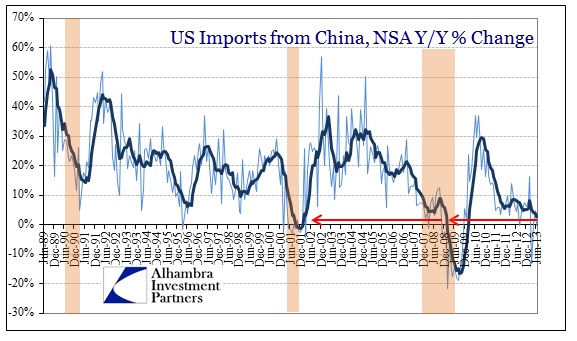

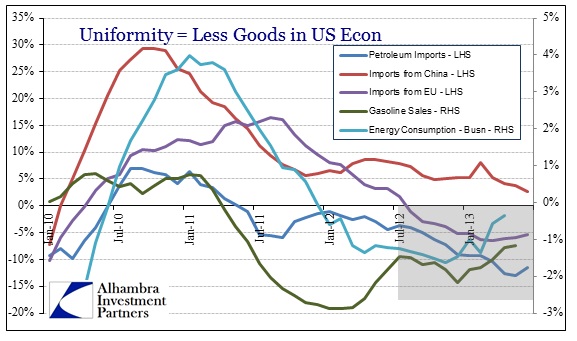

Next to petroleum in terms of volume, the US is addicted to manufactured imports from China. While the EU gets a lot of the blame for the dramatic industrial slowdown in China, it is clear from this side of the trade ledger that US demand for Chinese goods is showing the “wrong” trajectory.

The current pace of import growth from China is similar to Q4 2008 and Q4 2001. From the Chinese perspective, lack of demand for manufactured goods is much more global than just European depression.

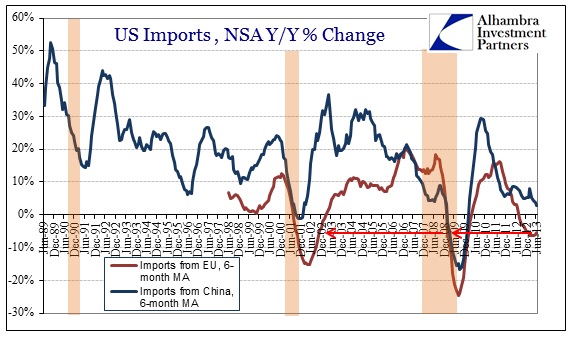

And the lack of US demand is also global. Imports from the European Union into the US have been contracting since last year. While there might be a tendency to blame currency fluctuations, the largest factors in global trade are actually macro-economic. Weak demand overcomes any and all appeals to currency manipulations and artificial boosting of export competitiveness.

Regardless of currency exchange rates, the behavior of US demand for EU imports looks very much like that of Chinese imports.

There is a noticeable slowing in the pace of imported goods since the middle of 2012, and in both indications the patterns conform (uniformly) to those seen in previous recessions.

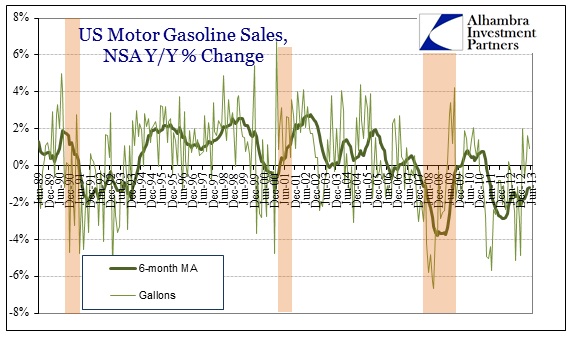

Given the behavior of other proxies for domestic demand, this is not at all surprising. Volumes of gasoline sales and deliveries have been trending lower for quite some time.

That would seem to strongly confirm that the reduction in imported petroleum is not simply due to domestic oil and gas production. There is a domestic macro-economic decline in the use of petroleum-based energy.

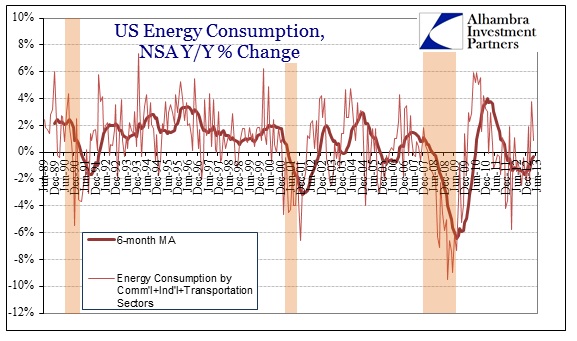

The lack of energy consumption also appears in total energy. The trend for combined energy consumption across the business sector (defined as commercial users, industrial users and transportation users) looks suspiciously like the charts above.

In fact, if we put all these indications together, we see a very familiar pattern.

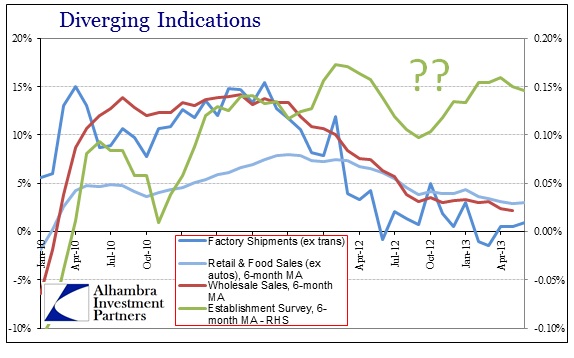

There was a dramatic decline in the rate of growth in 2011, followed by actual contraction in volumes in the early months of 2012. The uniformity in trend is something I have noted at length, particularly in arguing against the only indication that has largely gone against this demand pattern – the Establishment Survey.

Of the nine economic factors shown in the previous two charts, eight are in full harmony with only the Establishment Survey alone in its view of the domestic economy.

When every indication of real goods in the domestic economy is uniformly moving lower or contracting the word to describe it is not “growth”. The Fed can call itself a success and declare “mission accomplished” based on a lonely and flawed indicator, but the real goal of tapering lies elsewhere.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch