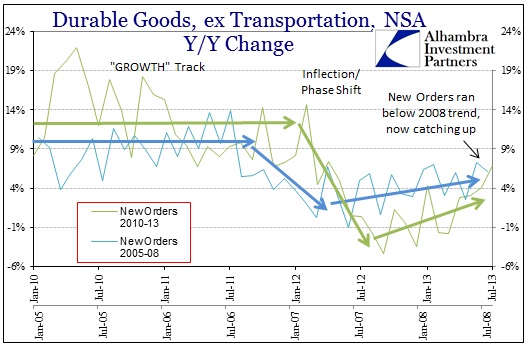

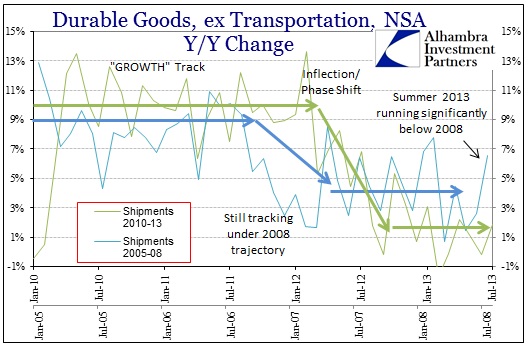

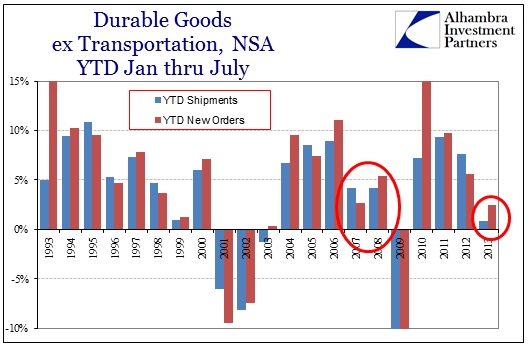

Not really much different to report from the Durable Goods numbers. There is a curious near-stasis present in the trends and patterns in each of these data series. For some reason, they want to follow and match the Great Recession as if there existed an economic template or programmed auto-pilot – which would really confound policymakers since this is decidedly not the program they chose.

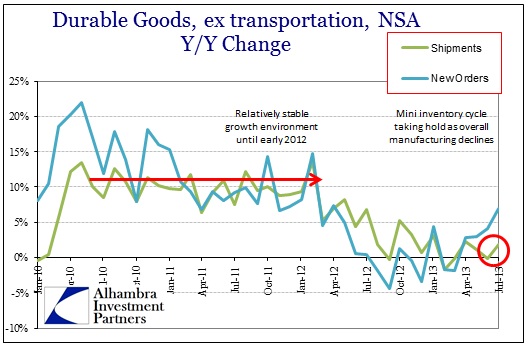

As usual, the raw numbers appear unremarkable; ex transportation shipments +1.84% Y/Y, new orders +6.95%. The bounce in new orders is a nice contrast from earlier in the year, but perspective cautions against reading too much into them.

As is an apparently durable theme now, the track is extremely similar to the first half of the Great Recession.

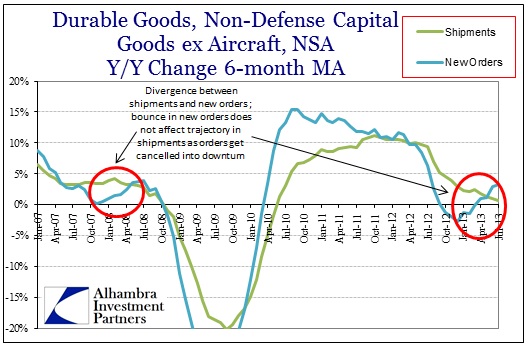

While new orders follows that pattern more closely, shipments of durable goods are considerably worse than the comparable period.

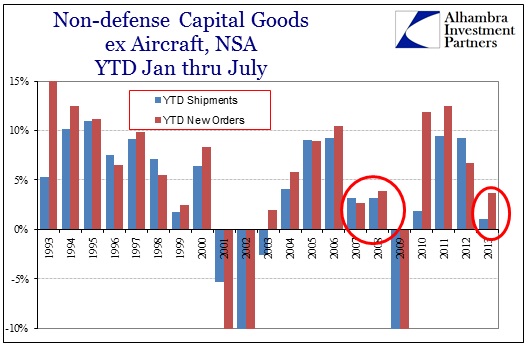

The cumulative impact of this extended weakness for both durable goods ex trans and capital goods ex air is obvious:

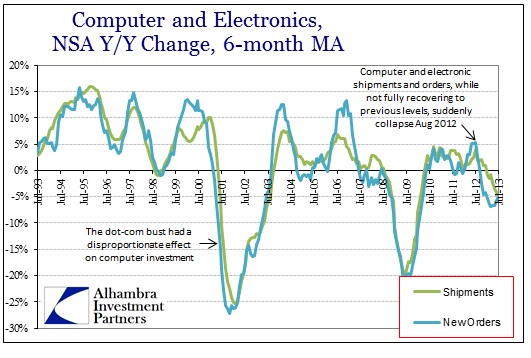

The only sector, outside the continuation of relatively stable growth in the auto sector, that seems to be performing outside the 2007-08 pattern is computers and electronics. This is important because this segment contains the intersection of business investment and consumer spending.

We know that the PC industry is in desperate trouble due to tablet incursion, but that does not fully explain these recent measurements. Included in this segment are industries such as semiconductors which are present in mobile devices. Considering these results include not only business purchases of computer equipment, but also consumer purchases of HDTV’s and Xboxes, there cannot be one single easy explanation outside of a deteriorating macro environment impervious to credit enticement and monetary diversions (where autos are the opposite, fully enthralled by cheap and persistent credit).

In any case, if this is the best we can get, including corporate earnings and revenues, of almost six uninterrupted years of “emergency” monetary measures that scale larger with time, than trouble is far greater than it appears in the month-to-month vacuum of statistical volatility.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch