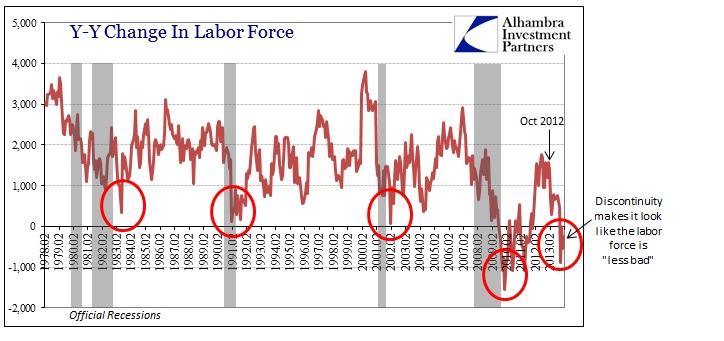

The term discontinuity is probably unfamiliar to the casual observer of economic accounts, but they are quite regular features in almost all the statistical data series. It goes with the territory, as statistical estimates themselves vary in depth and “quality.” For example, when the Census Bureau updates its population estimates to incorporate fuller or “better” samples or sample sizes, it affects a chain of downstream measures. That includes, as the BLS explains in a footnote that Jason Fraser of Ceredex passed along, both the Household Survey and the size of the official labor force.

I suppose this is what happens when you try to give this economy some credit for at least not stumbling too much further – it is, like almost everything in this “new normal” of reduced standards, illusory.

The Establishment Survey disappointed with only 113,000 job gains in January, but the Household Survey moved sharply upward with 638,000. However, the BLS notes that the January estimates reflect “updated population estimates”, meaning that some large share of the Household “gains” were simply refiguring the overall population. That includes the estimates for the official labor force itself (+532,000 revision), which is much more troubling. The labor force was already lower than where it was in January 2013, but when incorporating this discontinuity it seems that the labor force is shrinking by an even greater amount than would otherwise appear.

If the economy cannot really grow itself and translate that into jobs, at least there is the temporary comfort of discontinuity. For everything else, the nannies will have to do – the final revisions, including historical updates, were issued for the literal nanny state with the January report and thus burying what would have been a negative benchmark revision.

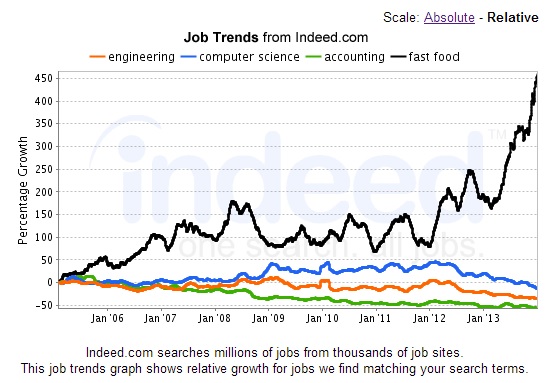

That leaves us with an unemployment rate even further suspect (which is unsurprising given that it was never intended for the labor conditions in which we find currently), an Establishment Survey that is now two months into disappointing the “assured” narrative of 2014 as the recovery year (maybe the sixth year will be a charm) and a Household Survey that is recessionary even with discontinuities. With so many unsettling properties in these statistics, it elevates the necessity toward outside anecdotes:

If indeed.com indeed provides any usefulness in the above data, it would seem that there was a drastic shift in job listings and searches right in the middle of 2012. Apparently there was a sudden change toward much less engineering and computer science, continued depressions in accounting, but an explosion of fast food. For 2013, about the only measure that beat stock prices were fast food jobs. That captures the essence of this “new normal” reductionism like nothing else.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch