I spend a lot of time on Japan not simply because it is the originator for the great QE experiment, rather the similarities between the US and Japan are well-worn and numerous. The primary interest in 2013, with the central banks of both going all out in monetary cajoling, is that those similarities are growing ever-closer.

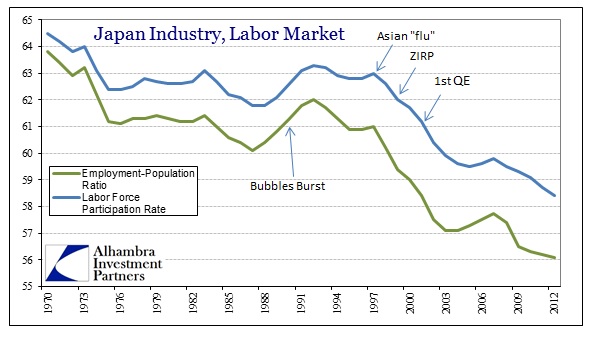

A few days ago I noted the tendency of new jobs in Japan to be disproportionately part-time rather than full-time. Again, with an absence of an Obamacare-type change to explain that similarity with the US economy, there has to be another explanation. The part-time trend is not the only labor market feature in common. By now most people are familiar with the labor participation problem in the US, but I don’t believe many know that it began in Japan a few years prior to the peak in US participation.

What had been extremely stable in the decades prior to the bubbles suddenly shifted as the response to the moribund Japanese economy became more and more monetary-driven. In 1995, the Bank of Japan was the first central bank to unleash “ultra-low” interest rates, followed shortly by ZIRP after the Asian flu crisis. Labor markets there have never recovered.

Some blame may be due to demographics, but that alone cannot explain the degree, the timing of these factors and, more importantly, why the US is experiencing much the same problems. In monetary terms, the FOMC belittles the Bank of Japan for its failures then puts in place the same policies along much the same lines only a few years hence. The BoJ goes down to and below 1% on its discount rate in 1995, fails, but Alan Greenspan follows in 2002.

Is it just coincidence that the US labor force participation rate peaked in March 2001, the last time it remained above 67%, when the FOMC began cutting the fed funds target that January? Perhaps so, since it is likely the then-burgeoning recession was fully responsible for the initial drop in the rate, but the ultra-low rates that resulted (and the bubble-burst-bubble cycle) seem to bear more than some correlation with the fact that the participation rate has never come close to returning.

From these two cases we can surmise that “stimulative” monetary policies beyond some threshold carry with it a distinct change in the economic nature of the system. I have chronicled these on numerous occasions, so it only bears quick mention: chiefly an over-management of costs and a tendency to “invest” financially rather than productively.

For Japan, the economic problems due to the former have been at the forefront of its malaise. Once a great export power, the country has been slowly transforming into an outsourcing nation. For Abenomics and the latest iteration of policies that have yet to succeed after almost two full decades, outsourcing is the primary enemy of the monetary “brilliance.”

Yet, for the obvious flaws here, conventional commentary fails to appreciate the magnitude and permanence of these distortions. When the September industrial production figures were released this week, they were mostly proclaimed as “proof” Abenomics was working as advertised. But, much like export “success”, the sentiment is just as soon disproved by little effort as nothing other than nominal changes.

An atypical case, however, is this article written for the Associated Press and distributed via Yahoo!News.

“Japan’s industrial output rose 1.5 percent in September from the previous month, as stronger production of vehicles and electronic components added to signs the recovery in the world’s third-largest economy is gaining traction.” [emphasis added]

The narrative in the first paragraph is pretty standard fare for these types of articles. However, this particular piece actually contradicts that first paragraph in the final three, bowing to reality instead of platitudes and uncritical headline regurgitation.

“So far, there is scant sign that Japanese companies are making significant commitments of new investment at home, despite the extremely low cost of capital given the central bank’s commitment to keeping interest rates near zero.

“But while business sentiment has markedly improved, excess capacity has kept most from spending more on plants and equipment in Japan. Instead, most are opting to shift factories overseas or to step up acquisitions of foreign companies.

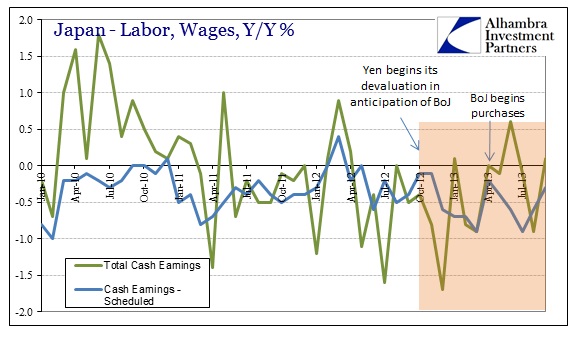

“Wage increases have likewise been scant, raising the prospect that Japanese consumers will face higher prices without a commensurate increase in their purchasing power.”

Each paragraph lists an instance where the recovery is most assuredly not gaining traction. Perhaps a new definition of the word “recovery” itself is in order because it doesn’t seem to be understood as it once was. After decades of monetary distortions and interventions, it seems most casual observers are accepting the idea of a recovery in nominal terms alone. These three economic factors (productive business investment, done domestically not overseas, and rising wages) in contrast are what a recovery actually is. A recovery is not some number turning positive in some economic account, it is more work for more people leading to more actual business.

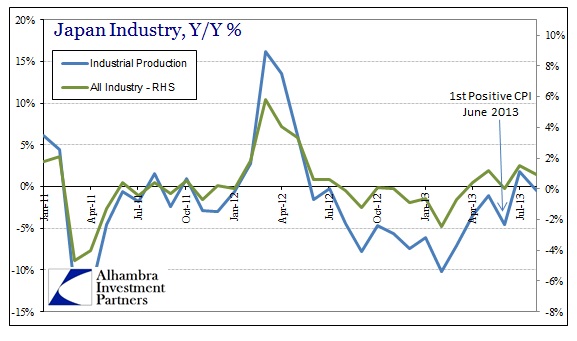

It may be true that industrial production rose 1.5% in September from August, but that’s not the same results we get without seasonal adjustments. Year-over-year, September industrial production was 0.5% less than September 2012, a decline from positive Y-Y growth in August.

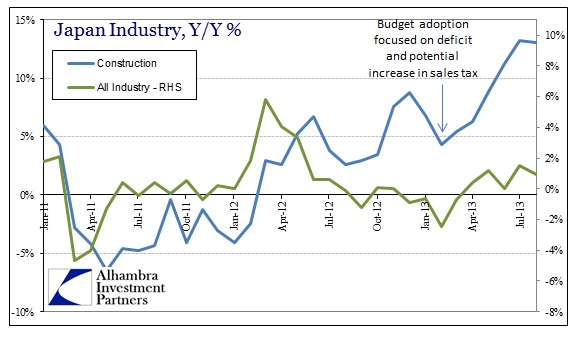

Regardless of the statistical discrepancies, the overall trend in industrial production and the Japanese “all industry” index is being driven by a now-positive CPI and a construction bubble ahead of the sales tax scheduled for next year (the sales tax does not exempt large purchases).

So the “traction” in the Japanese recovery is currency debasement heaped upon a bubble with a pre-existing time limit. And it still does not amount to very much.

On the other side, as the AP article actually included, Japanese wages continue to decline, even if factoring in all those expected bonus payments.

Other than a temporary surge in early 2012, wages, including bonuses, have not much changed since the semblance of a real recovery in 2010.

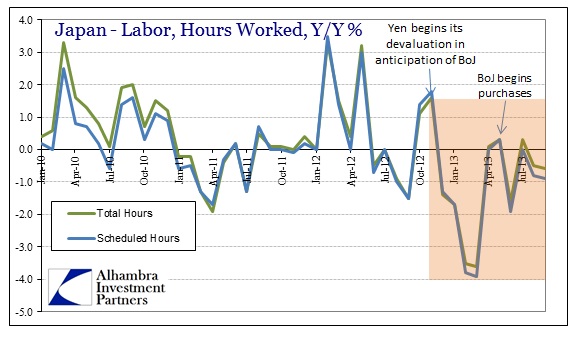

If that were not enough confirmation, the update for September showed total hours worked continues to decline as Japanese businesses opt, at the margins, to use more part-time workers or transition production overseas (leaving behind only retail and sales work).

Again, the importance of commentary and analysis of Japan is more than rubber-necking at a train wreck in progress, it is understanding the warnings such disaster provide to those on the same track. American economists and officials are wholly confused by the current state of affairs, particularly the obvious failure of the most recent QE’s, but there is no true difference in the US approach that would suggest different results.

Repressing capital and savings will always and everywhere lead to corporate and consumer distortions that corrupt true economic function to the point of perpetual dislocation. These “headwinds” are far from mysterious, particularly if the Associated Press is now catching on. It is only one article but it may point to the declining credibility and esteem which QE’s and central banks were once held. Then again, maybe not.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch