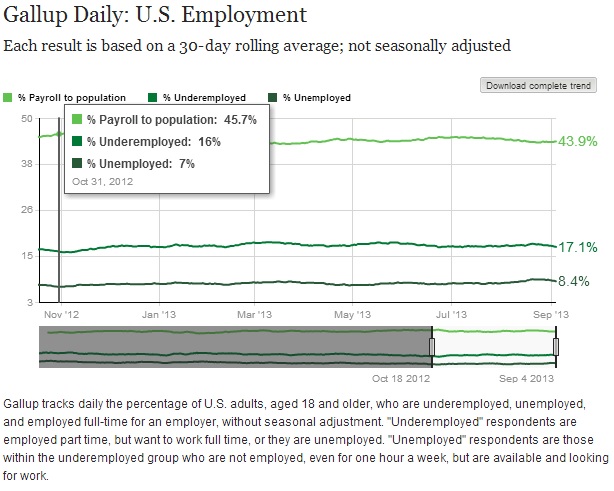

The Gallup Daily US Employment poll has seen a sharp rise in respondents indicating employment difficulties in the past month or so. The unemployment rate jumped as high as 8.9% on August 20, before settling back down. But it still remains well-above not just the BLS estimations, but levels from earlier in the year and in 2012.

The Gallup data is not seasonally adjusted, but there is no seasonality in this year’s results. Since October 2012, according to Gallup, all three indications of employment market conditions have worsened by a significant amount: unemployment from 7% to 8.4%, underemployment from 16% to 17.1% and the payroll ratio from 45.7% down to 43.9%. This is inconsistent with the Establishment Survey, but very much consistent with every other alternate labor market measure.

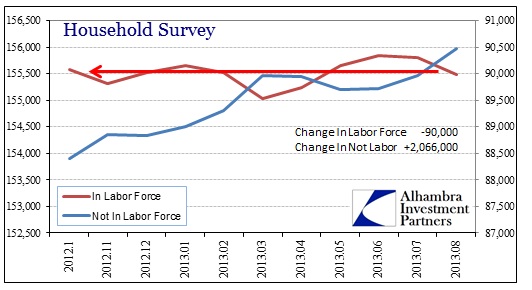

The drop in the official labor force, which was another large 300k in the just-released Employment Situation Report, is a well-covered topic at this point. But it bears repeating that there is an inconsistency with what we are seeing with those outside the official numbers and economic growth.

The population continues to outpace labor growth no matter how you measure unemployment. That may mean, and there is quite a bit of evidence here, that former workers are obtaining other means of income, particularly disability and social security, but in terms of economic health these sources are nothing like earned income. A person laid off in the Great Recession is not going to behave, in terms of spending and economic activity, as if they were still employed, even if they have obtained a transfer payment as a substitute (Milton Friedman’s permanent income hypothesis holds true for changing income sources).

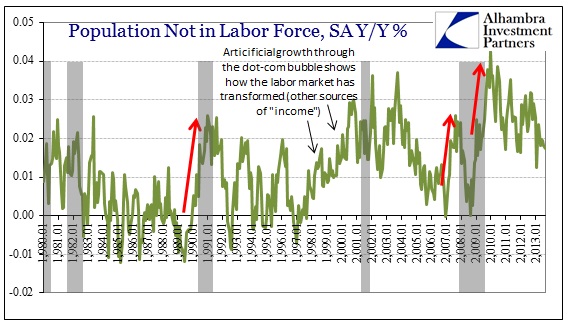

In 1994, the BLS changed its definition of the official labor force to remove longer-term “discouraged” workers. Any person wanting a job but unable to find one after 52-weeks is no longer counted in any official statistic (except “not in labor force”). Even if that former worker actively searches for one, it matters not to the BLS since one-year of idleness is enough to remove you entirely from the prominent statistics. While there are logical reasons for limiting the definition of “discouraged” at one year (and I don’t want to argue that here), considering what we know of the Great Recession that limit seems far more arbitrary than before.

Not the least of which pertains to unemployment insurance (UI). Nearly every economic study on the nature of UI concludes that a very large proportion of persons taking UI will cease looking for work until the end of the term. Since the federal government expanded “emergency” UI in 2008 and 2009 to potentially 99 weeks, the government essentially guaranteed an increase in the “discouraged” workers by the textbook definition.

That explains a great deal of the sustained increase in the population outside the official labor force. Growth in those “not in the labor force” remained elevated until the middle of 2012 (and is still growing, but at a slower rate). Now that those on “emergency” unemployment have fully exhausted eligibility for UI transfers (losing income), they suddenly began looking at the job market and finding it lacking. Their inability to gain employment, which should impact how one views and analyzes total economic viability, shows up exactly nowhere.

At least that is the case if one focuses solely on narrowly construed measures of employment. Looking at other economic accounts, especially income, it is readily apparent.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch