It’s a new year, and the markets keep plugging along. After a rapid drop to its short-term trend line, the Standard & Poor’s 500 ((IVV)) has temporarily resumed its climb up. It remains below heavy resistance at the 50-day moving average, and if it were to continue its trek up, it would need to make up a lot of ground this coming week. We might be in the midst of a turning point in the markets, so proceed with caution. It may be a good idea to take some off the table, especially if IVV fails around the 1800-1820 level. The index is down 2.60% in since the beginning of the year.

The S&P 500 Value Index ((IVE)), which consists primarily of US large-cap value stocks in the financial services, industrial, and consumer cyclical industries, tend to have lower price to earnings ratios and higher dividend yields than the market as a whole. This index is just below its short-term uptrend line at the 82.50 level, and must push through this level if it wants to stay the course. The index is underperforming compared to the S&P 500, returning -3.57% in the last year.

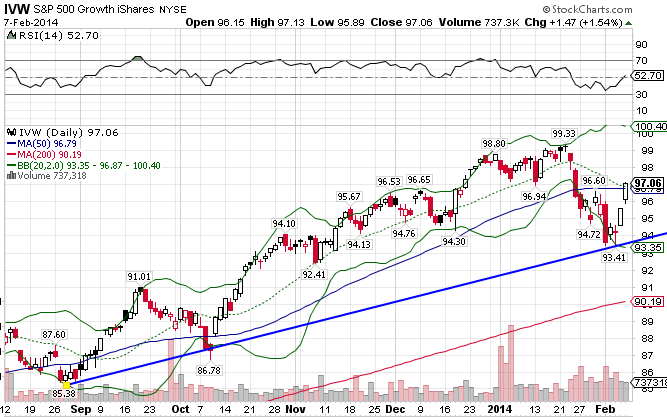

The S&P 500 Growth Index ((IVW)), which consists primarily of US large-cap growth stocks in the tech, healthcare, and energy industries, tend to have higher earnings growth rates, higher earnings multiples, and little or no dividend yields. The index is slightly ahead of pace set by the S&P 500, and has the slightly better-looking technicals, as it broke through its 50-day MA this past week. The index is down 1.71% YTD.

In the past few months, a short-term trend of growth stocks outperforming value stocks has emerged. The trend is strengthening of late though.

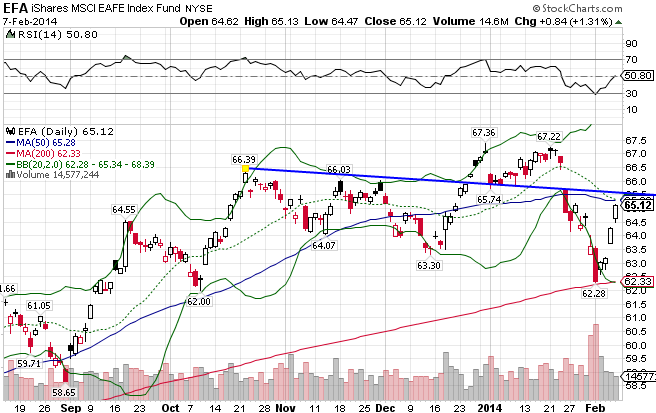

The MSCI EAFE Index ((EFA)), a global developed market index that encompasses Europe, Australasia, and the Far East, has underperformed during this latest run-up that began in October. The index is right below resistance, just as with the US markets, with a breakout likely this week, whether it be positive or negative. The index is down 2.94% YTD.

The MSCI EAFE Value Index ((EFV)), which consists primarily of low P/E international large-cap value stocks in the financials, energy, and communications industries, is also staggering of late, but has managed to hold its year-end gains to this point. Like the US markets, international value stocks are under-performing growth stocks of late, and the trend seems to be changing. The index is down 3.01% since the beginning of the year.

The MSCI EAFE Growth Index ((EFG)), which consists primarily of high-growth international large-cap growth stocks in the industrial, healthcare, and consumer cyclical industries, has underperformed in the short-term compared to the value index. The index is down 3.72% YTD.

Stay In Touch