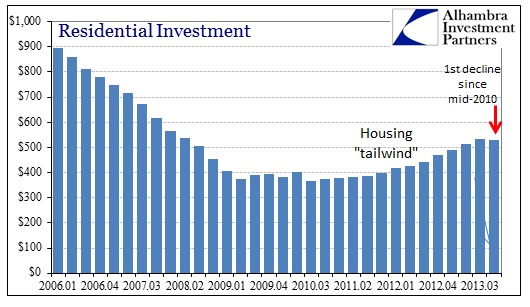

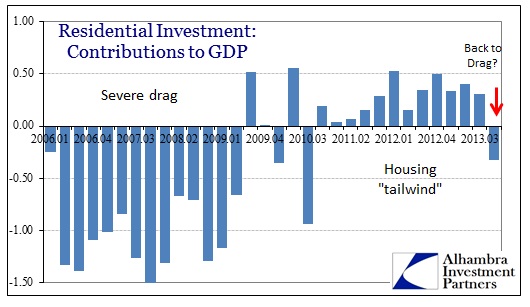

The economic hopes for 2014 have been largely concentrated in a few sectors. Monetary authorities have been counting on the historical channel of housing to be one of the continued “bright spots” that would transition finally, after almost five years, into an unambiguous recovery. You always have to be cautious about reading too much into one data point, so it is too early to conclusively determine whether or not the latest estimates are outliers or a potential change in trend.

In terms of housing, however, it might be one data point in the GDP report, but this idea of an inflection in real estate has been gaining for some time now. The “beneficial” impact of mortgage finance intrusion comes in three forms: home price appreciation, which should produce a “wealth effect” on overall consumer spending; mortgage refinancing, which augments that “wealth effect” by allowing home equity to become a liquid asset, or at least, as in the past few years, for mortgage payments to be reduced; and for home construction to provide a direct employment/profit opportunity in the real economy.

We know the refi/mortgage channel has all but ceased, with mortgage applications at their lowest point of the housing bust (and bank originations heading in that direction). Now in the latest GDP estimate for the fourth quarter, the pace of residential construction declined for the first time since this mini-bubble began.

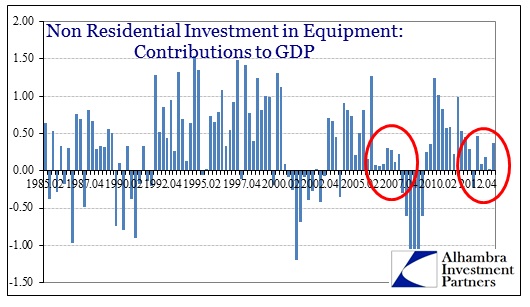

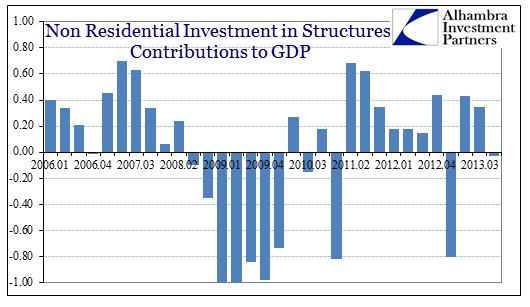

A second expected “tailwind” was supposed to take place in capex. The conventional narrative posits that large cash balances in the possession of corporate CFO’s have to go somewhere, and, given the lack of capex to date, an increase in investment seems somewhat logical. The first part of that formulation is fully incorrect, particularly since cash balances have, at best, only kept pace with balance sheet debt levels – businesses use liquidity buffers like any other economic agents, and proportion to debt has been a historically valid correlation. Thus a surge in debt balances will produce an increase in cash balances that are meant to be idle.

The second part of that tailwind formulation is not representative of the current reality of businesses in the US (and elsewhere for that matter). Productive investment since early part of 2012 has declined rather than accelerated. The reason for that is not particularly difficult to discern.

While business investment was slightly higher in Q4, it followed an extended period of extremely low levels of investment. And even the amount of investment in Q4 was well below what would be considered “normal” or part of a growth environment. That now potentially extends, like residential construction, to commercial construction as well.

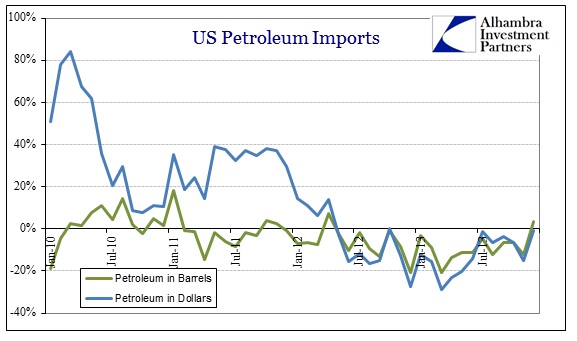

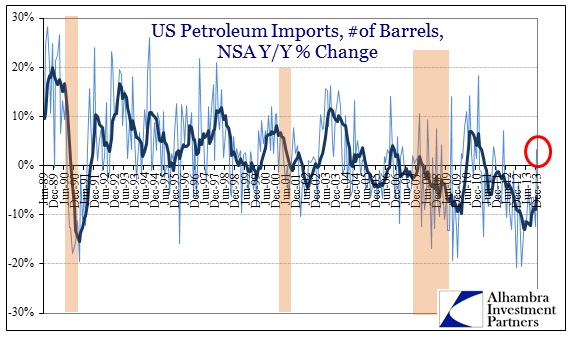

The last expected “tailwind” was believed to be the energy boom of the fracking age. Not only has it reduced the importation of foreign petroleum, it has created an export channel for real economic growth. That has had a clear effect on the trade deficit, as imports relative to the recent past have declined.

The Census Bureau estimated that in December 2013, for the first time since May 2012, the US imported an increasing quantity of petroleum. It was a small increase (and here is where making definitive conclusions is most treacherous) but it at least represents a potential drag to the economy in 2014 if it continues. Obviously, if it proves a one-month event there will be no effects at all.

However, the noise coming from the energy sector tends to be less than positive about the ability to maintain production levels, while costs and oil prices below $100 restrain exploration. Right now, I have no opinion one way or the other; I only note that there is a logical basis for a more durable increase in oil imports, and that is something that bears close scrutiny in the months ahead.

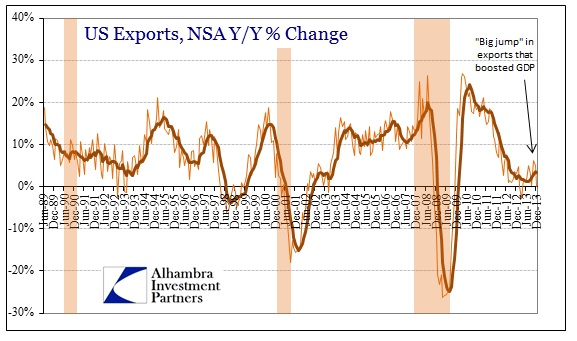

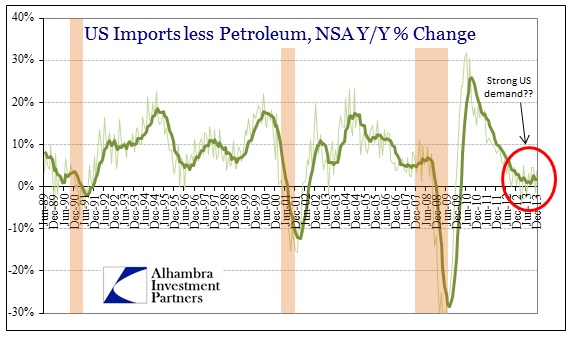

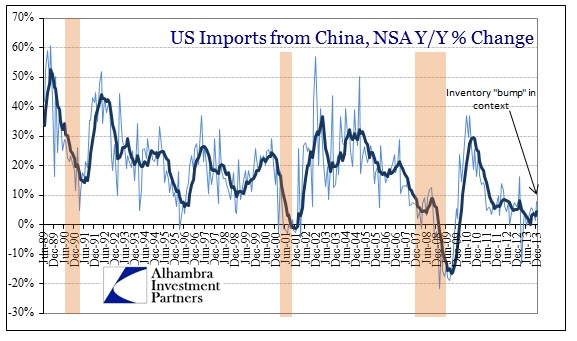

As far as import/export activity beyond energy, I still fail to see a spark for global trade or even the domestic economy. These figures are exactly why the GDP report can look so different than the estimates for other economic measures, such as Real Final Sales. Beyond questions of philosophy and overall legitimacy in the statistical construction, GDP simply “lives” in the second derivative which often does not comport with wider context. That can be extremely misleading.

An additional source of “strength” within the Q4 GDP report was the export/import balance, now in the US’ favor. Of the 3.2% growth in GDP, almost half (1.48%) came from trade, including a disproportionately large jump in export “growth” (1.34%). As I said, those are second derivatives, and the chart immediately above shows such an export “boom” in actual context.

It is entirely possible, like a reverse of the factors cited above, that this is the birth of a new trend, where a “tailwind” is born from what had been a drag on growth. I have sincere doubts about that, particularly with emerging market economies in shambles, but export growth did perk up to Europe in the September-November period (before contracting by a significant amount again in December).

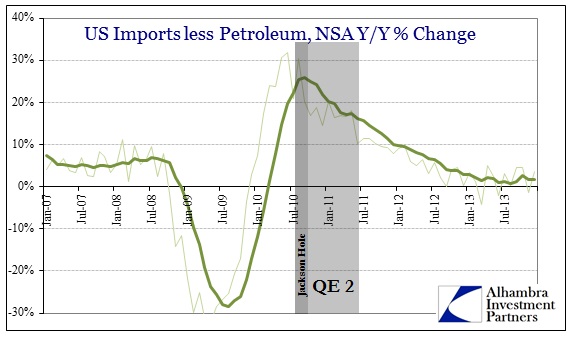

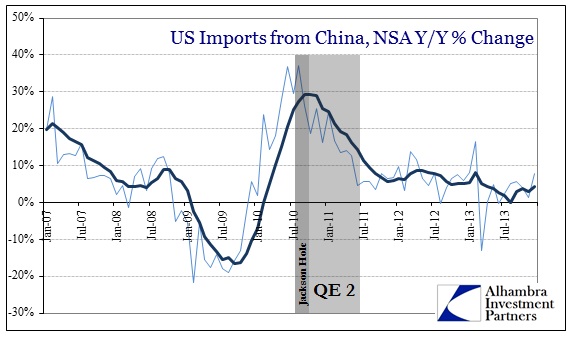

On the flipside, import activity into the US continues to show little demand for goods. Again, given the way GDP is constructed, that is a positive for the expenditure approach to economic accounting. But in real economic terms, as we see in the final sales methodology, there is no sustainable activity in the domestic economy – even when we adjust for lower petroleum imports.

We have never seen anything quite like this, as the graphs above amply demonstrate, where activity essentially flat lines. Mainstream commentary calls this the “new normal”, but I suspect, given so much other concurrent data, that this is simply a slower and more elongated downward slope than is typically associated with recessions. That would make sense given the bifurcation in the domestic economy and the massive monetary intrusions that caused it.

What that shows, to me, is that the idea that the purported benefits of the monetary policies are being far outweighed by the costs. The operative philosophy was that the “wealth effect” of asset inflation and the housing channel would begin to lift activity in the sections of the economy much more remote from the monetary source. If my interpretation is correct, then the opposite is taking place: the drag in those remote segments caused by monetary intrusion is beginning to grossly outweigh the lift of asset inflation. That tug-of-war would offer a plausible explanation for the slow fall into dislocation that we see now, rather than the more typical sharp action.

To bolster this assertion is to only note the timing of these trends and policies.

This hypothesis would be further supported by the changing trends noted at the outset of this post, where “tailwinds” cease and difficulties reappear. In other words, if housing reverses in a durable lower trend, that would mean monetary policy left no established footprint on the economy, only a temporary levy against the larger tide. There are innumerable costs hidden in that temporary “benefit” that are obscured even when it is removed, leaving the economy far poorer than had no temporary “benefit” been extended.

That is the legacy of debt-based redistribution attempts.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch