The sudden upturn in GOFO led me to believe that there were changes in the gold dynamics from the relatively favorable period through mid-August. Given the repo action around the UST auctions this week and last, there can be little doubt the collateral shortage has been renewed.

Starting August 27, several tenors of UST bonds went special in repo markets, with the 5-year as deep as -0.30%. The 10-year benchmark was special at -0.01%.

Since then, the 5-year and 7-year traded in and out of special, but had largely been back at “normal” levels by the beginning of this week. The 10-year, the issue with the greatest shortage problems, traded further special all this week. On Monday, the 10-year repo rate was -0.30%, continuing to trade special through the new issuance after Wednesday’s auction. At the close of trading today, the 10-year repo rate on the new issue was -0.04%, down from -0.16% on Thursday. The newly off-the-run 7-year, however, has gone back special trading at -0.35%.

The bottom line here is that there is again stress in the repo markets where it really should not exist. Even accounting for an increase in short positions (that compete with repo demand for specific issues) due to taper expectations, this continual special trading in repo is significant in signaling untamed collateral problems.

We know how this works in terms of gold as collateral, having seen it now three times in the past seven months or so.

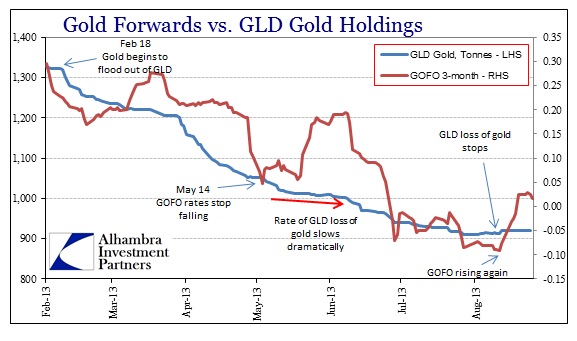

An increase in gold as collateral pushes gold forward rates upward, unleashing a tide of selling that depresses gold prices. It goes like clockwork. The effects on GLD gold movements also fit and confirm these trends.

Correlating all these movements and integrating them with other interbank liquidity indications pretty much confirms the collateral thesis. As far as the persistence of the collateral problem, it certainly relates to QE on the supply side. However, even since QE was adjusted to limit the impact in the on-the-run treasury space, there has not been a durable solution. My thoughts here relate to the wider dollar availability concern in eurodollar markets; the demand side.

Dollar tightening has been occurring since earlier in August, so a tightening in repo (increased demand for collateral) shouldn’t be all that surprising. Even if eurodollar funding markets have improved in the last week or so, that wouldn’t necessarily negate the problem in secured lending markets. Once unleashed, collateral demand can be independent of wider dollar conditions, diverging from other dollar indications (the action in February-March was uncorrelated with eurodollar funding, though I think the two are very much related as eurodollar positioning was ignoring building pressures in collateral markets until taper was unleashed in May, and then it exploded).

With repo markets again in overly special positions, gold prices are likely to be under pressure until something dislodges more treasury collateral to satisfy demand. Or, alternately, the FOMC meeting next week alters the funding dynamic enough to remove the marginal trend toward secured arrangements (taper off).

As long as these collateral issues remain, and I have little doubt this is figuring into the taper debate behind closed doors and off-the-record, gold prices are going to be susceptible to collateral pressures. This says nothing about the fundamental price of gold and everything about just how messed up QE has made the funding markets. In that respect, “tail risk” insurance is relatively favorable.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch