I suppose there is more than one way to interpret K-Mart’s decision to air the first Christmas ad 105 days before the actual holiday, but to most sane people it was a sign of creeping pessimism. Retailers have already been behind in their sales expectations for much of the first half of the year, despite relatively uniform optimism at the end of last year after QE3&4. This current back-to-school season, while not fully digested yet, has largely been “disappointing”, so the dreaded lack of momentum has appeared to be an industry-wide factor.

CNBC, not exactly a fountain of contrarian views, admitted as much in their take on the K-Mart decision,

“Summer was a bummer for store sales, and so far signs are back-to-school spending is sluggish, too. All that makes the holiday season even more important for nervous retailers. So while Christmas in September may be off-putting to many consumers, some companies are willing to take the risk to grab early holiday dollars.”

I put very little stock into consumer confidence numbers, but retailers use them like the Farmer’s Almanac. The lack of upward momentum during the summer/back-to-school in the Conference Board measure of consumer confidence cannot be well-received in the retailing industry. The large September drop in the UofM sentiment survey is causing far worse.

As it stands now, expectations are already for a slightly weaker hiring environment. Target announced a 20% reduction in temp hiring expectations, following through on its weakening mid-year projections. Wal-Mart, on the other hand, is going all in on market share and increasing (slightly) hiring expectations for the holiday season. This despite a rather concerning 7% increase in inventory after back-to-school spending did not match expectations.

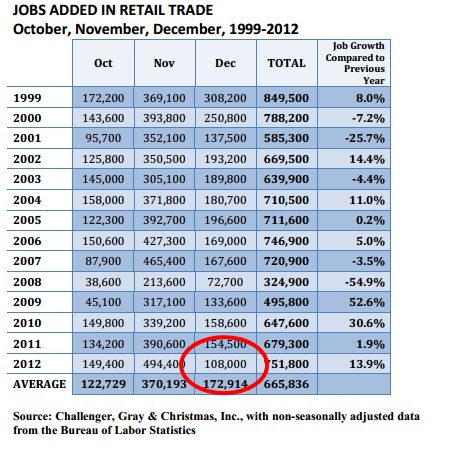

Overall, retail information firm Challenger is expecting a slightly softer hiring pace in 2013 compared to 2012. The release took pains to point out that temp hiring in 2012 was the best since 2000, which was promptly echoed like a talking point in every mainstream news article, lowering the bar and implying that a 2013 hiring season that is even close to 2012 is “good”.

However, 2012 was somewhat of an anomaly in the typical pattern. While it is certainly true that temp hiring was the best in 12 years, the pace from November to December was not. December temp levels were the worst (outside of 2008) in decades. Retailers, it appears, front-loaded their sales and activity into November, leaving December dry.

That has given rise this year to relatively contradictory statements from the retailers themselves.

“’We’re getting smarter in terms of anticipating how many resources we need when guests are really going to be shopping the hardest,’ said Jodee Kozlak, Target’s executive vice president of human resources.”

So last year it was “good” when hiring was high, but this year is also good when hiring is “smarter”.

That sentiment was echoed, almost exactly (talking point) by Challenger as well,

“’Along with the rise of online shopping, retailers are getting smarter about using data to predict more accurately when they need to change staffing levels in their stores’, Chief Executive Officer John Challenger said in a statement.”

As it is, ShopperTrak expects retail growth of only 2.4% for the holiday season, down from 3% last year. Since that growth in just a bit above official inflation (and, like back-to-school, is likely to be downgraded), real growth is beneath tepid. That would explain the need to be “smarter”. In relation to 2012, retailers seem to be learning that overdoing it on optimism is not a “smart” policy.

At the very least, according to another common talking point among nearly all of these press pieces, stock prices and housing are gaining (some of them also mention jobs, the old Establish Survey impact). While that hasn’t turned into actual progress, they dutifully acknowledge, apparently the retail industry expects that asset inflation will work any day now. Until it actually does, they will be smart about hiring and inventory levels.

What they really mean by mentioning asset inflation is the bifurcated economy bequeathed by Bernanke,

“’What you see is two different sets of attitude,’ Paul said. ‘For the well-heeled consumer, they are feeling good, so high prices or a 2-percent payroll tax—that doesn’t mean much for them. But for the lower-end consumer, those are two different real impacts on their budget.’”

It remains to be seen whether starting Christmas around Labor Day falls is the smart play, instead of the “desperate” hope. Despite the conspicuous lack of official inflation, it sounds an awful lot like the effects of inflation – benefiting a small segment at the expense of everyone else. I suppose, then, this represents a “smarter” stance in not expecting quantitative easing to be fully effective this time.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch