A few months back when WalMart cryptically referenced its discomfort with inventory levels, the implications were that the retailing giant had been too optimistic heading into the back-to-school season. Since that secondary calendar event is followed closely by the all-important Christmas season, too much inventory is a very unwelcome circumstance. Excesses of this kind lead to excesses in discounting, leading to disruptions in sales and profits. Economically speaking, excess inventory is the precursor to disinflation, or “deflation.”

Despite continued mainstream narratives spinning a forward recovery, everything but the Establishment Survey of employment is contradicting that idea. It’s not just the US, either, as Japan and Europe are wrestling with precisely the same negative economic factors (and are now hinting at precisely the same wrong-headed monetary “solutions”). To back up these empirical interpretations, one need only look at the bevy of scary comparisons coming from companies.

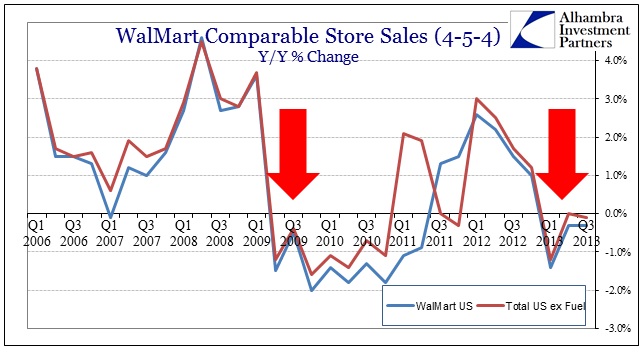

Getting back to WalMart, the just-released earnings and sales report for its fiscal third quarter ended October 25, 2013, continues to show an economy more consistent with recession than recovery. Comparable store sales look far too much like 2009 (they are so far below 2008) for the recovery idea to hold validity. You might dismiss Cisco as a minor piece of the economic picture, but WalMart is the largest retailer in the US and the world.

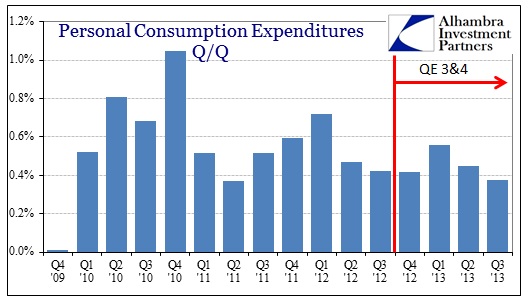

What Cisco and IBM show are business proclivities toward productive investment, and it is suffering badly (particularly in contrast to corporate tendencies favoring financial investment). WalMart is a proxy of end user demand, and like Cisco with business investment, WalMart’s latest results fit with economic accounting estimates of consumer demand (lack of).

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch