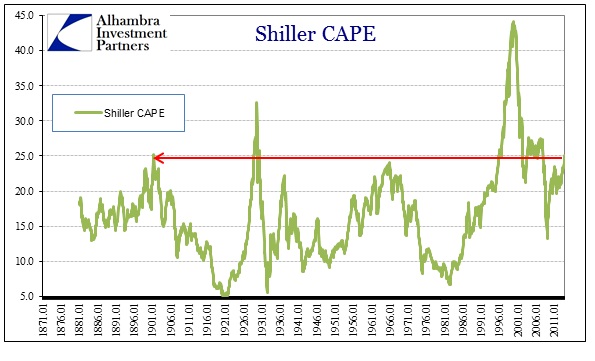

Given recent and growing consternation about stock prices and financial assets, it has been heartening to some that so many people are now talking about bubbles. The logic here is that if everyone “knows” there is a bubble there simply cannot be one. Even Robert Shiller, newly minted Nobel Laureate, was pulled into the discussion. With the recent creep upward in his own CAPE measure, his caution over using the valuation metric for short-term analysis was soothing to the stock believers (bubble deniers?).

However, what he really said, and what really applies for investors with a time horizon beyond next month, was that his valuation tool only suggests relative returns going forward. In other words, when valuations are high you should expect little in terms of returns for a good piece of time into the future. It describes nothing about the manner or conditions upon which those returns are derived.

But even that is not enough context to render any kind judgment about bubbles or anything. The current CAPE of 25.09 is both higher than peak valuations in 1965 and below the housing bubble peak of 2006. One sounds extreme, the other less assuredly so.

When stock prices rocketed to the wholly ridiculous levels in 1999 and 2000, again Shiller’s interpretation held. Stocks did not “crash” from that point, rather taking a tortuous three year “orderly” decline, but owning and holding stocks over the subsequent thirteen years got you exactly nowhere – those extreme valuations were very much indicative of what to expect.

The problem arises not because people are aware of bubble possibilities, but because people recognize potential bubbles and then rationalize their existence as untroubling or actually favorable. It’s not quite the Greater Fool, but something closer to the human instinct for wanting to believe in “too good to be true.”

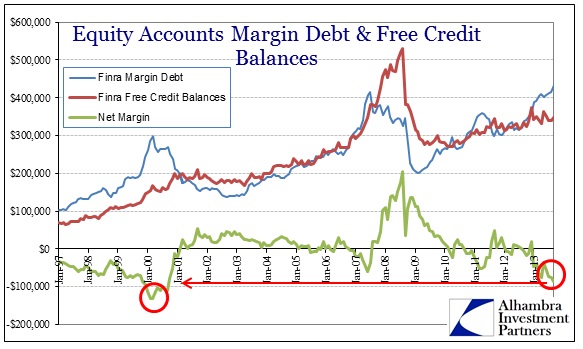

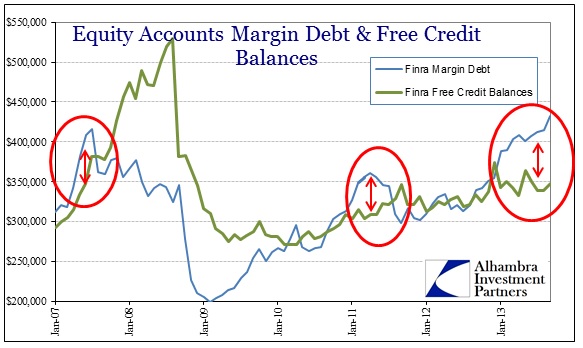

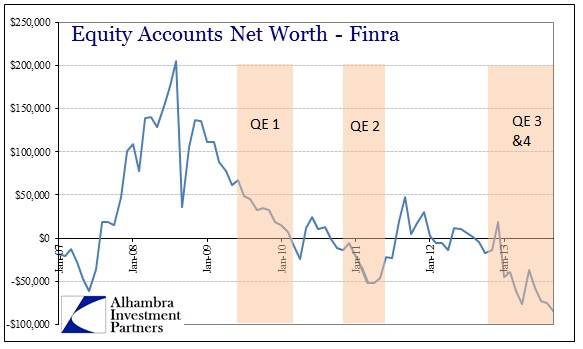

In 2013, US stock investors have set aside any lingering doubts born from the 2008 panic scars and fully embraced risk again. Margin debt is at an all-time high, having shot up through the summer at the same time as devastating bond market turmoil. Stock investors could care less, as even net worth valuations have sunk to dot-com levels. Investors are as overextended now as when the CAPE was above 35.

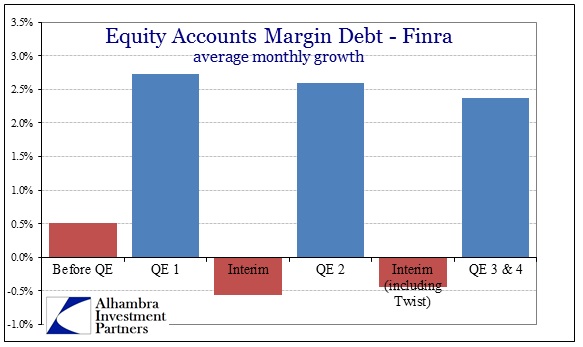

Perhaps the most important factor in answering all these questions is monetary policy. There are several layers of correlations here that may not, in the end, be proof of causation, but they are very persuasive. Margin use simply rises with QE, as do stock prices.

And this extends beyond margin debt, as investor participation in the equity rally has again moved to extremes. According to Vanguard, there has only been two other occasions where stock investors were as “long” as now.

“Equity allocations were higher only twice in the past 20 years, Kinniry said: in the late 1990s leading up to the technology stock crash of 2000, and prior to the 2007-2009 global financial crisis. He based his calculations on the total amounts of money in mutual funds and exchange-traded funds across asset classes at U.S. firms.”

For some, this is all evidence of successful policy. The Fed engineered exactly what they wanted, and markets are responding (even if the economy doesn’t). Given that, it still requires an extra layer of rationalization to set aside lingering doubts – the Fed has been successful like this before, in fact, twice in recent memory. I guess it is always possible that this time is different, and that a “permanent plateau of prosperity” has been reached, a “new economy” of monetary precision and robustness.

Whether or not there is an increase in bubble chatter matters little. Talk is cheap in sports and in investing: they can inquire and search for bubbles all they want, but if they keep their portfolios as complacent as they are now, the bubble remains. In other words, there is so much talk about bubbles not because investor awareness is a magical cure, defusing its nefarious potential, but because they realize that there is an imbalance and that they are at risk of Shiller’s warning coming true. Again. For the third time this young century.

In times like these nobody wants to get left behind as the herd captures “easy money.” Reckoning is for the overly cautious to worry about. Nobody wants to listen to Bernard Baruch’s timeless lesson, “I made my money by selling too soon.” But they are aware and rational enough to know that they at least need rationalizations, silly as they are, to keep going.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch