QE’s hope is that in the course of redistribution any spurt of temporary activity caused by such monetary deck shuffling will lead to follow-on activity (the cult of aggregate demand). As we see in the US, the redistribution appears to have had the reverse effect, including effects on global trade. In Japan, the other nation so fully devoted to QE, the appearances are different but the strands of dysfunction are very much recognizable.

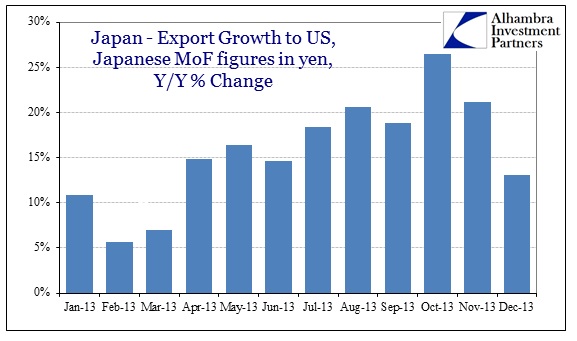

The US would surely welcome an export renaissance (there was reference to doubling exports a few years back; it subsided after the laughter died down), but that has not been a primary driver of growth really since the agrarian age. Japan’s entire economic and monetary philosophy, however, is very much focused there. When export growth began to show robust positive rates in 2013, it was convincing to many that there might just be something to this Abenomics.

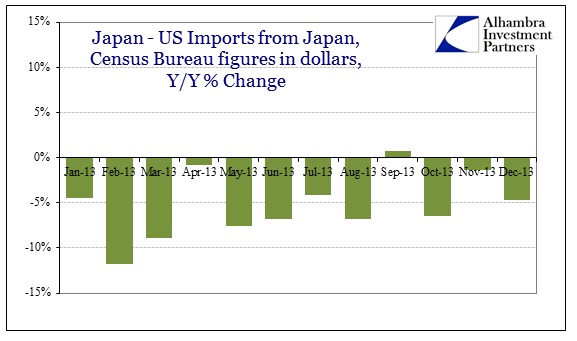

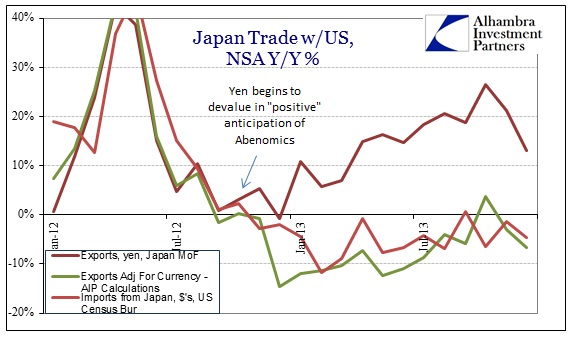

That only lasted a few months as the illusion began to fall back on reality. That once-promising start is now engulfed in whispers of even more devaluation and a heavier approach by the Bank of Japan (the answer is always more). As I have shown many times before, for every export there is a balancing import. We can use different currencies to measure activity, but unless both sides agree there is no organic growth. With the release of trade activity by the Census Bureau, the illusion is again illuminated.

The divergence is solely due to yen devaluation, where true volume growth remains elusive (the US market is not exactly a fountain of robust demand for anyone).

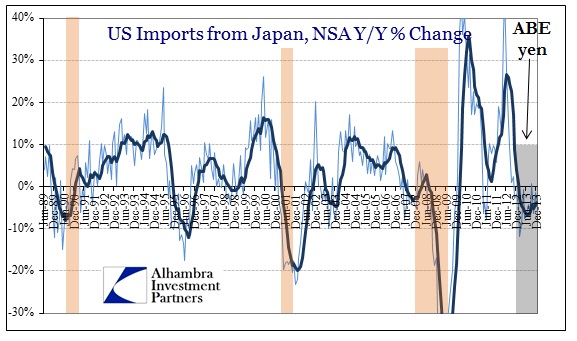

The fact is, even these charts do not do justice to the scale of the problem, nor the size of that illusion. Using a longer-term historical comparison, we can see, from the dollar side, just how little impact Abenomics has had on trade with the US. Given that exports to the US are about the same level as exports to China (the two largest export markets for Japan), this is not some minor or trivial flaw in the QE plan.

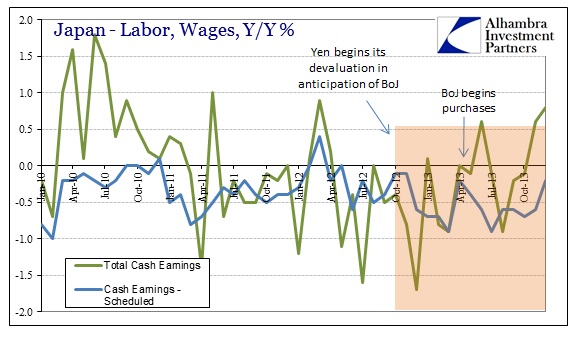

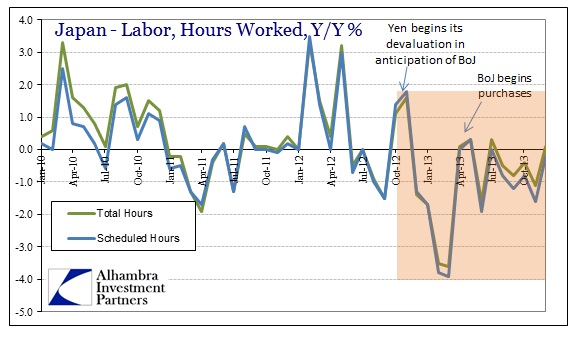

Shuffling the value of the currency has produced a lot of paper changes, but nothing by way of true organic growth. That would help explain the fact that Japanese wages and hours continually shrink, even though Japanese companies are filling up with yen profits.

Abenomics is working only in the sense that the numbers look much better. A real economy and recovery requires actual improvements that run far, far deeper. That would include a durable trend where capital actually stays (or flows) in (or into) Japan for real investment, something not seen in more than two decades.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch