Joe Calhoun circulated an article in Bloomberg that I never thought I would see.

“Obama this month spoke four times in five days of the need to avoid what he called ‘artificial bubbles,’ even in an economy that’s growing at just a 1.7 percent rate and where employment and factory usage remain below pre-recession highs.”

It goes on to list bubble candidates, matching perfectly with the sense of alarm that is spreading through credit markets.

“While economists are more concerned with inadequate growth, there’s reason for vigilance. Thanks to low borrowing costs, U.S. companies have issued $241 billion in junk bonds this year, more than twice the amount during the same period in 2007; investors’ use of borrowed money to buy stocks is up about one-third in the past year to a near record, and housing prices are surging in areas such as Las Vegas and Phoenix.”

In just one paragraph they give us three of the four main areas of concern as if it were obvious to everyone (the fourth being derivatives, particularly the crowded trade in interest rate swaps). If the bubble-policies were self-evident, they wouldn’t be bubbles as investors would actively avoid them. Instead, bubbles become self-rationalizing, particularly when the Fed engages in exactly that.

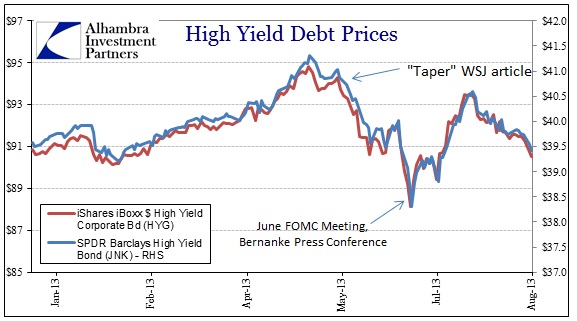

Monetary policymakers still cling to the idea that the Establishment Survey is showing enough economic improvement to justify reducing the pace of QE. The only other possibility is a disingenuous appeal to false economic readings as a cover story. Aside from the fact that the Establishment Survey is unique in its economic interpretation, the primary problem for the conventional narrative of QE taper has been the incongruity of the credit markets’ collective response. The selloff has been broad and violent, hardly in line with a small reduction in the QE pace (from $85 billion per month to $65 billion per month).

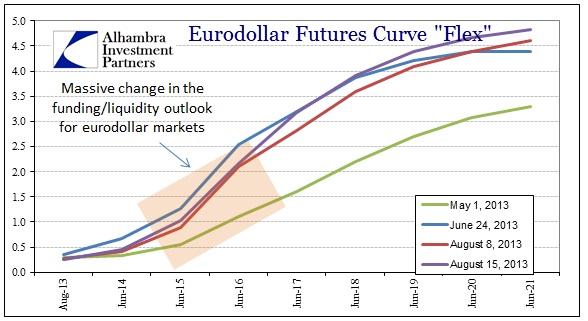

There is something far more important underway, a full revaluation of “market” perceptions and, more importantly, positioning. This gets back to the eurodollar futures curve I highlighted last week.

On May 1st, there were expectations for a smooth and orderly transfer out of ZIRP and QE sometime three to five years from now. All of a sudden, after the word taper came out, funding markets puked future dollars.

Liquidity conditions tightened, including overseas dollar positions, and interest rates have shot higher. Here’s the real problem, though. The “market” assumes interest rates are Fisherian, meaning there is a risk-free component at the base of an inflation spread and credit risk spread. So if interest rates rise then it must be the “market” recognizing one or the other (or both) as rising spreads. If it is inflation expectations being adjusted, then great – the economy is really what the Establishment Survey says and we are on our way to enshrining Bernanke heroism.

What if it’s the other?

What if the market has been shocked into seeing that QE-liquidity is fragile, not robust and durable? Then credit risk perceptions rise because QE has kept companies afloat with cheap (relatively) debt alternatives. Isn’t that what the selloff in junk bonds is saying? Mispricing credit risk, not inflation?

I think that is why credit default swaps were bid in the bond selloff, the realization that defaults will naturally occur far more frequently when the Fed is no longer guaranteeing the whole bond complex. It’s not an orderly transition, as volatility gets dispersed into funding markets as well as asset markets. The entire financial system will have to adjust not just perceptions, but modeled assumptions and risk management efforts (think of how much VaR models will change with so much funding volatility).

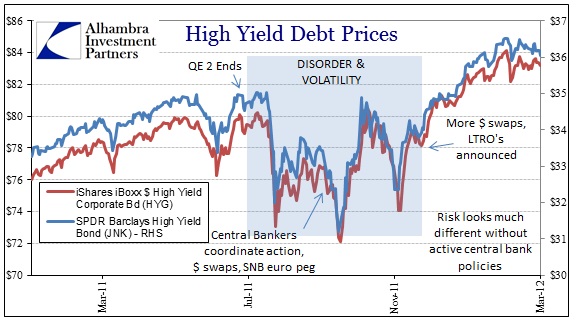

We have seen this before in credit risk, namely the 2011 episode – that last time markets were “naked” without QE or some other active central bank program.

Without any central bank backstop active at the time, credit risk drove volatility in credit markets, including high yield. The system came so very close to panic once again by late November 2011 because dollar funding had reacted so negatively to such volatility. Once central banks returned and focused on repressing “tail risks”, yields dropped and issuance eventually spiked to levels far surpassing even 2007. Rather than a panacea, it has been nothing but an artificially constructed illusion.

The bottom line here is that interest rates are not telling us much about the economy, only that the “market” has no idea what policy impacts there will be in the not-too-distant future. Worse, that date of potentially disorderly transition is creeping in very quickly, so duration risk is likewise heightened. These transitions are not good for a financial system that has rebuilt leverage almost exclusively based on policy. Unwinding it cannot be anything but disorderly.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch