QE in any language has enthralled the mainstream media and economics profession so much that what should be so simple to interpret winds up as uncritical mush. For example, in the Washington Post with Bloomberg yesterday, the “business” section had this to say about Japan’s export data release for July:

“Japan’s exports jumped by the most since 2010 in July, aiding Prime Minister Shinzo Abe’s efforts to drive an economic recovery even as rising energy costs boosted the trade deficit.”

The first clause of that sentence is factually accurate, but after only one comma the “analysis” devolves quickly into QE hagiography. Only one paragraph further on, we get more of this obtuse dosing of the monetary anesthesia that has been applied all over the globe.

“The stronger exports show Japan’s economy is benefiting from a recovery in demand in Europe and the U.S., and the yen’s 11 percent decline against the dollar this year.”

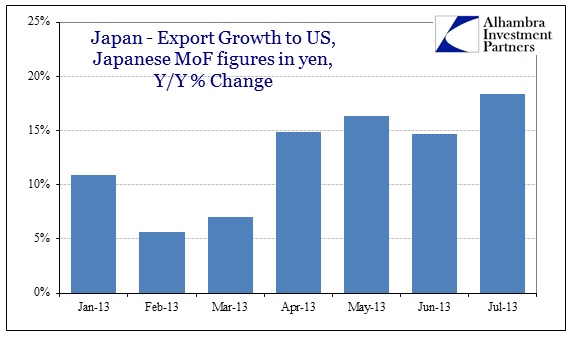

A cursory and extremely basic review of the facts seems to support these opinions. Japanese exports did rise 12.2% Y/Y in July, including an 18.4% jump in exports to the United States. So far in 2013, export levels to the US have increased very noticeably.

Each of the past four months, those occurring under the three “arrows” of Abenomics, have seen close to or better than 15% Y/Y growth. On a strictly factual basis, cleared of any context, there is no dispute that Japanese exports have risen in the terms cited.

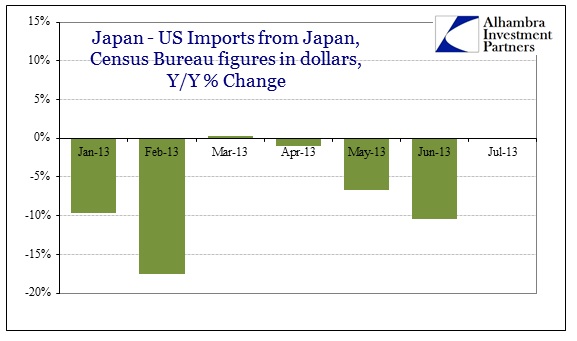

As we know from the minor stir caused by Chinese trade data a few months back, there are two sides to the export process. What is exported by Japan to the US is imported by the US from Japan. If Japanese exports and the Japanese economy are “benefiting from a recovery in demand” in the United States, the Census Bureau on this side should be able to confirm it.

While we don’t have July’s trade data yet, the numbers from June backward are almost the exact opposite of what the Japanese export figures show. There does not appear to be much recovery in US demand to aid the Japanese monetary excursion. There is growth in exports (denominated in yen) but a decline in imports (denominated in dollars).

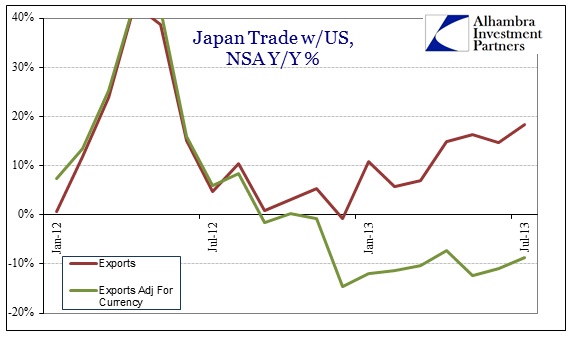

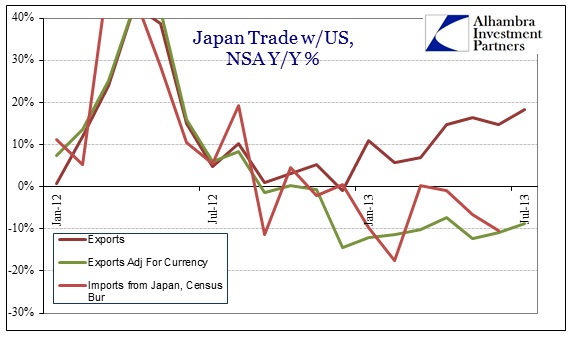

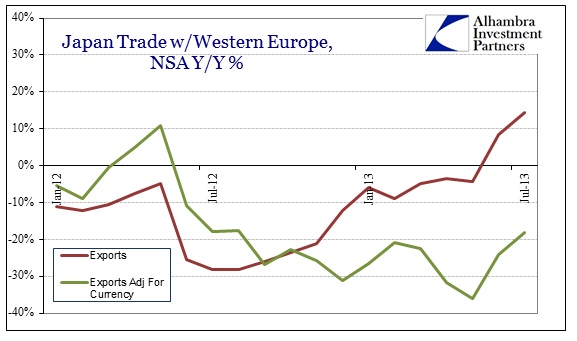

Where mainstream analysis gets it so decidedly wrong, owing to ideological closeness to orthodox economics, is in the “effects” of currency manipulation and movements. In the article cited above, the Washington Post clearly states that the Japanese are being “aided” by currency weakness, itself due to Japanese QE. But if we adjust the Japanese export figures by yen depreciation, the data no longer supports the idea that there is currency benefit. In fact, it no longer appears as if exports are growing at all.

While my currency adjustments are crude estimations of yen depreciation, they do match rather closely the figures from the Census Bureau.

The monetary illusion is laid bare; what looks like improvement doesn’t survive even minor scrutiny (which the media and economists simply take as gospel). The problem of such currency illusions is the disconnect between what is expected and what actually occurs. Policy expects these kinds of illusory results, but then further expects actual businesses to react to them as if they were real.

In other words, the Bank of Japan actually presumes Japanese businesses, from industry through to exporters, will hire more workers and invest in more capacity based on nothing more than this increase in currency flowing into Japan from trade. But why would Japanese businesses need more workers or capacity when they are “rewarded” with more nominal revenue by doing nothing? The Japanese aren’t shipping more goods to the US, they are just getting more yen back for the same (or actually less) quantity. This is not anything like real growth, but it counts all the same in the academic world of policymaking and commentary.

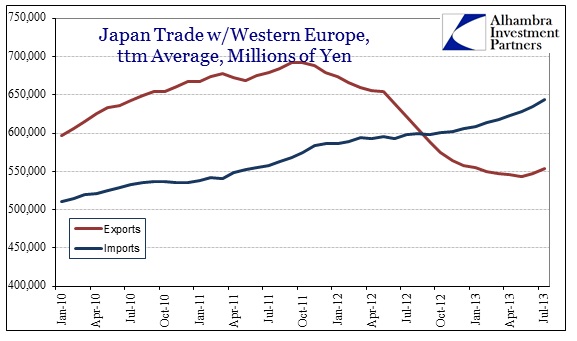

This currency illusion stretches to every market the yen touches. Exports to Europe finally flipped to the positive in June, growing even faster in July. But, again, if we adjust for currency deprecation there is no growth at all. In fact, the contraction in activity to Europe continues largely uninterrupted.

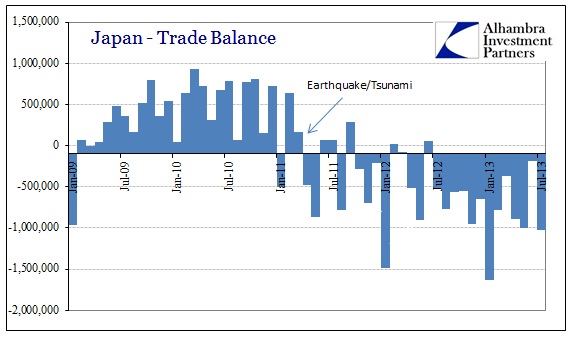

In the real world, this is extremely problematic because where QE policy is really nothing more than a psychology experiment (true of QE in any language or geography) aided by mainstream ignorance, the downside is very real. While there are more dollars flowing to Japan to pay for fewer goods, these dollars cannot stay within Japan to create the monetary effect policymakers assume. Instead, because the Japanese economy has been turned inside out, any increase in dollar inflows are turned back overseas just to pay for the now-more expensive imports.

Where a trade surplus existed with Europe going back decades, for example, as Europe fell into depression in 2011 it suddenly reversed. So exports fell off a cliff but imports into Japan continued to rise. The monetary illusion of export growth rising in June and July 2013 is nothing compared to the scale of this adjustment, even if it were something more tangible than just currency-driven. Currency translations cannot change this trade dynamic since weak demand from Europe has little to do with the availability of Japanese goods (or how cheap they are in comparison with alternatives).

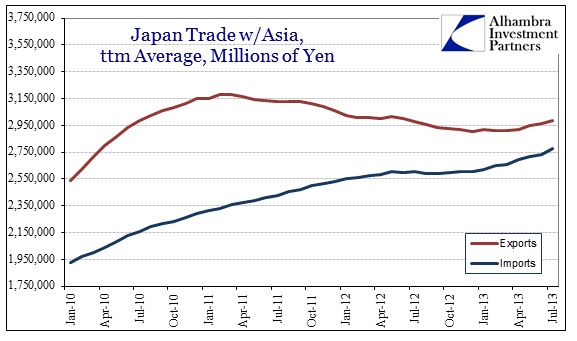

Where Japan’s biggest problems exist, however, is trade with other Asian nations. The Japanese still hold a trade surplus with Asia, but it has considerably dwindled as Japanese businesses continually re-locate capacity overseas. So much so that Japanese imports from Asian nations, production that was once accomplished domestically, has surged in proportion these past few years. As more production is moved offshore, exports to those other Asian nations necessarily falls.

It is here that QE is actually most poisonous. Given the lack of certainty surrounding power availability in Japan, the push of QE on the currency translation only adds to the pressure to move out of Japan where possible. Monetary policy cannot cure or reverse this trend without a total yen collapse. Like the US, Japan cannot compete directly with low-wage countries (instead, both should adapt through real innovation, rather than continuous appeals to financial innovation). QE’s nasty effect on import prices only squeezes domestic profits further, forcing businesses to increase cost controls and the appeal of those low-wage Asian jurisdictions.

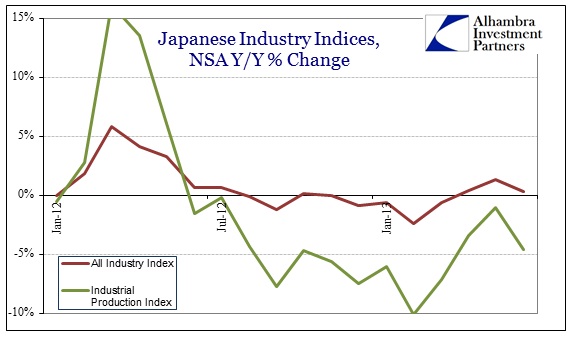

At the very least, these adjustments to nominal/headline data are not difficult to make, nor are they all that challenging to understand. That is why it is of little surprise to see industrial production in Japan look nothing like the currency-driven gains in exports. Since all this runs counter to orthodoxy, however, it is just ignored in the fiction of how well QE works. That is another factor that is uniform across all variations and languages speaking and practicing it.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch