The only real noteworthy aspect of this morning’s retail sales report was the dramatic downward revisions to December. I’m not sure if the temperature readings have been similarly revised, given that it is now fashionable to correlate the two, but in either case the adjustment shaved off 85 bps of Y/Y growth for sales ex autos (auto sales were revised slightly upward).

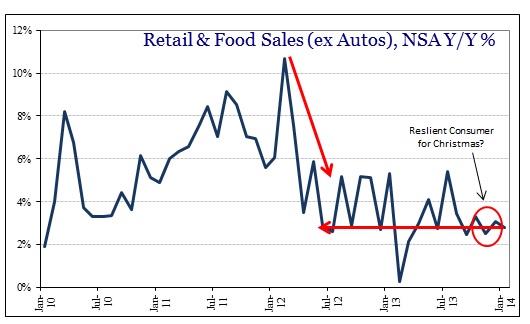

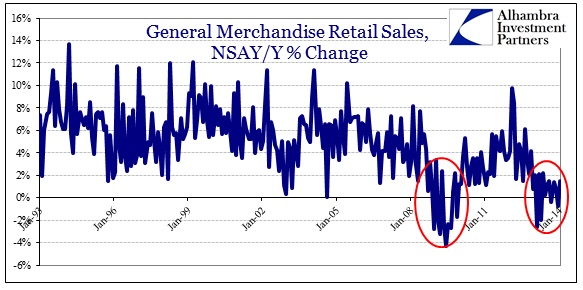

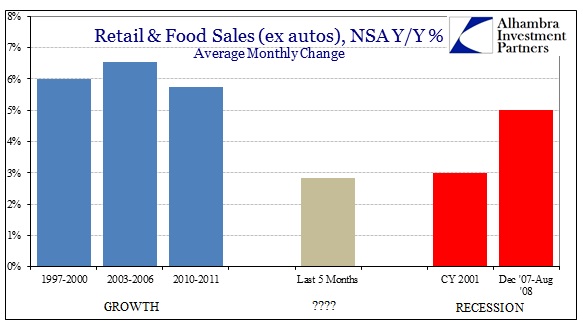

The estimates for January sales are all-too-familiar and unfortunately not “unexpected.” January simply continues the ugly trend that we have seen really going back to the middle of 2012. The consumer is not resilient at all, instead stuck in a stasis comparable to previous recessionary periods.

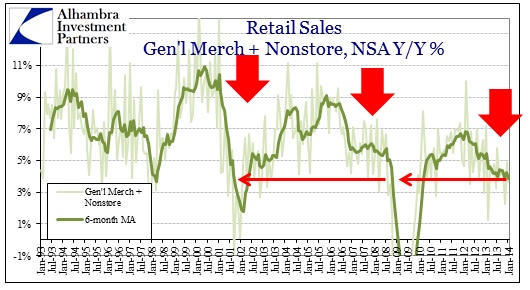

Part of the problem for economists’ expectations seems to trace back to the bounce in the middle part of 2013. Rather than see it in the wider historical context that features numerous such temporary ebbs and flows, it was simply assumed to be a durable trend and was thus extrapolated into the rest of 2013 and well into 2014. That was done despite the continued erosion in wages and earned income.

So we see the now-familiar trend cut across the broad spectrum of consumer spending. That would strongly suggest this malaise is not likely some idiosyncrasy in a data point or specific industry.

And no analysis of the consumer should be left without examining the economic bifurcation as a result of inflationary (asset) tendencies. There is far less economic strength and momentum where it has been left untouched by the hands of QE, with a fair argument that QE has actually left this broad segment much worse off for it.

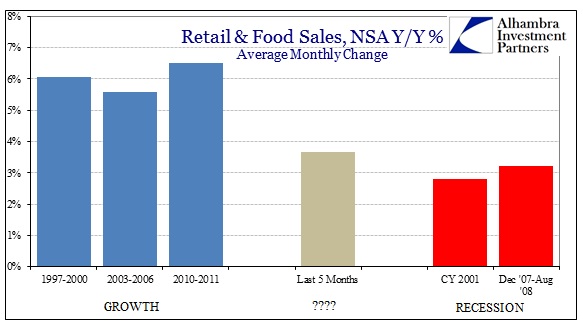

Finally, to get a clearer sense of proportion and context, we can compare the past five months with unambiguous periods of both growth and recession. These results add to the impression given by the Household Survey of payrolls and especially the decline in the overall labor force seen since the middle of 2013. That would imply perhaps a cyclical shift concurrent to the latent structural deficiencies left over from the Great Recession.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch