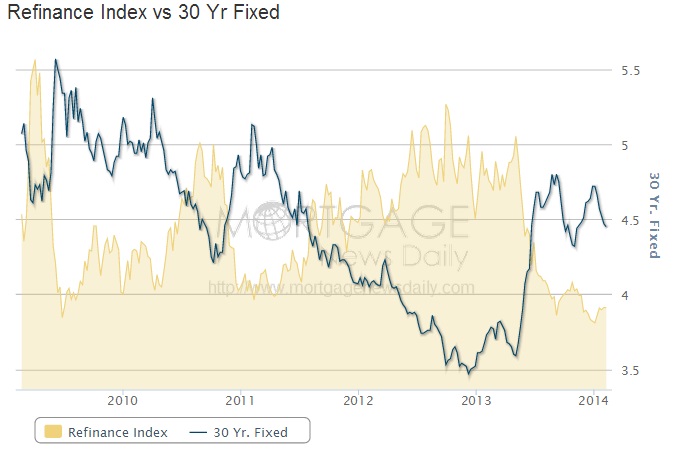

By any reasonable token, a healthy home market should not be all that much disturbed by a 100bp rise in the average mortgage rate. And even that likely overstates the degree to which mortgage rates have moved – they briefly reached a record low of about 3.5% at the end of 2012, now settling just below 4.5%. At the tail end of QE2 in the middle of 2011, mortgage rates had just declined to a then-record low of 4.5%, so the context of recent rate levels is somewhat misleading.

It cannot be said that the “market” is functioning when mortgage rates are required to move ever-lower to maintain any positive growth in dispersed finance. This is the Fed’s primary monetary channel, after all, and to have mortgage activity collapse so precipitously on slightly-less-than record low interest rates is a key clue that the overall housing market was again captured in the mirage of “stimulus.” Refi applications are now 63% below year ago levels, and 75% under the 2012 “peak.” The scale of the decline is incongruous with that rise in interest rates, except if you factor the financial end of it.

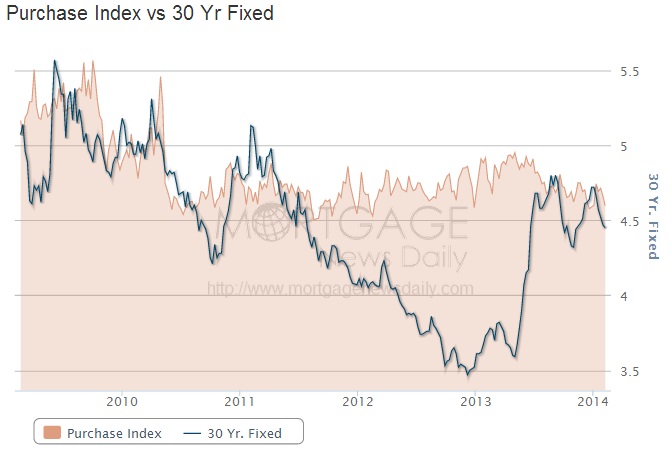

As much as it first appeared as if purchase applications, unlike refis, would be insulated, they have now fully joined the dysfunction. Mortgage applications for home purchases are down just over 20% Y/Y, and almost 30% from early May when taper hints changed the entire paradigm (itself a conspicuous incongruity).

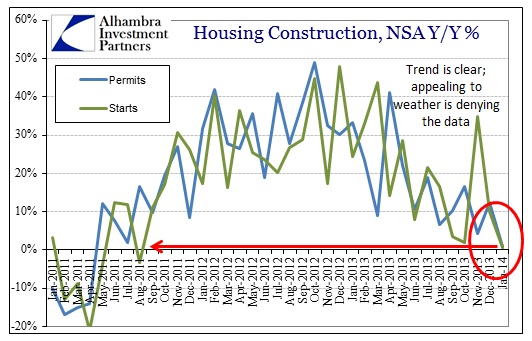

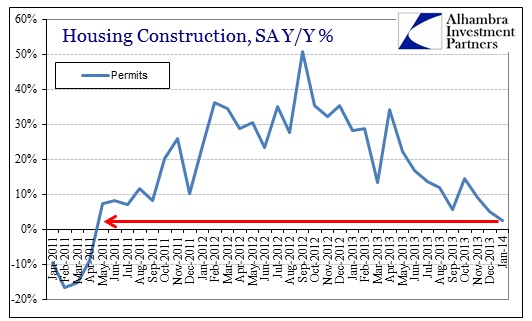

While so many want to blame these results on weather, unless there has been steady snow since May there is a clear correlation between financial disruption (evident in rates) and activity levels. And just as that correlation is obvious, there is another that feeds directly into home construction and sales.

While it is perhaps “easy” to abuse the weather or appeal to the government shutdown, there are too many palpable correlations here to separate and assign distinct and ultimately unrelated causation. Sometimes the simplest explanation is the best because what makes it simple is that it is blindingly obvious.

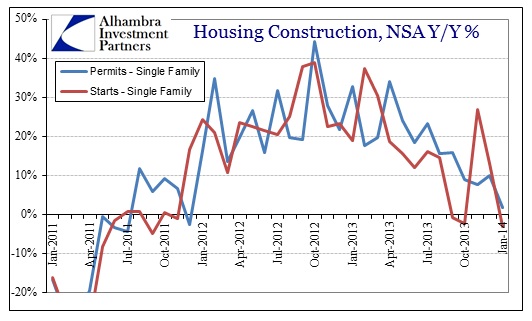

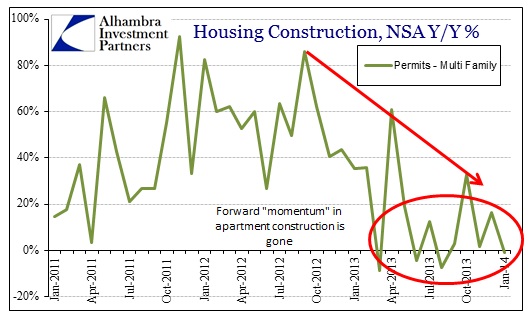

What is perhaps most noteworthy, and ultimately points to further financial factors, is that multi-family home construction is now declining right alongside single family structures.

In this case there is no daylight at all between seasonally adjusted and unadjusted data. That makes it a relatively easy leap to make between where we are now and where we are headed. “Economists” expect this to be a temporary pause for whatever reasons they can imagine, but the growing scale of the mortgage disaster refutes that assertion with relative ease. How can this “market” re-emerge from this obviously durable downward trend when only a relatively minor disruption in mortgage finance produces such disproportionate devolution?

Perhaps it speaks to the idea that the housing market, much like its predecessor bubble, was, in fact, nothing like a “market” and moreso a channel for bad policy. The removal or even taper of bad policy is, unfortunately, not good results, but rather another violent adjustment in the unending series of them.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch