As is usually the case, ShopperTrak was cautiously optimistic about holiday retail sales for 2012. In September 2012, the firm estimated total spending growth to be about 3.3% above 2011, with a more modest 2.8% increase Y/Y in foot traffic. By January 2013, it appeared as if total retail sales only grew at a 2.5% rate. That was down from 3.5% holiday Y/Y for 2011.

In September 2013, ShopperTrak was already cautious, estimating only 2.4% growth in the holiday season with declining foot traffic.

To this point in the calendar, with only a partial week left in the season, the pace of sales has been declining steadily. For December, sales have fallen in each week, -0.8%, -2.9% and now -3.1%, respectively, compared to the same weeks in 2012. Cumulatively, sales estimates have been pared back to 2%, but indications for the rest of December are not looking particularly robust. Already blaming the weather, foot traffic fell off a rather noticeable 21.2% in last week.

“Super Saturday” sales, the last weekend before Christmas, saw a 0.7% decline over 2012, “Despite more markdowns and promotional efforts from retailers.”

The markdowns and promotional efforts are going to figure prominently in economic accounts for the next few months, as it indicates what we already knew well. Inventory has been deeply misaligned, as sales forecasts were overly optimistic earlier in the year. Putting a brave face on it, a spokesman for Taubman Centers, an owner of 28 mall properties, summed this misalignment up, “I felt for sure it was going to be gangbusters. But it was just OK.”

Over and over we hear these kinds of divergences between sales forecasts, leading to inventory accumulation, and actual results. I have little doubt that is related to QE and the idea it was working so well it needed to be tapered, but any cursory examination of the customer base would have proven such fantasy as nothing more than unsubstantiated monetary hope. The primary impediment to a real recovery has, and continues to be, income growth.

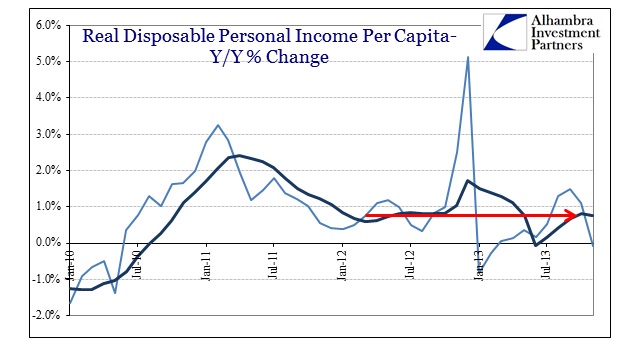

The average American in the past few years simply does not have any means to foster a revenue renaissance. That is as true in 2013 as 2012. Real DPI per capita continues to falter at less than 1%.

While we have base effects adding confusion to the Y/Y comparisons, due to the tax changes and income pulling at the end of last year, the smoothed-averages show that for two straight years there has been little to no growth in income. And that understates the problem to some unknown degree because we have less idea about actual distribution. We know that upper incomes are doing far better than those at the bottom, particularly as new jobs have been far more proportional among the lowest paying.

That has led to this durable bifurcation where certain segments are running far ahead, such as autos, but the rest of the economy is left behind. So where Chairman Bernanke is poised to be named salesman of the year for every automaker, especially the luxury brands, A&F, AnnTaylor and Aeropostale are constantly running 50-75% discounts, and stores like Kohl’s and Toys R Us are unable to close their doors.

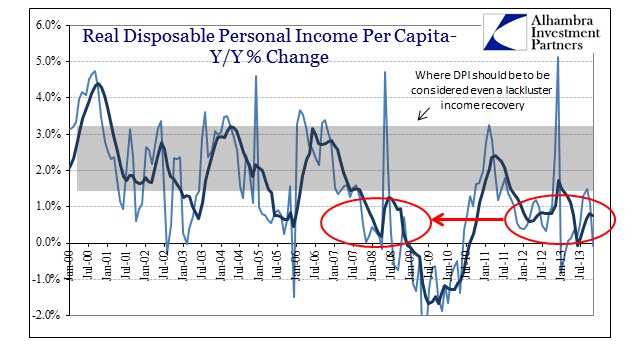

Even setting aside those complications, the chart above does not really capture the problem all that well. There was really never any recovery for incomes after the Great Recession, making the deceleration into 2012 all the more vexing (and should have figured into retail forecasts far more prominently than hope of a monetary miracle).

Income growth should be in the 2-3% range to be even considered a tepid recovery, such as that during the housing bubble. Recall that the housing bubble economy grew despite 2-3% income growth, only because of the debt supplementation. Right now we have neither, as income growth in the past two years (too) closely resembles the first half of the Great Recession.

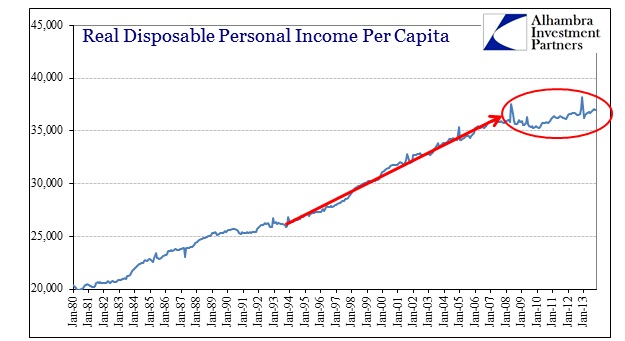

But even that doesn’t give us the full picture of dysfunction either. It becomes clearer when viewed in terms of trajectory.

There was an obvious, nearly stable, progression in incomes throughout the 1990’s (and even going back to the pre-1980 period). It grew more tired into the housing bubble, but more or less it was a consistent trajectory. Since the advent of the Great Recession we have had only minimal progress (that curiously ended around late 2010) in returning to that trajectory – which would be a requirement for any kind of sustaining recovery.

So, in fact, the conditions here are worse they even appear in the more recent comparisons. Each and every month of sub-standard income growth pushes the economy further and further behind. Time is a factor due to not only population growth but also the irresistible march of prices, driven by intentional madness at the FOMC.

For example, even though gas and energy prices are down compared to last year, leading to falling Y/Y inflation rates in these subsectors and dragging down the overall official calculation, from the perspective of the average American that is little comfort. Gasoline and energy prices are still high relative to the pace of incomes in absolute terms – something that economists ignore completely. If your income has been reduced and has never returned to pre-crisis levels, it doesn’t matter if gas is at $3.80 a gallon or $3.40 a gallon; it’s too high in either case. But official economic measures see “disinflation” and simply assume a “boost” to consumer spending power.

Companies would have to assume real productive risks to change that, something they are not going to do under constant threat of monetary instability. Such manipulation forces firms to hyper-manage their costs, and, to the everlasting shame of orthodox economics, drastically favor financial “risk” over any others. Hundreds of billions of dollars are recycling into stock prices rather than wages, further narrowing the scope of redistribution (the inequality that is prominently featured in an ill-suited critique of the current state of capitalism, when capitalism is actually the economic feature most missing right now).

With that kind of background, retailers might have thought differently about their propensity toward robust inventory in 2013, avoiding the looming inventory Damocles.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch