When you don’t sell everything in your store, you tend not to order a lot of additional inventory. The advance look at December’s durable goods was completely unsurprising in that regard. In fact, it only reinforces other elements of the inventory mini-cycle that have appeared recently, including the sub-50 China PMI. Despite attempts to spin otherwise, retailers overdid their optimism last year, were caught with too much as consumer “resiliency” was overstated, and now the global economy will again be captured by the downward leg.

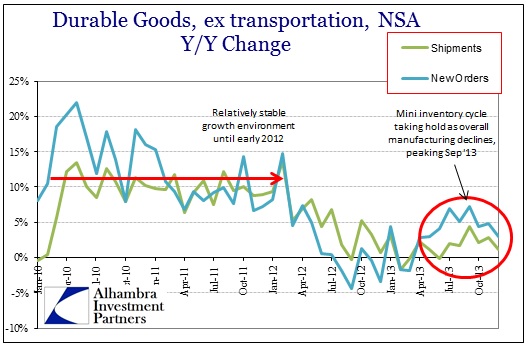

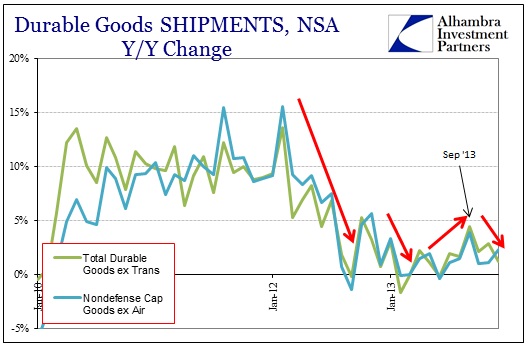

The peak in the mini-cycle looks to be September 2013, a little later in the year than 2012 which perhaps speaks to that overwrought expectation of a blowout holiday period. That was also the month that inventory “whispers” began to leak out into the mainstream, particularly that ominous note from WalMart. It’s been downhill ever since.

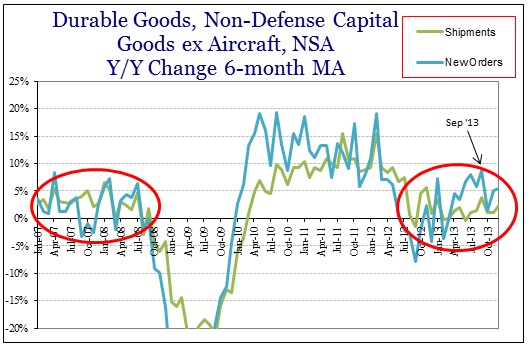

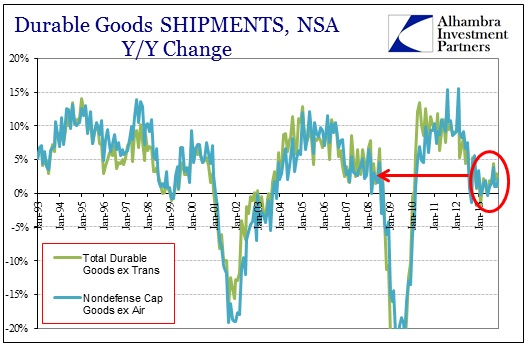

Again, without a wider context it is easy to lose sight of just how bad durable goods and capital goods activity has been. In both cases, current levels of growth are nearly identical to late 2007/early 2008. That is a tremendously bad place for this segment of the economy to be heading into the downside of the mini-cycle.

It is particularly noteworthy in that businesses are investing at levels consistent with the Great Recession (pre-collapse) on the productive side, but at bubble peak levels on the financial side (share repurchases). That shows both how bad the real economy is in relative position, but also just how bad inflation (including asset prices) policy can screw up resource allocation. It’s almost as if the economy is far worse than even sluggish GDP estimates would indicate.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch