With so much talk about bubbles resurfacing lately, it’s worth an attempt to try to draw out exactly what a stock bubble looks like. There is little dispute about the bubble nature of the dot-com era, but the market has drastically changed in its appearance and structure beyond just Greenspan’s exuberant creation. In this instance it is more than just valuations, which we have explored in the past.

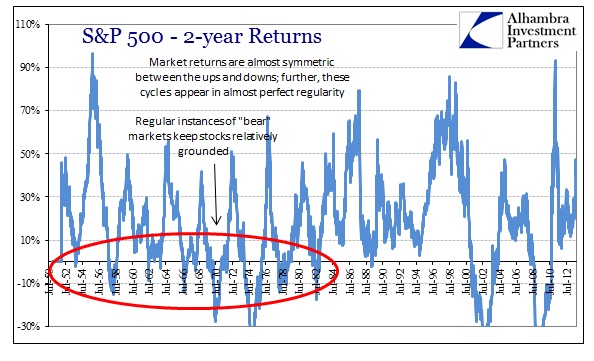

Plotting rolling 2-year returns on the S&P 500 (2 years being sufficient time to get past the short-term volatility that does not help describe “bubbles’) something becomes very, very clear during and after the 1980’s.

Market cycles before the 1980’s were exactly that, cycles. There was a symmetry and regularity that is obvious. A market with that kind of behavior is certainly one that will not move too far in either direction. Since it encompasses both a secular bull and secular bear, this is more than just price behavior and speaks to the very market structure itself.

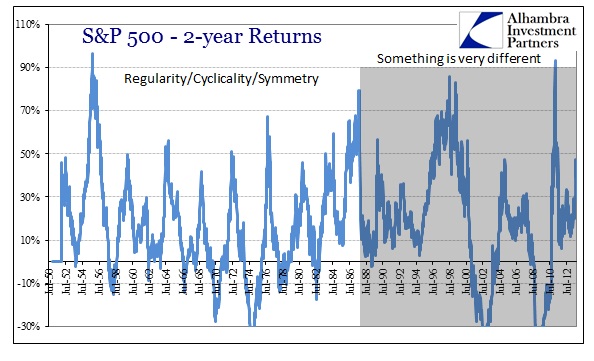

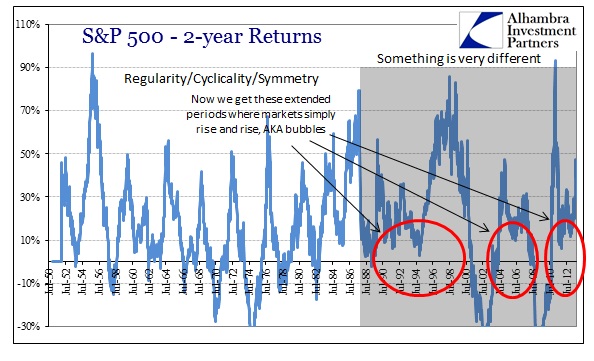

Again, between the beginning of the bull market in 1982 and the Crash of ’87, the regularity and symmetry first shifted, then changed altogether.

Those regular interludes between upward price movements were conspicuously absent. What that meant was uninterrupted market upswings, i.e., bubbles. However, these extended periods without downturns simply increased the violence of the inevitable – markets cannot move upward forever.

Thus, we can begin to see how asset bubbles are different in structure than markets that were never classified as such.

There was only one major structural change that ran parallel to the transition from symmetry to bubble: the Fed moved to interest rate targeting. The monetary regime change meant removing monetary scarcity completely from the financial system. Interest rate targeting is an implicit promise to satisfy any and all demand for “reserves” at whatever target interest rate is set by the FOMC. It doesn’t take a huge intuitive leap to see how that might impact a broad array of financial characteristics, including channels (both financial and psychological) into stocks.

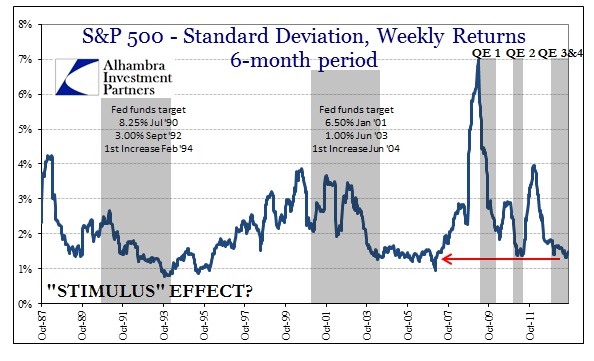

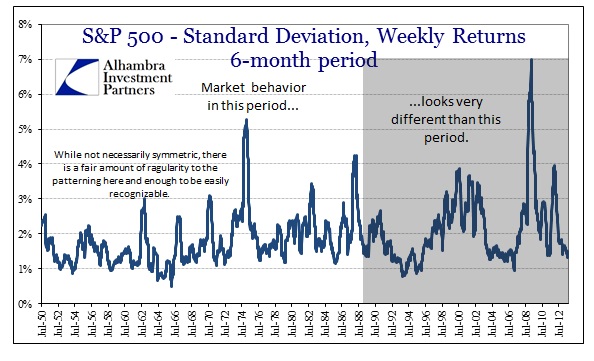

We can get a sense of that in the large applications of monetary “stimulus” during the Greenspan/Bernanke era. Viewing market volatility (which I’ve used before), it appears as if using interest rate targeting in exaggerated doses has an immediate and direct impact on stock price behavior.

Overall, the change in volatility mirrors almost exactly what we see from the picture provided by the 2-year returns.

Again, the only change that would account for this is the transition to interest rate targeting. While mainstream economics denies any possible link, it may have actually predicted such behavioral and price changes had it not turned away from its far more humble roots.

That raises the question as to exactly what markets are indicating via prices. Stocks are supposed to be discount mechanisms of future events. But what were stock prices indicating in December 1999? They were certainly not discounting the future, even the near future. And what about October 2007? Record prices there were not at all representative of the fundamentals, as the financial system was already imploding by then and a recession was only weeks away.

Instead, it is entirely possible that this character change in the market is indicative of a systemic shift in market price relevance. In other words, stock prices, in general, may be telling us more about market liquidity then fundamental conditions – how policy has become the dominant variable in an economic system that is now more financial than anything else. If that is correct in the current market and its interpretation, then prices only reflect policy. As we have seen, that is a dangerous proposition as upswings are only elongated, not set in permanence.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch