Bill Dudley, never one to shy from causing controversy, regained the throne of most honest Fed official. Speaking at an economics conference, the President of the New York Branch, the one with all the QE assets, Dudley admitted,

“We don’t understand fully how large-scale asset purchase programs work to ease financial market conditions, there’s still a lot of debate …” he said. “Is it the effect of the purchases on the portfolios of private investors, or alternatively is the major channel one of signaling?”

The main part of that problem is that, in Dudley’s version, the evolution of computer modeling at the Fed still has not progressed enough to realistically model financial interactions. Given the way the economy has financialized since about 1985 (a trend that really began in the 1960’s, with a big boost in 1971) that’s more than a small blind spot. Some of this gets back to the oversimplification of modeling that took place in economic accounts in the 1940’s, 50’s and 60’s. It was the time when, due in large part to Milton Friedman, the equation of exchange lost its T and the idea of the closed system was “scientifically” validated.

On the bright side, Dudley’s admission shows at least the possibility that there is some thought about limitations to the core DSGE models (Dynamic Stochastic General Equilibrium). As usual, however, this minor and likely fleeting impulse will soon be lost in the noise as technocrat Yellen moves into the Chair.

Part of the idea of a closed system posits the flow of “money” limited largely to real economy outlets. Therefore, any “stimulation” in the psychology of monetary agents (banks) has as its ultimate destination real economic flow. The temperature of such monetary intrusion is the official inflation measure. And that makes sense in the DSGE orthodoxy since the economy is essentially a closed loop with a minor monetary intake.

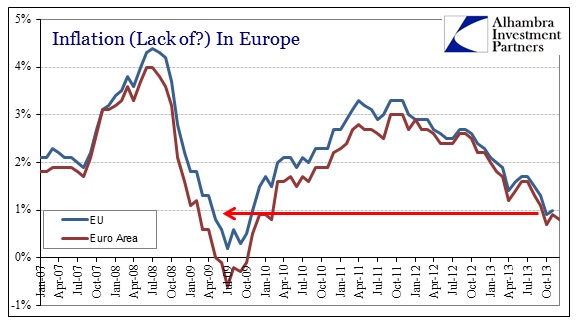

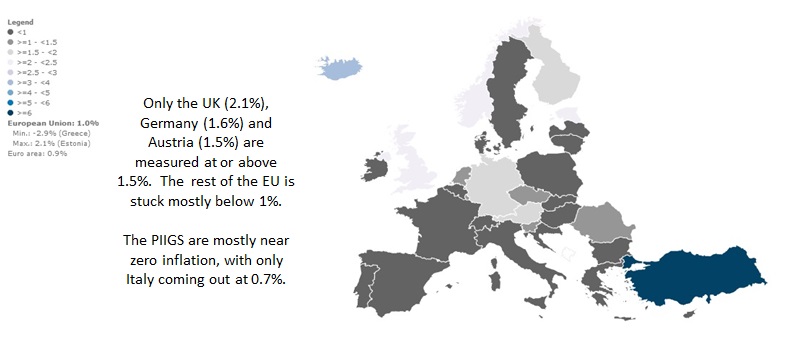

The aim of QE was essentially that input – inflation expectations causing real world transactions. And it was not just the US that held such expectations for inflation to lead the economic recovery. The ECB held just as steady to that inflationary impulse, even if through largely different means (but still psychology and influence on agents). Yet, for all the efforts and the blatant intentions to stoke “inflation”, neither central bank has come even close to its goal. In fact, in both Europe and the US the problem with inflation is not so much overheating in consumer prices as “dangerous” disinflation.

The official inflation measure in Europe is nearing the levels seen during the 2009 collapse rather than the recovery narrative that has pushed into the mainstream since summer. Worse still, the “low” inflation problem is widespread. Even those that are experiencing less problematic levels still are below target.

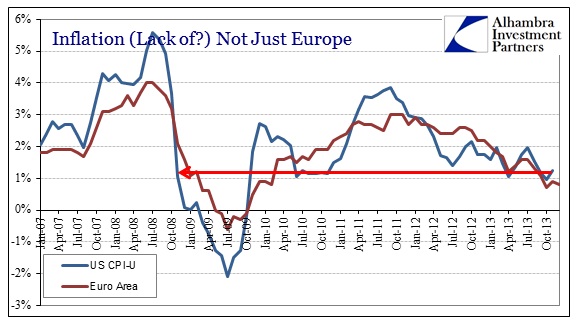

But what should really confound these intercontinental orthodoxists is the obvious and close correlation between the US and the EU. Again, if these economies operate as closed systems then this should not be possible:

The correlation between the US CPI-U and the EU HICP cannot be explained by traditional econometrics. And the reason is Dudley’s admission. The connection between the two systems lies in London. What is essentially a global US dollar system has a very tangible impact on the world apart from individual economies.

That actually makes far more intuitive sense then the closed system approach. It should not be a revelation that global banks can transmit monetary impulses to nearly any market in any country or geographic location. If that lesson was not learned by the Japan/yen carry trade, then it will never seep into the policymaking complex.

The implications go beyond just the failed inflation approach. As Irving Fisher noticed in the original formulation for the equation of exchange, money can find its way into financial uses, meaning that inflation could very well be “overheating” without their knowledge. It would simply take a different form, one not measured or believed valid: asset prices and bubbles. That too is a consequence of monetary systems operating in far more open environments than currently understood by the perpetually behind-the-times “experts” at the FOMC.

The theme developing now that QE is being tapered is that the lack of inflation is actually evidence of success, particularly so since many QE critics were wary of runaway inflation from the beginning. Those critics have been largely correct, just not in the place they were expecting or where it is easily measurable.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch