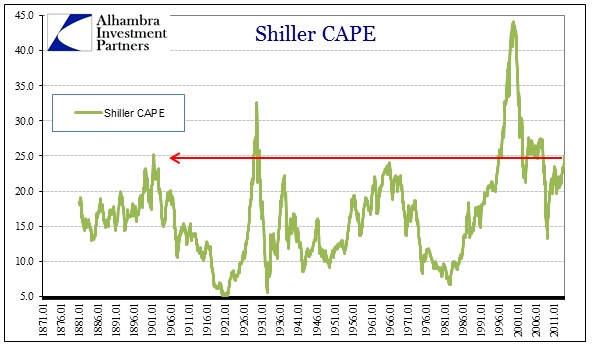

There is an age-old, simple axiom that should form the basis of portfolio management but often gets pushed aside in shorter-term considerations. Whether in the form of “buy when there’s blood in the streets”, or “be fearful when others are greedy”, it preaches about extremes. At its core this idea is really about managing asymmetric risks. When everyone wants to own stocks that is probably the worst time to do so since the risks are heavily skewed to the downside without sufficient upside potential. That is the essence of valuations. The flipside is also true; the best time to buy is when everyone hates stocks (asymmetry in your favor).

The grand game is agreeing (ahead of time, not with hindsight) which is which. I would classify the current market as asymmetric against being long, and that leads to conflicts with “all-time highs.” Nothing is more alluring to investors (and a great many formerly cautious we have seen recently with bears turning bulls) than the pull of new highs in the major indices. But such “success” is easily disproved with some simple math.

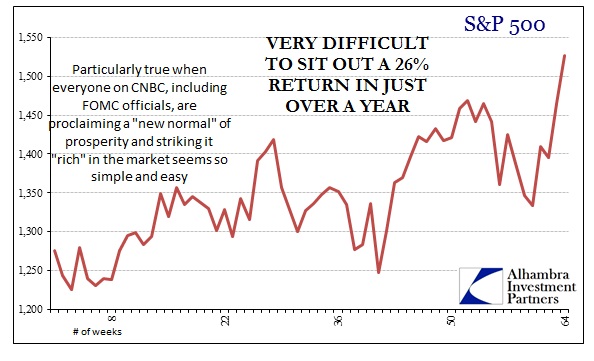

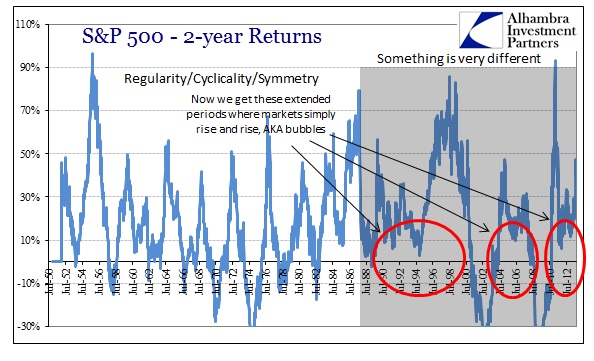

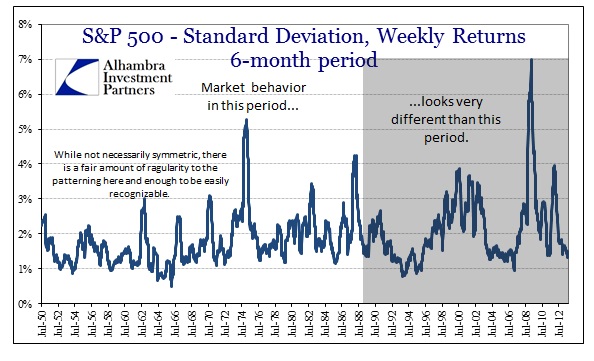

We have seen this kind of market before; in fact, many times before. We need only go back to 1999. Sitting out that year would have been difficult at the time, as everyone was convinced markets were in a “new normal” that would go and go and go. “Wealth” was easy to obtain, all you had to do was play the game.

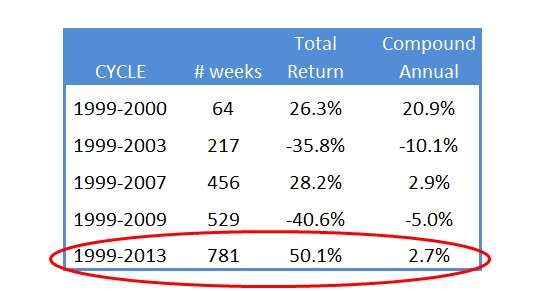

In a little over a year, the market (using the S&P 500 as a proxy) was up about 26%. Obviously, other indices varied in performance, with tech stocks running up far higher. Is it better to chase, and hope you are not the Greater Fool, or sit out while everyone else looks like a genius? Being so cautious is a lonely place.

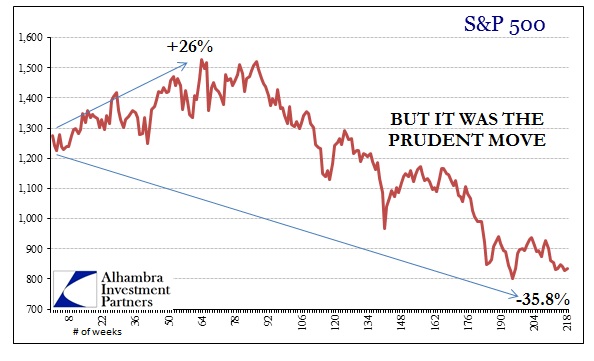

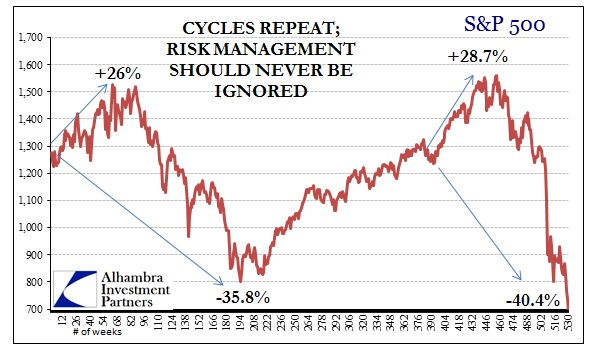

In this historical context, the answer is obvious. But it was the power of rationalizations that overcame the simple and basic axiom in the very next cycle. Despite some very, very ominous warnings in finance, the stock market indices saw new highs and failed to warn of the impending Great Recession. And so the same mistakes were made (and were likely worse outside of the context of stock indices and survivor bias into individual holdings).

Again, in a little more than a year prior to the October 2007 highs, the S&P 500 gained about 28.7%. Convinced that it was not a time to be avoiding stocks, the majority of investors got burned rationalizing that sentiment all the way down.

But we are back at new highs now, thanks to the “heroic” efforts of Chairman Bernanke and his compatriots. And while they are the world’s best luxury car salesmen, all they can show apart from that for the unending “emergency” measures is record high stock prices. And that, we are told, justifies faith in being risky and long, again, despite recent history.

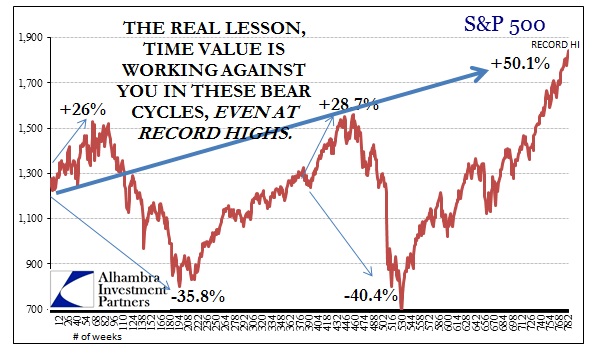

If you got into the market in January 1999 and rode through the ups and downs, the major bear moves and the rallies that followed, you are up just over 50%. That sounds terrific, and seemingly justifies the crowing coming out of the orthodoxy.

The problem here is not that markets are at an all-time high, but that ignoring the basic axiom leads to asymmetric risk against you. Holding stocks for the past fourteen-fifteen years has produced a numerically pleasing return, but only if you ignore time value.

Participating in all the trepidation the monetary policy-led markets have thrown at you has worked out to a paltry 2.7% compound annual return. At all-time market highs. That is the very definition of asymmetry, and not in your favor.

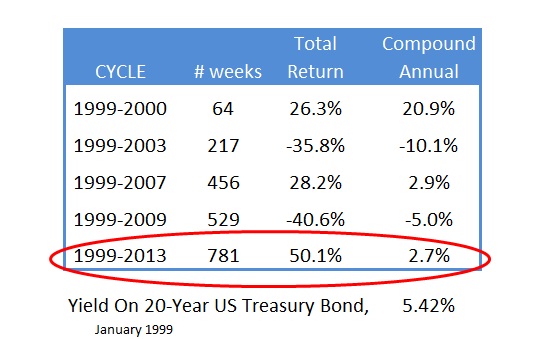

I have appealed to this common sense before, particularly in the comparison to more favorable risks.

The above US treasury bond example assumes no compounding at all. And it still doubles the stock market without all the risk.

To be excited about stock market returns in 2013 is to miss the bigger picture; investing is a marathon, not a sprint. You have to ignore all the bubble properties, including the massively and historically skewed current bullishness, and rationalize how this time, despite all recent history and inclination, is somehow different. There is a reason markets follow cycles, and paying attention to risk management is, by far, the best long-term strategy. There are times when investing prudently means managing true risk, not participation.

For those that chase, the problem is keeping what they “make.” Sufficient upside potential, and therefore trying to find asymmetry in your favor, is not about what the market does in any one particular year, but what your assets are worth when you actually need them.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch