Following up on yesterday’s inflection narrative, Caterpillar seems to have fallen prey to the same blindspot as economists. Everything with regard to economics and the economy is always assumed to move in a straight-line, forever. Linearity is a feature of the predictive economic model, and it is such an obvious weakness.

In the earning’s release for the first quarter of 2012, Caterpillar CEO Doug Oberhelman said,

“We remain on track for another record-breaking year in 2012 at a time when U.S. construction activity remains depressed and economies in Europe, China and Brazil have slowed. While our outlook reflects a record year, we are highly focused on preparing for additional growth over the next few years. Although it’s tough to predict the exact timing, we expect positive economic growth moving forward. China and Brazil took steps in 2011 to slow their economies and bring inflation under control. Both countries have realized inflation levels in their targeted range and have begun to move to more accommodative economic policies that should support improved growth later this year. Improvement in those economies, better growth in Europe in the coming years and our view that the United States will continue to improve is why we are so focused on improving factory efficiency and putting additional capacity in place. We have a record order backlog today, and we need to be ready for continued growth.” [emphasis added]

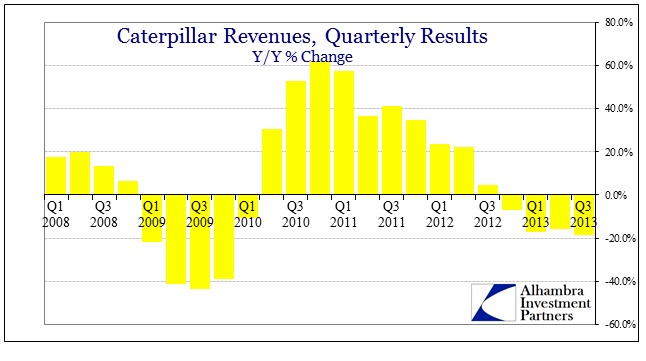

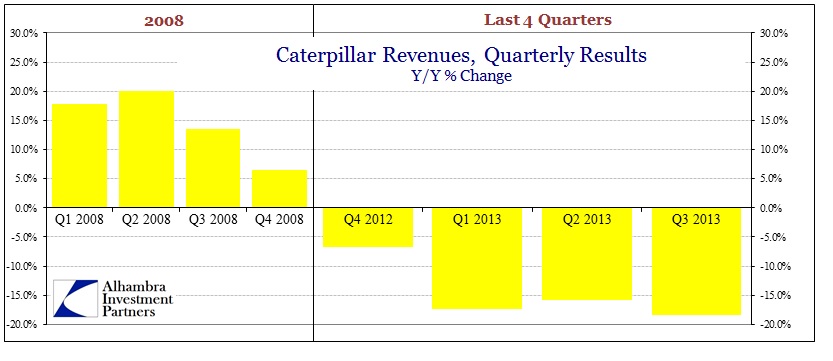

The company at that time and based on those predictions expected full year 2012 revenue of between $68 and $72 billion. From what the company was seeing, given the propensity toward linear extrapolation, those expectations were not unrealistic in the mainstream convention. Revenue growth in Q1 ’12 was up 23.4% Y/Y. In fact, that expansion continued into Q2, as revenue also surged 22% Y/Y.

But then revenue growth, like the economy, suddenly and “unexpectedly” decelerated. By Q3, revenue growth was only +4.6% Y/Y, still positive but nowhere near recent experience. By the time Q3 earnings were released in October 2012, the incoming sales channel was already contracting, but the company still remained “pragmatically” optimistic heading into 2013.

“We are taking a pragmatic view of 2013—we’re not expecting rapid growth, and we’re not predicting a global recession. At this point, we expect 2013 sales will be similar overall to 2012, but with a slightly weaker first half and a slightly better second half. While machine deliveries to end users have continued to hold up, our sales will probably remain relatively weak early in 2013 as dealers are likely to continue reducing inventories. When expected dealer inventory reductions level off, and easing actions by central banks and governments around the world begin to improve economic growth, we expect our business will begin to improve. While there’s reason for optimism, and we’re not expecting a global recession in 2013, we are prepared and stand ready to take action no matter what happens to the global economy.” [emphasis added]

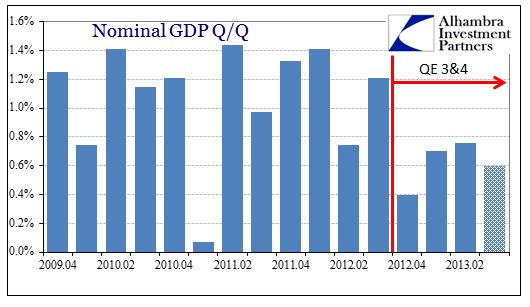

My translation of that is, “the global economy caught us by surprise but the Fed (and ECB, BoJ, etc.) will save us by the second half of next year.”

Revenue for the full year 2012 never did match those earlier expectations, falling short at $65.8 billion (still up 9.5% over 2011). For 2013, the company was expecting, based on the Fed’s second half magic, between $63 and $69 billion in revenue.

The first half of 2013 started badly as expected, but CAT did not anticipate the level of decline. Worse, the second half “Fed save” has yet to materialize. The company has now booked three consecutive quarters of 16+% declines on its top line. The forecast for full year 2013 is now down to $55 billion; far, far below expectations. They never saw this coming (just like 2008).

As a matter of historic comparison, Caterpillar’s results are far worse than even 2008, a recurring theme among economically sensitive companies. The dramatic declines in 2013 are being led by mining activity as commodity producers scale back, dramatically, their appetite for new equipment. That suggests commodity price declines are more than temporary, further cementing the idea that the weakening global environment (through the supply chain, from end users in the US and Europe, through manufacturers in China and elsewhere, to resource countries like Australia and Brazil). Australia, a rough proxy for Chinese demand, was singled out by Caterpillar as a primary source of mining equipment weakness.

But as much as commodity producers and mining activity are responsible for Caterpillar’s unfortunate circumstances, it is not the only segment showing significant declines. Nor is Asia or Latin America the only regions as such. Despite the myth of the recovery-just-around-the-corner, North American revenue was down in every segment: -9% Construction Industries; -28% Resource Industries (mining); -12% Power Systems; -19% “Other Segments.”

If Caterpillar, as IBM, tells us anything about the macro economy, it is that there was an “unexpected” and large slowdown in the middle of 2012. Once that was digested, businesses (like economists) fully expected a H2 2013 turnaround based almost exclusively on policy measures. It hasn’t appeared yet, nor are there any indications it will. Caterpillar has finally admitted reality, how long before the NBER and the rest of the economics profession? How about policymakers?

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch