After the results from this summer, it was clear that if there was ever going to be a reduction in the pace of QE it would “have” to be accompanied by something more amenable to fickle “markets.” I leaned more toward the camp that saw taper coupled to a decrease in the IOER, particularly now that the reverse repo program has been tested and is supposedly operational (providing a “hard” lower bound to all manner of wholesale money rates).

Instead, we get more forward guidance, now in the form of a reduced unemployment threshold. That, to me, is extremely curious in that it makes no sense in the mathematically modeled universe of the Federal Reserve policy system. In other words, if there was evidence that this was effective given economic inputs and assessments, they wouldn’t just pick a number out of the air because it might sound plausible enough to pass muster with largely sycophantic “markets.” Given that, it is an overt admission that QE is nothing more than psychology, and therefore is whatever everyone cumulatively makes of it. That should be more discomfiting than comforting, but we are still in the evolutionary process of central bank credibility.

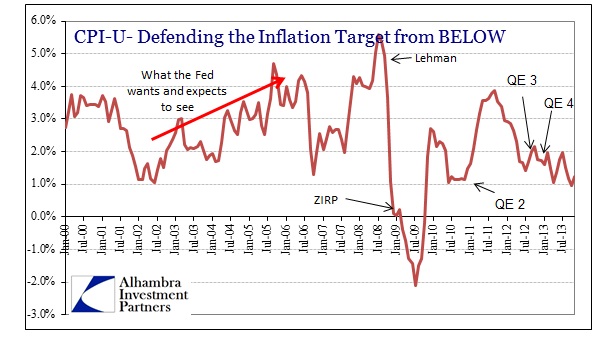

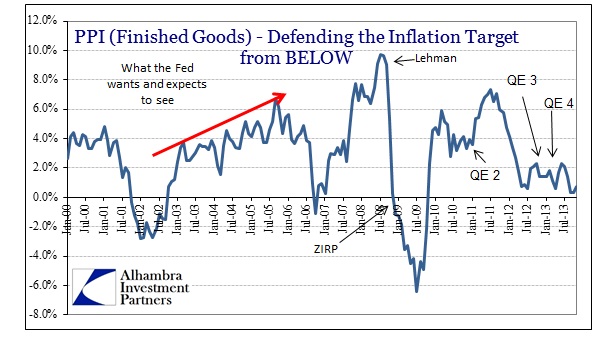

In the wake of finally (FINALLY) reaching the primary taper point, it is worth remembering exactly what QE was supposed to do. QE is the “extraordinary” policy tool that accompanies ZIRP. That mystical lower bound of 0% rates is believed penetrable by jiggering with inflation expectations. Thus, QE is meant as a means to increase inflation expectations, leading to negative real interest rates – and economic panacea/utopia from there.

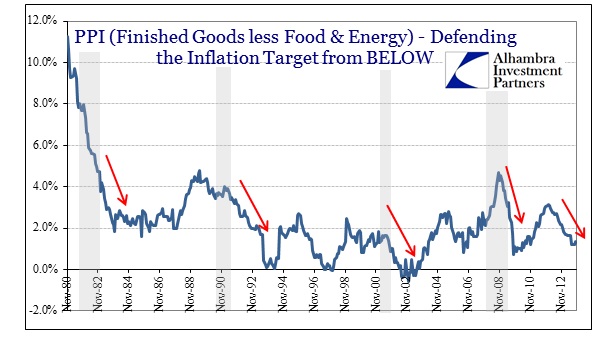

Instead of that, we still have ZIRP now almost for five full years and inflation behaving very much contrary to modeled and publicized expectations. That is true not only in the CPI, but in nearly every official measure of inflation. That would make this a curious development in light, again, of what QE was supposed to accomplish.

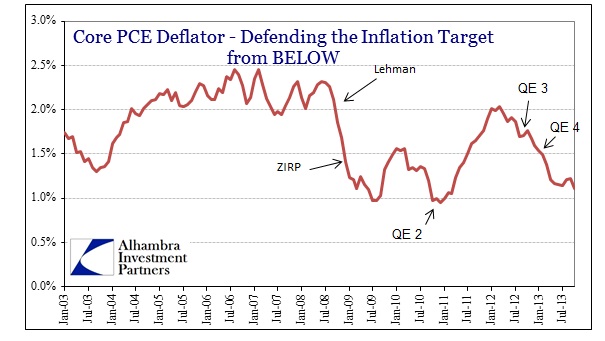

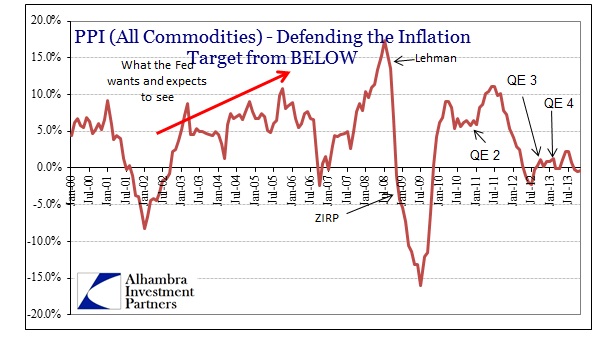

The last chart immediately above is the preferred inflation measure for the economists at the FOMC (both policymakers and academics). It has spent 2013 closer to 1% than the target of 2%. But perhaps most damning is commodity prices, exhibiting something far closer to the real world economy than the figments of statistical imaginings.

Since the early part of 2012, commodity prices have begun a multi-month descent. There is surely some monetary expectations accompanying that result, but, for the most part, it is signifying actual (lack of) demand for “things.”

Further, inflation of this type is often seen in close proximity to recession. Note, however, that the deceleration of prices is usually afterward (the exception being the precursor to the Asian flu in 1997).

We know this a troubling development for the FOMC because they openly acknowledge it as such. But they are shifting their views of this inability to maintain inflation targets (portending something about the usefulness of forward guidance?) to more intermediate concerns rather than immediate.

In today’s statement, this is acknowledged as,

…monitoring inflation developments carefully for evidence that inflation will move back toward its objective over the medium term.

While it is nice that some of the mainstream economic numbers are more positive than they have been, there is more sense that inflation is being recognized as more than consumer prices. That would make the current run of seasonal adjustments more favorable toward providing cover to at least attempt an adjustment for more than one type of inflation.

At its inception, the equation of exchange actually offered this more complete idea for monetary “uses.” It was not limited into consumer prices (PxQ or y), but rather encompassed every possible use for money and credit (T for all monetary transactions, including asset purchases).

The point here is not that the equation of exchange is flawed innumerably, but that it endures despite its defects; it is a tautology. Setting aside any problems or concerns over the concept of velocity, or whether price indices are sufficient for aggregate measurement, this conceptual formulation for the intersection of the monetary with the economy encompasses an enduring intuition that we can see and feel in a tangible way. It simply makes sense, though it is not so rigid.

But that has to include the monetary intrusion into financial transactions and the dynamism by which it all progresses. Financial evolution has opened the possibilities far beyond what Fisher or Friedman ignored. The monetary system and the financial system have nearly fully merged, and it has changed the economic system. You cannot endlessly “stimulate”, openly encouraging banks to “print money” for decades, and expect “moderation.” The incongruity of that should be fully obvious, but adhering to the Friedman closed system approach has blinded monetary policymakers. Even children learn at a relatively young age to progress beyond “that which I cannot see cannot hurt me.” The first step to rectifying this is bringing back Fisher’s fuller idea of T.

At his press conference, Bernanke alluded to exactly this concept, signifying that there is some “concern” QE has an impact on asset prices. Given the full concept of inflation data, including the consumer inflation noted above, as well asset prices like exuberant equity shares, it adds weight to the idea that they really don’t know what they are doing at the FOMC; just winging it as they go. Unfortunately, that is consistent with history outside of a true monetary anchor.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch