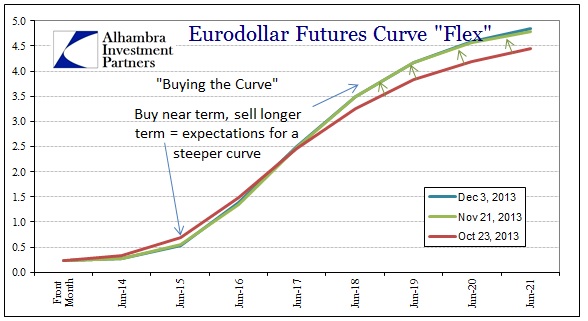

A basic building block of funding market dynamics is not only expected rate movements but the time value of money, i.e., the curve shape. Normally, you would expect a steeper yield curve to be consistent with stronger economic growth. In terms of dollar funding, you can package eurodollar trades (either bundles or packs of various “colors”) to buy short and sell long in that case. By purchasing futures in the short end and selling at the longer end, you create a trade to take advantage of expected “steepness.”

That is exactly what we have seen in eurodollars in the past few weeks, akin to a certain kind of “tightening.” In fact, it is conspicuous and obvious.

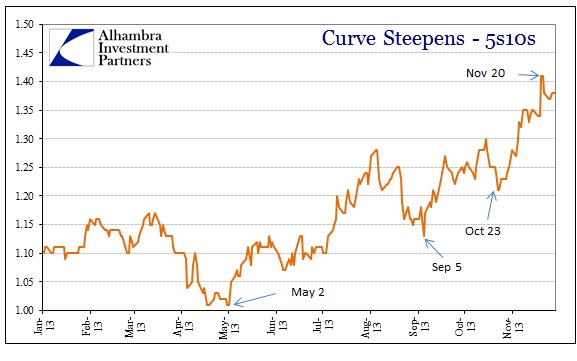

And, as institutions were putting on these steepener trades, the yield curve has responded.

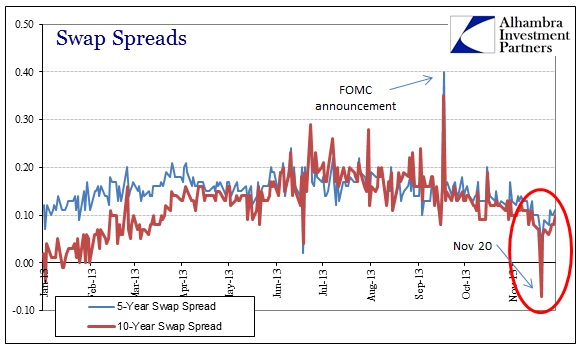

However, the rapid steepening of the curve particularly entering the middle of November seems to have created some anomalies along the way. Swap spreads, for example, collapsed right around the end of that last violent steepening trend, turning negative in the 10-year – if only for one single day.

That seems to suggest dealer books that were not adjusted for the more intense move in the curve steepening despite futures markets essentially warning as much. It’s even more curious that the swap spreads collapsed rather than rose (which would be more consistent with expectations for a flatter curve). However, it is exactly opposite the rapid ascent in spreads concurrent with the FOMC September announcement, thereby signaling a somewhat counterintuitive shift in positioning.

Whether or not that had to do with contradicting analysis with regard to the Yellen circus is not clear, but it seems to add some evidence to the idea that markets are not functioning in a manner fully consistent with past experience. That would be the logical outcome of extended periods of extreme policy disruptions from five years of ZIRP and QE.

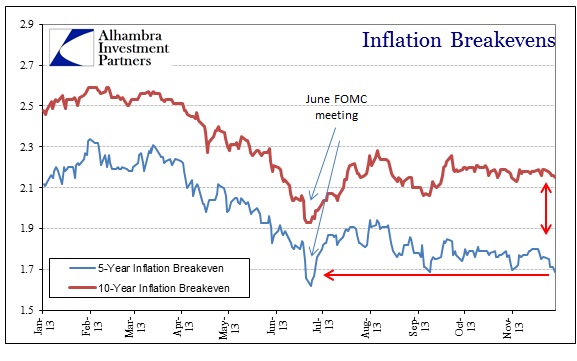

To further that point, inflation breakevens are falling despite the curve steepening. That would seem to contradict the idea that expectations for strengthening economic growth prospects is leading the curve steeper. That might also suggest part of the problem with swap market identification of rate expectations since these points added together proposes policy disruptions (or anticipation of such) as explanations for this incongruent and atypical behavior.

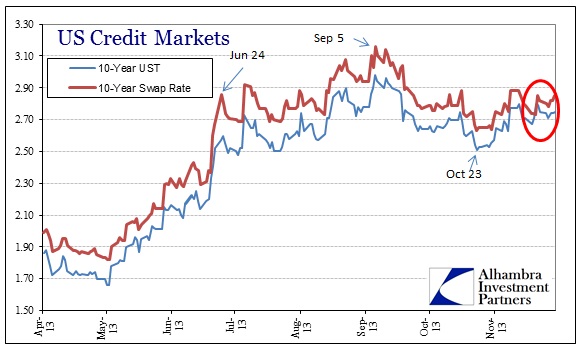

Other markets have seen more muted action, though, again, behavior is not necessarily being directed toward market rates but rather spreads.

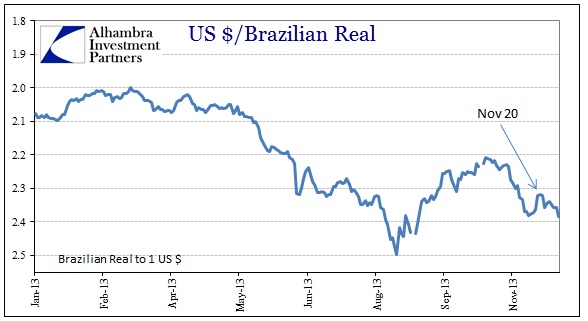

The trend begun on October 23 is still quite intact, though there are noticeable disruptions around the middle of November in other markets. That includes the international flavor to the dollar funding conditions.

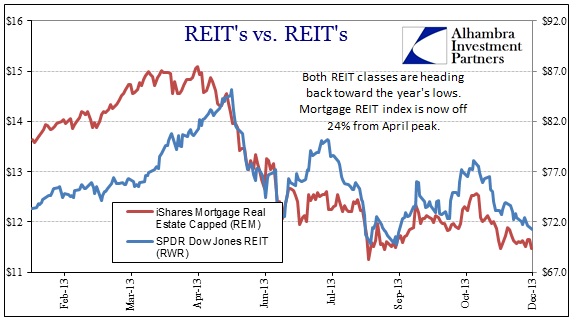

In terms of perceived funding, mortgage REIT’s, a pretty good indicator of liquidity in short-term and repo markets, have continued to selloff hard since October 23. They have been joined this time by equity REIT’s which are much more sensitive to interest rate expectations.

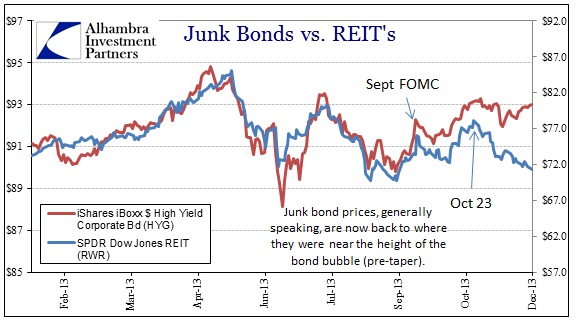

Interestingly, however, junk bonds have, in general, diverged with REIT prices since the September FOMC. This spread has only widened in the past few weeks, perhaps pointing to exactly the kind of deviating analysis with regard to policy expectations shown above.

From all of these various indications, we can surmise that dollar markets are still wary of policy taper and are acting as such. However, that is manifesting in different sets of related circumstances than the more direct selloff from May/June. While that seems to be very much related to uncertainty about not just a Yellen Fed but a possible December policy adjustment, there is also an economic component that is consistent with expectations for economic trepidation rather than resolution.

If those two interpretations are correct, then it would mean partial dollar market expectations for tapering into a weakening growth environment. At the same time, momentum and retail investors (via junk bonds and stocks) are totally and completely discounting any of this. They are sending signals of nothing but confidence in either the economy or the Fed (more the latter than the former), while credit markets appear to be becoming far less devoted to that once unshakable faith.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch