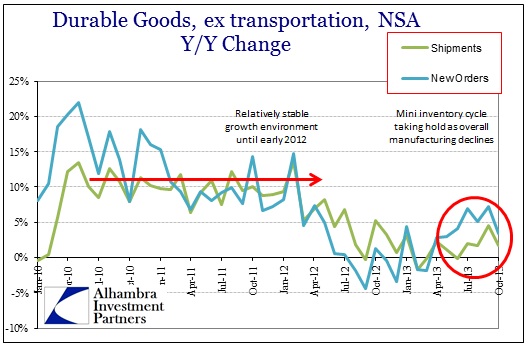

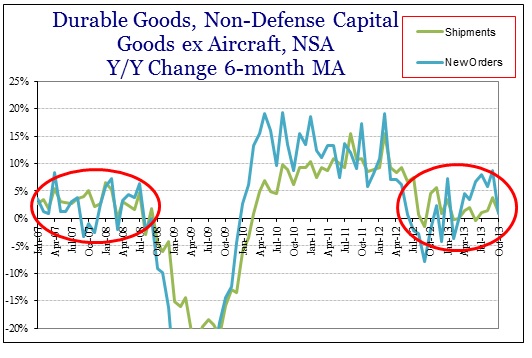

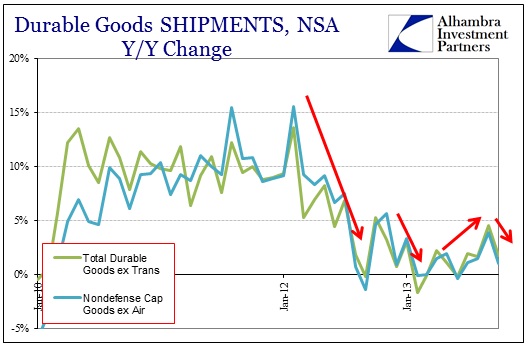

The latest estimates of durable goods manufacturing was a blow to the idea that economic momentum had been gathering over the summer. Orders had rebounded almost to what you would expect in a more stable growth environment, but the level of shipments never quite caught up to them. Shipments (ex transportation) were up only 1.71% in October 2013 over October 2012, while new orders in that segment were only up 3.4%. In capital goods (ex aircraft), shipments were nearly flat Y/Y, but so were orders (both just less than 1%).

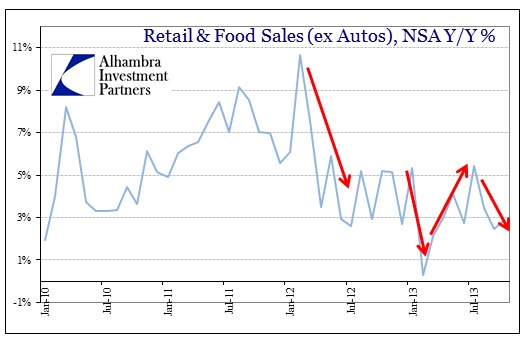

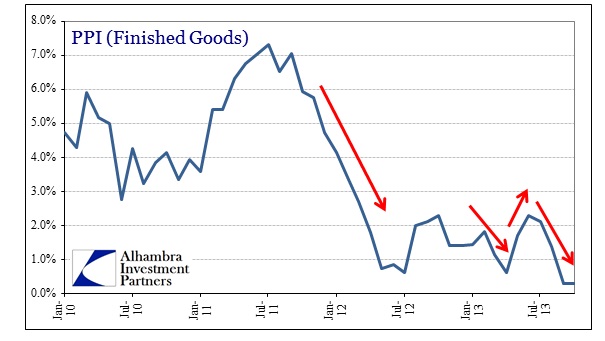

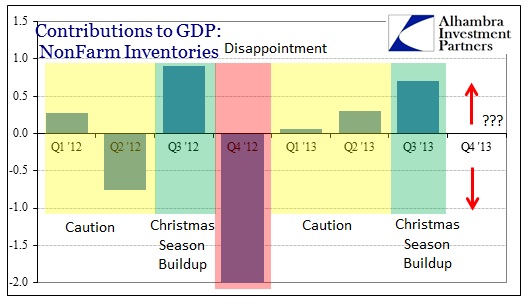

Unfortunately, we have seen this pattern before and it isn’t a reason for optimism. This latest data simply confirms the inventory-driven pattern that is being replicated throughout the wider economy. It seems clearer as time progresses that the urge to build such inventory was unwisely related to sanguinity that QE would actually work this time. The early months of 2013 were littered with mainstream commentary that this would finally be the year (with or without an op-ed from Tim Geithner).

With the inventory cycle, even in the 21st century, stretched out more than a few months, that would mean overzealous activity coming out of last year’s inventory-led debacle, peaking right into the third quarter. And so it repeats:

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch